Barry Diller Dubs AT&T’s WarnerMedia Sale “The Great Escape,” Flays Telco For String Of Business Flops

AT&T continues to take a licking heading into the weekend with mogul Barry Diller describing plans to unload WarnerMedia as “a great escape” and calling its three-year dalliance with showbiz the telco giant’s latest bungle in a string of bad deals.

Never one to mince words, the founder of sprawling digital powerhouse IAC and former head of Fox and Paramount said, “It’s the power of monopoly. I mean, Ma Bell should have been dead and buried by now. I mean, they go into cable, only a few years later to say ‘oh my god we made a mistake’ and sell it. They go into Direct [DirecTV], and go into Time Warner with an idea, but certainly not fully fledged, and then they go about basically, I think, hurting Time Warner assets.”

AT&T acquired John Malone’s cable operator TCI in 1999, later selling the business to Charter and Comcast. It bought satellite provider DirecTV in 2015 and last February announced it was spinning the asset off into a new joint venture with investment firm TPG. WarnerMedia was acquired in 2018 and, as per Monday’s announcement, will be spun off to shareholders of AT&T and Discovery to create a new public company in a deal expected to close in mid-2022.

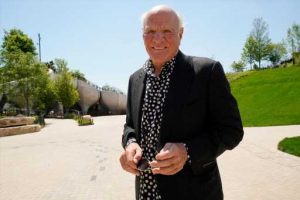

“They drove Jeff Zucker out of the building…They drive out [many of] the talented people and then they say ‘never mind’ and they sell it,” Diller told CNBC in an interview from Little Island, a new park that opened today on the edge of Manhattan’s Meatpacking District. Diller conceived of the project and he and his wife Diane von Furstenberg donated $260 million to build it.

Jeff Zucker, chief of CNN Worldwide, had previously announced plans to leave WarnerMedia at year end. But in interviews this week, Discovery CEO Zaslav, who will be running the combined business, praised Zucker and said he plans to invest more in the news network and support a global streaming platform for the brand.

With Discovery, Diller said, WarnerMedia “is in better hands.”

AT&T shareholders are also clearly peeved, as evinced by the stock’s flop. It’s trading up late Friday morning but still off nearly 10% over the last five sessions, mainly on news that it plans to reduce the dividend that it has long offered its broad base of retail investors. Jim Cramer, host of CNBC’s Mad Money, who has been on the company’s case all week, said “widows and grannies” need that income and projected large images of current AT&T CEO John Stankey, who’s held the job since July, and former CEO Randall Stephenson on his “Wall Of Shame” Thursday night.

AT&T execs have noted that that the company has reaped benefits from its ownership of WarnerMedia, which launched streaming service HBO Max last year, but felt that the two businesses – telco and media — could grow more successfully on their own.

Read More About:

Source: Read Full Article