Mexican Billionaire: My ‘Liquid Portfolio’ Is ‘60% in Bitcoin and Bitcoin Equities’

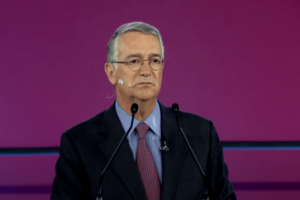

On Thursday (April 7), Mexican billionaire Ricardo Salinas Pliego talked about Bitcoin while speaking in Miami as part of a panel (titled: “Billionaire Capital Allocators”) on day two of the four-day Bitcoin 2022 conference.

Ricardo Benjamín Salinas Pliego is the founder and chairman of Mexican conglomerate Grupo Salinas. He is currently the third richest person in Mexico, and according to Forbes, as of today (April 8), he is the 158th richest person in the world with an estimated net worth of $12.7 billion.

Salinas started by saying that he has a “big grudge” against fiat currency, and explained that he had personal experience with hyperinflation in Mexico, and he warned the attendees of the conference that unfortunately today it looks like hyperinflation could also come to the U.S., with the value of the dollar dropping to 1/100 of what it is today in six years time, which is why he said he is urging people to save in Bitcoin rather than in fiat.

Later, at the same panel, Dan Tapiero said that “traditional asset allocators” (such as pension fund managers) have 60% exposure in equities and 40% in bonds.

A few minutes later, Salinas explained why he hates bonds:

“I know for sure that some of you out there are counting on your pensions, and this is very dangerous because like the poet said, things change gradually and then suddenly, and the problem is that this bond investment is a terrible investment. I wouldn’t touch a bond with 10-foot pole.

“It’s just that the worst thing. I mean the best thing that can happen to you, you get back your hundred dollars. That’s the best thing that could happen to you… I definitely don’t have any bonds. I have the liquid portfolio. I have 60% in Bitcoin and Bitcoin equities, and then 40% in hard assets stocks like oil and gas and gold miners. And that’s where I am.“

https://youtube.com/watch?v=JA7WJmcA67U%3Ffeature%3Doembed

On 17 November 2020, Salinas recommended the book “The Bitcoin Standard” by Saifedean Ammous to his followers on Twitter, and said that this was the best and most important book for understanding Bitcoin. More interestingly, he revealed that 10% of his liquid assets were invested in Bitcoin.

In December 2020, during an interview with Cointelegraph’s Giovanni Pigni, he talked about Bitcoin. The interview started with Salinas telling the story of how he first heard about Bitcoin:”“I was invited to a conference in New York’s city… And there were different sessions, and [at] one of the sessions, this guy from Grayscale showed up. And he gave us the whole talk about Bitcoin and how it’s going to take over…. It immediately attracted my attention. I said ‘well, let’s try it out and see what happens’. I put in a small amount. It was trading at $200 per bitcoin. It was 2013, but at that time…

“What I liked about Grayscale was they simplified it — basically you put your money in the trust, then this trust would do the investment, they would take care of the whole thing, they would take care of the custody, they sent you a monthly statement, and that was a very good arrangement, and eventually that that trust turned into GBTC, which is now an exchange-traded product…“

Although Bitcoin initially grabbed Salinas’s attention as a “payment vehicle,” he later realized that “it’s the store value that really makes it valuable.”

Later in the interview, Salinas said that he sold all of his BTC holdings in January 2017 (when BTC was trading around $17,000):

“I had a big party, [was] very happy with my best investment ever, but you know, we always return to the scene of the crime, right? So when it went down to $10,000, I thought ‘well, now, it’s more reasonable’, and I bought some at that time. and then it went down more to $6,000, bought about some more, and that’s where I am, where our average right now is around $9,000, and I’m not done. I’m not selling it. I think I’m gonna sit around for another five or ten years.“

Then, on 24 December 2021, Salinas had an interesting new year video message for his over 959K followers on Twitter:

And less than two months later, he advised his one million Twitter followers to HODL bitcoin:

Disclaimer

The views and opinions expressed by the author, or any people mentioned in this article, are for informational purposes only, and they do not constitute financial, investment, or other advice. Investing in or trading cryptoassets comes with a risk of financial loss.

Source: Read Full Article