Institutional Investors Bet on Ethereum’s Long-Term Value as ETH Price Remains Above $2,000

So far this month, there has been a significant increase in Ethereum (ETH) holdings by institutional investors, marking a renewed confidence in the cryptocurrency’s long-term value, according to a trend analyzed by analytics firm CryptoQuant.

The firm found that there’s been a growing trend of institutional investors betting on the second-largest cryptocurrency by market capitalization through a series of channels, which include trusts, exchange-traded products, and investment funds.

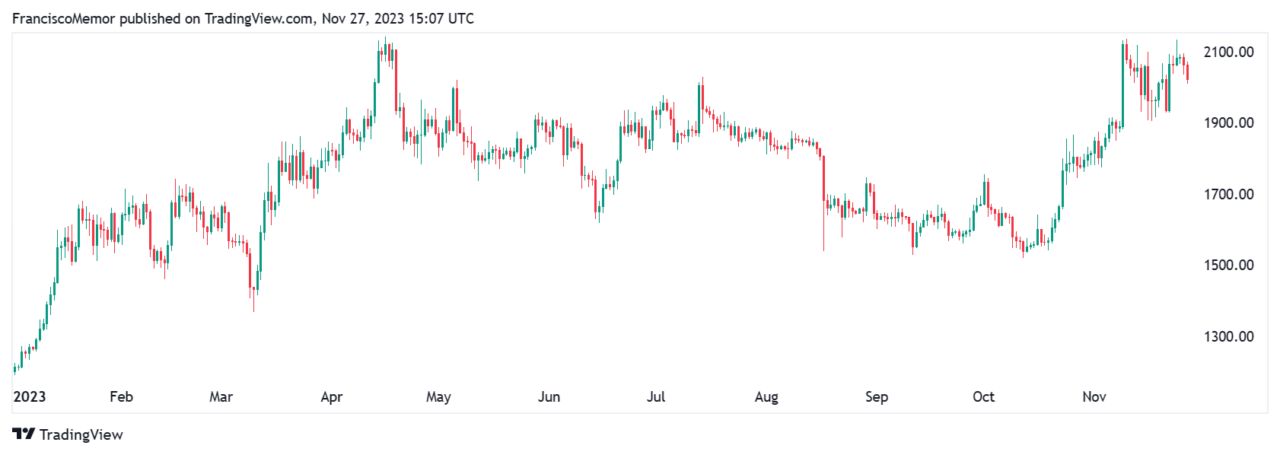

Over the last 30 days, the price of Ethereum’s Ether has moved up over 13% amid renewed optimism on the cryptocurrency sector and after asset management giants BlackRock and Fidelity filed to launch spot Ethereum exchange-traded funds (ETFs) in the United States. Year-to-date, Ethereum’s price is up 68.8% as it is now trading above the $2,000 mark.

According to CryptoQuant’s analysis, the spike in institutional interest in Ethereum signals a strong belief in its long-term value and potential for market expansion. These investors are not just drawn to the current market trends but are also looking at Ethereum’s promising future, with the implementation of Ethereum 2.0 and other enhancements seen as key drivers.

As CryptoGlobe reported, Ethereum investment products saw $49.1 million of inflows last week, bringing their year-to-date flows to a negative $58 million as they recover from significant outflows seen earlier.

According to former Goldman Sachs executive Raoul Pal, a ell-known figure in the finance and investment world, particularly recognized for his expertise in macroeconomic trends, Ethereum could outperform Bitcoin in Crypto’s “late spring” phase.

Pal referenced the Tom Demark Sequential indicator to support his view that Ethereum is gearing up to surpass Bitcoin. The Tom DeMark Sequential is a technical analysis indicator developed by Tom DeMark to identify potential price exhaustion and reversal points in financial markets. This tool is particularly popular among traders and analysts in various markets, including forex, stocks, and cryptocurrencies.

Featured Image via Unsplash

Source: Read Full Article