Bitcoin Price May Have Hit Support Following Coinbase's Premium Upsurge

Bitcoin dropped to $61,049 after it surged to new levels on Wednesday. The $63,500 high was followed by a dip, knocking bulls to the lower ends of the $60,000 price mark.

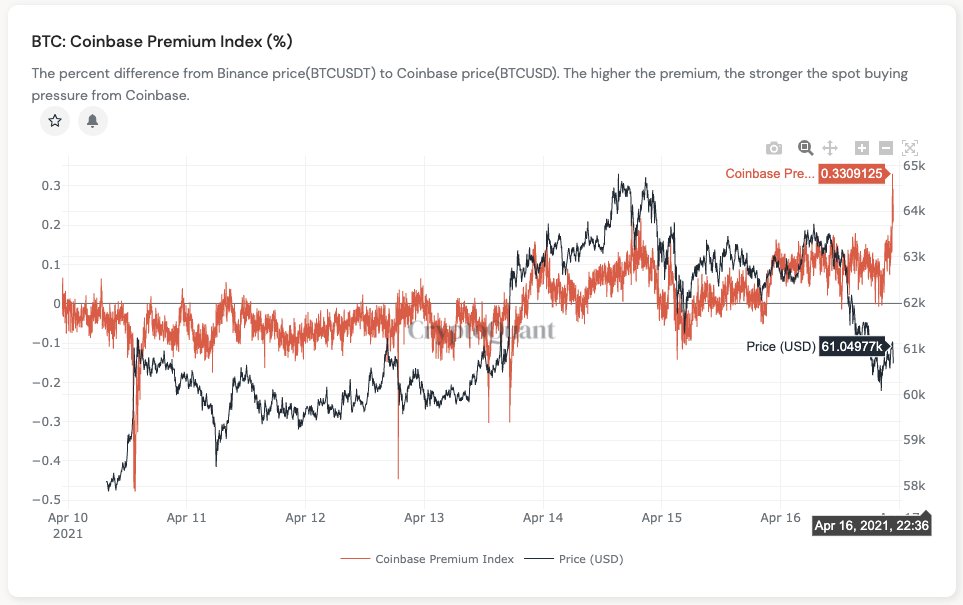

As the market blinks in subtle red for Bitcoin, Coinbase premium skyrockets, meaning that the spot buying pressure from the exchange is becoming stronger. Institutions, long-term holders, and investors are opening their wallets to continue accumulating more Bitcoin.

The result of this activity is what is reflected in the chart below as a surge in Coinbase’s premium in comparison to the Binance exchange. This is yet another healthy sign for the Bitcoin market.

Bitcoin hits key support. An upward correction is imminent

Essentially, this is bullish for the price of Bitcoin in the long-term. As Ki Young Ju, the CEO of On-chain platform CryptoQuant reckons, Bitcoin may have hit the support line.

If Young’s assertions are accurate, then the market could bloom in green in the following weeks as prices are poised to go up from here.

Q2 Bitcoin Bulls may outperform Q1’s

The first quarter of the year will enter the history books as Bitcoin’s best performing first quarter in eight years. As for the second quarter, there is no telling how far the market could go. But from what the current on-chain data tells us, there are many reasons to bet that Bitcoin could flourish even better than it did in the last few months. A close look at On-chain performance shows a growing Bitcoin network. Glassnode recently captured the growing movement in its “Total Transfer Volume” chart.

Bitcoin records its highest daily on-chain transfer volume. In 2016, the value was only slightly higher than $0. Between 2017 and 2018, the price value picked up traction and hit an all-time high that slightly surged past $40 billion. As of today, we see a thriving transfer volume touching $49.45 billion for the first time.

Conclusively, analyst William Clemente advises paying attention to the on-chain indicator SOPR, which is used to measure profit in times of a price bottom. He asserts that there is more room for the rally to continue.

“SOPR shows some more room for price to rally from here but will definitely be something to keep a close eye on in coming weeks along with funding rates.” He noted.

Source: Read Full Article