Nicholas Merten Warns of a Potential 46% Bitcoin Decline Amid U.S. Recession Concerns

Recently, Merten warned his substantial following that Bitcoin could see a significant decline if the U.S. economy enters a recession. He attributes this potential fall to the Federal Reserve’s hawkish stance, which he believes could lead to a prolonged economic downturn in the United States.

Nicholas Merten, a leading voice in the crypto space, is best known as the founder of DataDash, a YouTube channel with over 512,000 subscribers. The channel is a go-to resource for many, offering comprehensive analysis and insights into cryptocurrencies, blockchain technology, and financial markets. Merten has earned a reputation for his ability to simplify complex financial topics, making them accessible to both newcomers and seasoned investors.

Merten suggests that if commodities like oil, natural gas, and uranium begin to stabilize or decrease in value, it could be a sign of an upcoming short-term recession. In such a case, he anticipates that equities might experience a downturn similar to the 33% correction seen in October 2022. For Bitcoin, this could translate to a drop to a price range between $15,000 and $17,000. Merten views this as a relatively favorable outcome, as it could set the stage for a double bottom in most asset classes.

According to a report by The Daily Hodl, Merten said:

“[A short-term recession] is going to cause a little pain. Equities will probably go back down towards their lows, that 33% correction that we saw back in October 2022. Bitcoin could likely come back down toward a similar low range that it saw before around $15,000 to $17,000. And that would actually be a pretty good scenario. We may be getting a double bottom across most assets.“

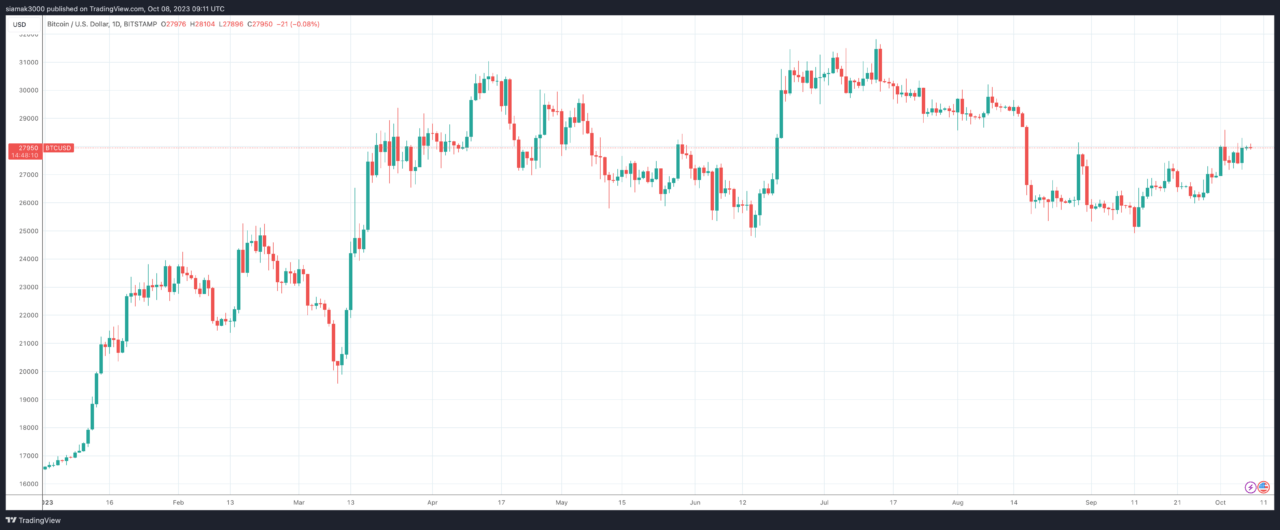

He argues that a sustained Bitcoin bull market is unlikely until the Federal Reserve starts to increase liquidity in the economy. Merten notes that Bitcoin has been trading sideways from March to October 2023, unable to break through resistance levels between $28,000 and $32,000. He recommends a cautious approach, advising investors to wait for clear signs of optimism and increased liquidity, which he identifies as crucial for risk-on assets like Bitcoin.

Merten stresses that Bitcoin thrives when there is an increase in the money supply and a risk-on investor mentality. However, he notes that neither of these conditions is currently present.

https://youtube.com/watch?v=2SXPW1Ctn58%3Ffeature%3Doembed

At the time of writing, Bitcoin is trading at around $27,939, up 0.5% in the past 24-hour period with a return of +66.81% vs USD in the year-to-date period.

Mike McGlone, Bloomberg Intelligence’s Senior Macro Strategist, warns that Bitcoin could see a price drop of over 60% due to negative liquidity and rising global interest rates. He believes that the U.S. is likely to face a recession by the end of 2023, which would have a significant impact on Bitcoin. McGlone identifies the $30,000 mark as a crucial resistance level for the cryptocurrency and suggests it is more likely to decline toward the $10,000 range.

He also sees a substantial risk for the broader cryptocurrency market, particularly if a recession triggers a stock market downturn. McGlone leans toward interpreting the crypto market’s Q3 2023 weakness as an indication of a recessionary trend. He notes that central banks are tightening monetary policies despite economic contraction signs in the U.S. and Europe and the ongoing property crisis in China, which he views as having deflationary implications.

Featured Image via Midjourney

Source: Read Full Article