Jack Henry improves Paycheck Protection Program service

Jack Henry, a US-based company that offers core tech solutions to financial services providers, has streamlined its Paycheck Protection Program (PPP) lending solution, which it launched in early April to enable borrowers for loans to apply online, per PR Newswire.

- Jack Henry has enhanced its PPP lending solution following the US government's launch of a third round.

- This will help incumbent lenders better meet SMB demand and fend off fintech disruption.

- Insider Intelligence publishes hundreds of insights, charts, and forecasts on the Fintech industry with the Fintech Briefing. You can learn more about subscribing here.

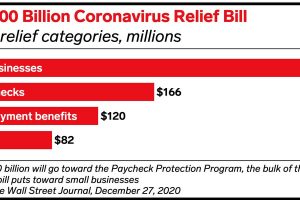

Jack Henry has now improved the digital interface for borrowers and added a broker option that allows its clients to refer the loan application to a Jack Henry partner lender. The revamped solution follows the US government initiating a third PPP round worth $280 billion. The first $349 billion round was exhausted within two weeks in March, followed by an additional $310 billion second round in April, which closed in August with $134 billion in unused funds. Jack Henry offers tech solutions to 8,700 clients nationwide, including financial institutions (FIs), community banks, and credit unions.

The improved lending solution will drive incumbent lenders' momentum in successfully distributing PPP loans to medium-sized businesses (SMBs). As the economic effects of the pandemic materialized, SMBs facing shrinking revenues turned to accredited lenders to access government-backed PPP loans. But many faced poor communication and long wait times: JPMorgan's online portal, for example, struggled to process the first round of applications, requiring the bank to call each applicant for more information, creating a bottleneck.

This was seemingly a wake-up call for many incumbent lenders, which became more effective in distributing PPP loans during the second round, per Insider Intelligence. And with an estimated 90% of small businesses having already exhausted their PPP funds, demand for the third round will likely be high. Jack Henry's updated offering thus provides an opportunity for lenders to continue supporting SMBs with an improved digital experience.

Incumbent lenders' original shortcomings opened the doors to fintech disruption, which should further accelerate demand for the likes of Jack Henry's solutions. Traditional lenders' discrepancies in distributing PPP loans in the first round enabled accredited fintechs to swoop in with faster and more streamlined services. By the end of the second PPP round in August, alt lender Kabbage had approved 297,587 applications, with only two major banks approving more: Bank of America (343,626) and JPMorgan (280,185).

Pressure to fend off this fintech lending disruption will likely push existing Jack Henry clients to double down on its services—the tech provider has supported 400 banks and credit unions so far with PPP applications, per PR Newswire—and attract other incumbent lenders. Moreover, with the pandemic slowing banks' IT spend, smaller banks in particular will likely increase their use of services like Jack Henry's to continue their digital transformation in a fast and cost-effective manner.

Want to read more stories like this one? Here's how you can gain access:

- Join other Insider Intelligence clients who receive this Briefing, along with other Fintech forecasts, briefings, charts, and research reports to their inboxes each day. >> Become a Client

- Explore related topics more in depth. >> Browse Our Coverage

Current subscribers can access the entire Insider Intelligence content archive here.

Learn more about the financial services industry.

Source: Read Full Article