Bitcoin Miners Stop Selling

Bitcoin miners have finally stopped selling for the first time since December and have seemingly began accumulating.

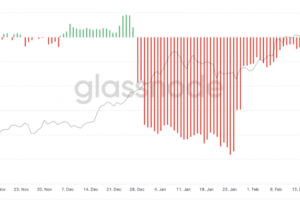

As can be seen above, for much of December miners kept their new coins, but then began selling.

Miners were selling some 20,000 bitcoin a day for much of January, worth nearly a billion dollars.

For February as well they were selling 5,000 BTC a day, worth $240 million, according to Glassnode analytics.

For the past two days, however, the miners’ net position has turned green, increasing their holdings by about 2,000 bitcoins ($100 million).

This could suggest miners have depleted their bitcoin savings, some of it perhaps kept since even prior to the halvening.

That most likely added pressure to bitcoin’s price, which at one point fell to the high $42,000s briefly.

Now that new supply pressure is seemingly being withdrawn, with publicly traded miners in addition holding their coins, unlike the China based ones which tend to insta sell them.

For now however the publicly traded hashrate is fairly small, maybe about 10%, but they’re growing fast due to their ability to tap into global capital markets.

As such it is most likely they will gain a higher share, adding some financial sophistication to the bitcoin mining market, which should benefit bitcoin.

Source: Read Full Article