hielen Foresees 330% Surge in This Bitcoin Mining Stock

Matrixport’s Head of Research, Markus Thielen, offers an incisive evaluation of the Bitcoin mining sector, pinpointing a stock with the potential to climb by more than 330%. Revealed in his blog post on 26 October 2023, Thielen delivers this forecast alongside incentives for new subscribers, encapsulating his commitment to enhancing crypto investment literacy.

According to Thielen, the mining sector has reached a profitability fulcrum due to rising Bitcoin prices, much like any commodity-dependent business witnessing operational margin growth. He explains that as the Bitcoin Network Hashrate has surged, intensifying the mining competition, the increase in Bitcoin prices has likely pushed most miners into the profitable zone.

Revisiting his earlier predictions, Thielen refers to his September 28 report, which envisaged a significant Bitcoin upturn, now reflected in a 30% increase in its value, aligning with his expectations. He had earlier identified institutional investments as key drivers in his September 20 analysis.

Thielen’s research highlights Galaxy Digital as a particularly undervalued entity, where despite a 28% share price increase, further growth is expected, based on his regression analysis, if Bitcoin maintains its value over $30,000.

The Matrixport strategist then provides a meticulous breakdown of mining costs, pinpointing the Q2 figures for various firms indicating the disparate nature of mining efficiency across the industry.

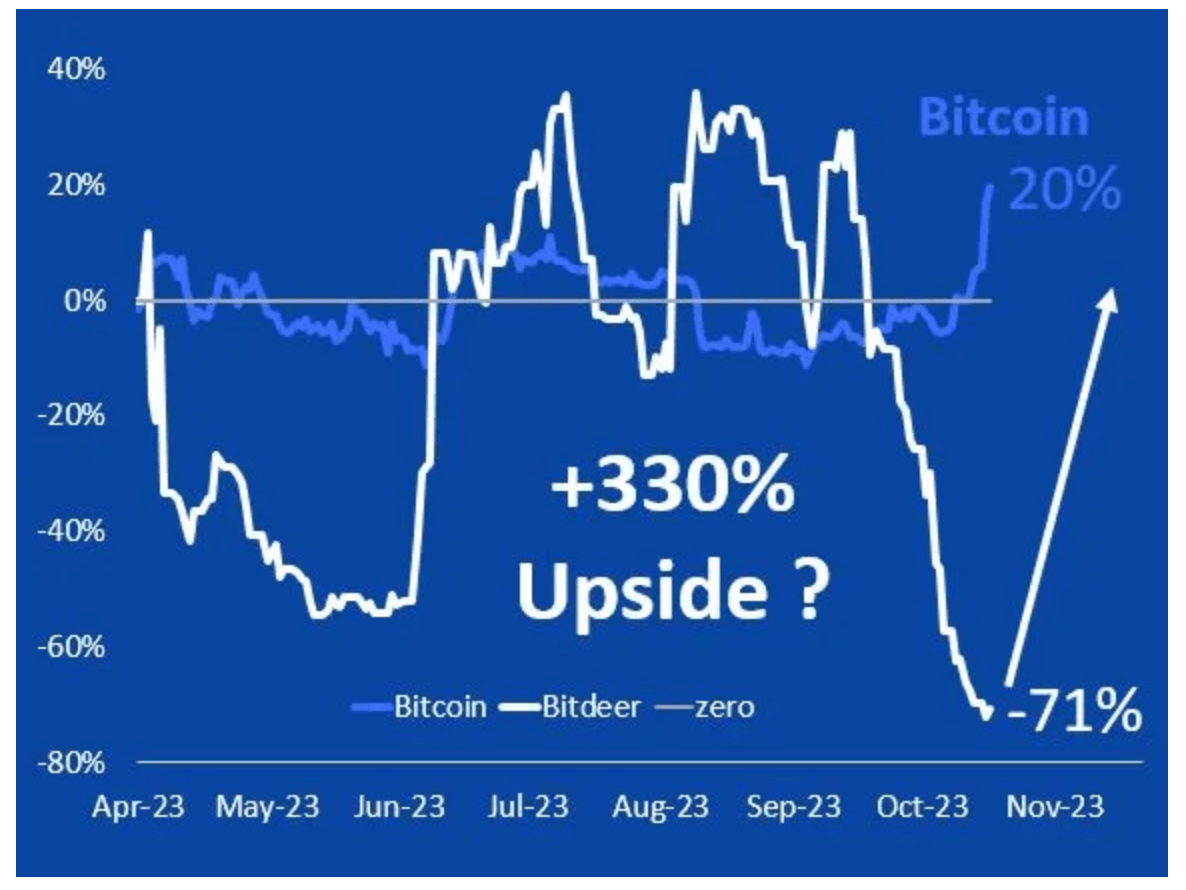

In a keen observation, Thielen underscores the remarkable upside of Bitdeer, a stock that faced a considerable devaluation since its IPO. He suggests that the company’s April 2023 valuation was significantly impacted by the timing of the market, relating it to the reduced exuberance from the November 2021 peak.

Thielen also sheds light on the selling trend observed with Bitdeer’s stock, exacerbated by the expiration of a lock-up period, indicating an expected sell-off from employees capitalizing on pre-IPO benefits.

Further attributing the comparative perspective, Thielen notes that despite Bitdeer’s mining output being less than that of industry leader Riot Platforms, the disproportion in their market caps suggests Bitdeer’s growth potential, particularly if the selling pressure abates.

In his closing remarks, while recognizing the risks involved with investing in Bitcoin mining stocks, Thielen emphasizes the integrity of his independent analysis, irrespective of Bitdeer’s connection to Matrixport. His commentary solidifies the stock’s status as a risky yet potentially rewarding investment, epitomizing the volatile yet opportunistic nature of cryptocurrency mining investments.

An evaluation of Bitcoin’s historical performance, as reported by CoinDesk’s Omkar Godbole, shows a pattern where the cryptocurrency often enjoys significant gains towards the end of the year. Thielen has indicated through his studies that Bitcoin when witnessing a minimum of a 100% increase within a single year, tends to continue its upward trajectory through the year’s end about 71% of the time. On these occasions, it’s been observed that the digital currency averages an additional 65% increase in value.

At this juncture, Bitcoin has already achieved a substantial increase, trading over $35,000, which equates to a 114% climb on a year-to-date basis. This impressive performance has been linked to several factors, such as heightened expectations for the approval of spot Bitcoin ETFs, speculation surrounding the Federal Reserve’s potential pause on increasing liquidity restrictions, and the growing perception of Bitcoin as a stable investment during economic uncertainties.

In a note to his clients dated November 2, as per CoinDesk’s coverage, Thielen elaborated on this trend. He explained that Bitcoin’s historical patterns show a strong tendency for the currency to not only sustain its value after a double increase during the year but also to potentially see a further substantial rise. This period, particularly from early November leading up to mid-December, could well be regarded as a seasonal bullish phase for Bitcoin, often referred to as the ‘Santa Claus Rally.’

Source: Read Full Article