Contrary advance rulings on GST leave industry perplexed

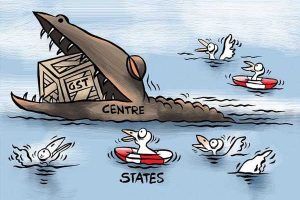

In addition to this confusion, classification issues, revenue biases in rulings, delays in disposing of applications, and lack of senior officers in AARs have made the advance ruling mechanism under GST unpopular among industry players, reports Dilasha Seth.

An auto company with a presence in 20 states of the country is in a fix as to whether it can avail itself of input tax credit (ITC) on demonstration vehicles under the goods and services tax (GST) regime.

The reason is the contradictory verdicts by advance ruling bodies in four states on the matter.

The Madhya Pradesh Authority for Advance Ruling (AAR) recently held that ITC could not be taken on such vehicles because they were not used for furthering supply.

This runs contrary to the rulings by the Maharashtra and Kerala AARs, which said there could be ITC on such vehicles.

Besides, the Haryana AAR denied ITC benefits on demonstration vehicles in a ruling for BMW India.

This has left the industry perplexed.

In addition to this confusion, classification issues, revenue biases in rulings, delays in disposing of applications, and lack of senior officers in AARs have made the advance ruling mechanism under GST unpopular among industry players.

States like Punjab and Delhi have reported delays in disposing of AAR applications.

Besides, the proposal for a national AAR, which was passed by the GST Council close to two years ago, to decide on cases in which there were divergent orders at state level, is yet to see the light of the day with some states not having passed the relevant law.

“Contrary rulings by AARs are perplexing industry. Taxability of liquidated damages, employee benefits, solar power projects, back-office services are a few examples where there are contrary rulings. Thus, the challenge is uncertainty on tax positions, diverse practices, notices by tax authorities, etc,” said Harpreet Singh, partner, indirect tax, KPMG.

As regards registering liaison offices of foreign companies in the country, divergent rulings have complicated the matter.

While the Karnataka AAR in the case of a German company had held that its liaison office would need to be registered under the Central GST (CGST) Act and would be liable to pay GST in India, the Tamil Nadu and Rajasthan AARs ruled that since there was no supply under the provisions of the CGST Act, it was not required.

However, in February, the Karnataka Appellate AAR (AAAR) reversed the AAR’s ruling on German company Fraunhofer-Gesellschaft zur Forderung and held that since the liaison office in Bengaluru did not have a separate legal existence, it was not liable to register in India.

M S Mani, partner, Deloitte India, said the contradictory rulings had made businesses cautious in approaching the AAR.

Besides, some pointed out that there was a perception of a pro-revenue bias in the rulings, causing industry to avoid approaching AARs.

“As some AARs are pro-revenue and against taxpayers, there is fear and the trend is to avoid filing,” said Singh of KPMG.

Rajat Mohan, partner, AMRG Associates, concurs with the view. “Most AAR judgments are revenue-biased,” he said. Abhishek Jain, tax partner, EY, too has the same view.

AARs comprise joint commissioners or additional commissioners of state governments and the central government.

While 525 AAR rulings were passed in 2019, there were only 318 in 2020. So far in 2021, three have come.

Another issue plaguing the advance ruling mechanism is the severe delay in some states in delivering a verdict.

While there has been no hearing for months together in a few AARs, states like Punjab and Delhi have seen significant delays in disposing of applications.

The last order passed by the Delhi and Telangana AARs was in 2018 and for the Punjab AAR it was 2019, according to the data on the portal.

“The concept of a national AAR is unique. Even if implemented in future, it is not expected to get any favour from taxpayers,” said Mohan of AMRG Associates.

Source: Read Full Article