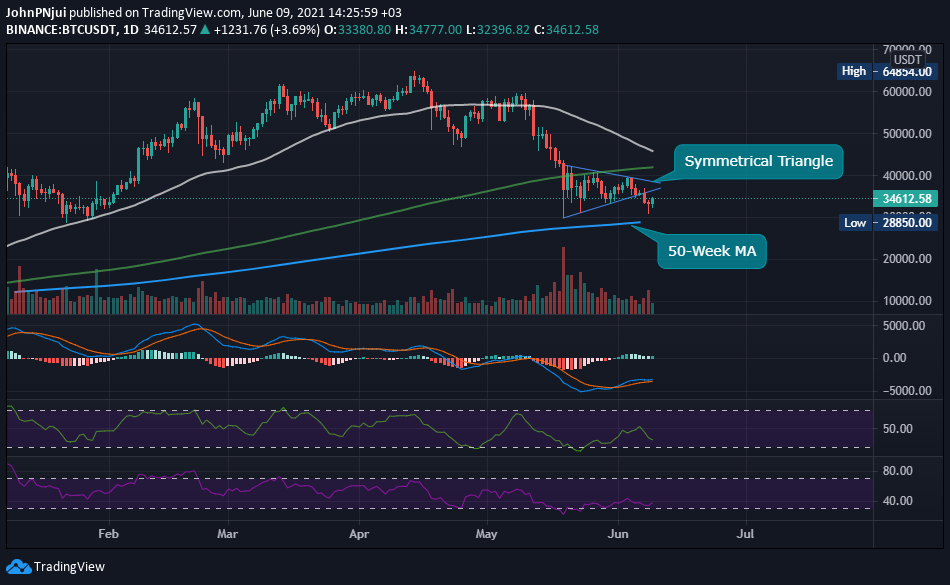

Bitcoin's 50-Week MA Could Produce a Nice Relief Rally – BTC Analyst

Bitcoin’s Death Cross Seems Inevitable

Also from the chart, it can be observed that Bitcoin continues to trade below the 200-day moving average (green) with the earlier mentioned death cross, destined to occur in the next few days. Therefore, the relief rally mentioned by Magic might be short-lived given the fact that Bitcoin is very much in bear territory.

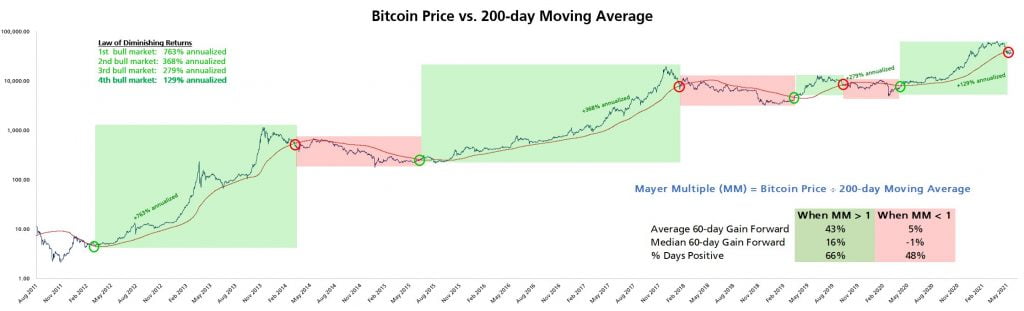

Bitcoin Trading Below the 200-day MA Signals the End of a Bull Market

In addition, and regarding Bitcoin trading below the crucial 200-day moving average, BTC and crypto analyst, Timothy Peterson, had earlier this week warned that BTC trading below this crucial metric had always marked the end of a bull run. His analysis of Bitcoin can be found below alongside a chart he shared demonstrating the historical significance of the 200-day moving average.

Bitcoin price has dropped below 200-SMA for 17 consecutive days and counting. This metic has *always* marked the end of a bull run and the start of a bear market.

Source: Read Full Article