Michael Saylor “I’d Rather Win in Volatile Fashion Than Lose Slowly, Sell your Gold”

- Microstrategy’s Former CEO Michael Saylor pointed out in a recent interview for Stansberry Research that he would rather win in a volatile fashion than lose slowly.

- Saylor continues to say that the volatility will only impact short-term investors and public companies. Bitcoin has outperformed every single company on the stock market in a longer timeframe.

MicroStrategy’s Former CEO and well-known Bitcoin advocate Michael Saylor addressed in a recent interview with Stansberry Research that he still believes in Bitcoin in the long term.

My discussion with @DanielaCambone on $MSTR volatility & performance, my role at @MicroStrategy, the future of #Bitcoin, Stablecoins, Altcoins, & Gold, as well as thoughts on regulation, macroeconomics, wealth preservation, and an engineer’s common sense definition of recession. https://t.co/hFCnR9eEd7

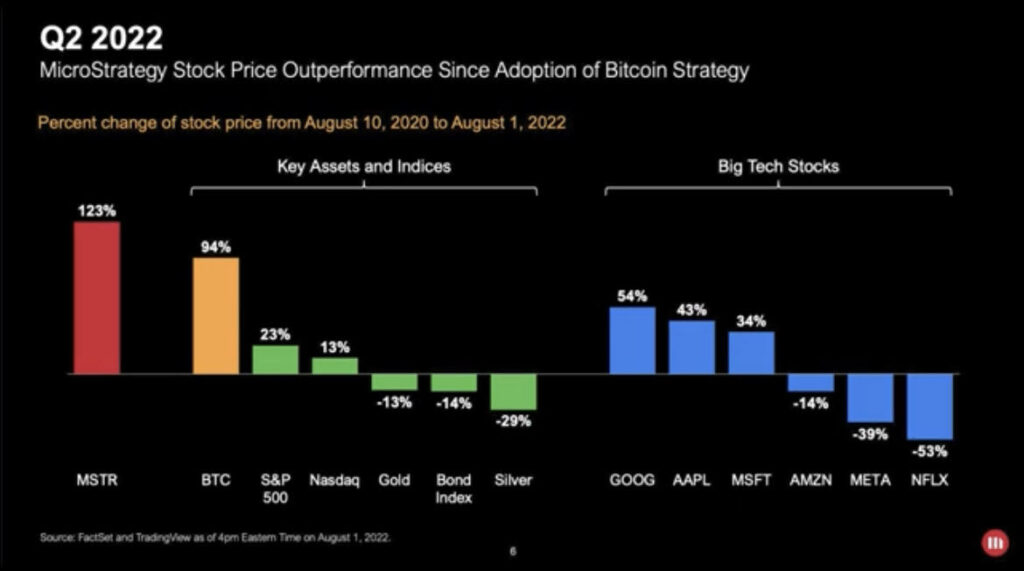

According to Saylor, since MicroStrategy adopted the Bitcoin Strategy, Bitcoin has heavily outperformed the S&P 500, Nasdaq, Gold, Bond Index, and any Big Tech Stocks. He says that the only stock that has outperformed Bitcoin in this period is Microstrategy’s stock, MSTR.

When asked if he thinks Bitcoin’s volatility is for everyone and some market participants cannot handle the extreme volatility, Saylor provides the below response.

“The way to think about investing in Bitcoin is, you should only invest what you will hold for four years or longer; ideally, it’s generational wealth transfer. The metric you want to stare at is the simple four-year moving average.” If you have a short time frame, it is going to be much more stressful because it is a volatile asset. “

Saylor continues to highlight that Microstrategy has outperformed every asset, even the prominent big tech companies. He would rather win in a volatile fashion than lose in a non-volatile way.

Saylor’s Reasoning Behind Crypto’s Recent Downfall

Saylor firmly believes that the events that caused crypto’s recent downfall were triggered by the incoming interest rates and the tightening of the fed. The next catalyst was the big Terra Luna Meltdown, which affected a lot of cryptos. He believes that an algorithmic stablecoin was an accident waiting to happen.

Saylor’s opinion is that these events needed to happen to flush out the industry’s bad actors. Market participants are now more educated and cautious about banking applications that provide huge yields.

“If you believe in sound money, you should sell your gold and buy bitcoin.” says Saylor.

Saylor Recently Stepped Down as MicroStrategy CEO to Focus on Bitcoin

After 33 years of being CEO of MicroStrategy, Micheal Saylor stepped down recently instead of taking the role of executive chairman. Phong Le, MicroStrategy’s current president, will take his role as CEO. MicroStrategy’s message to investors was that Saylor is to continue to provide oversight of the company’s bitcoin acquisition strategy as head of the Board’s Investments Committee.

Source: Read Full Article