JPMorgan CEO on state of economy: 'We should celebrate growth'

Dimon on US economy: ‘Celebrate growth’

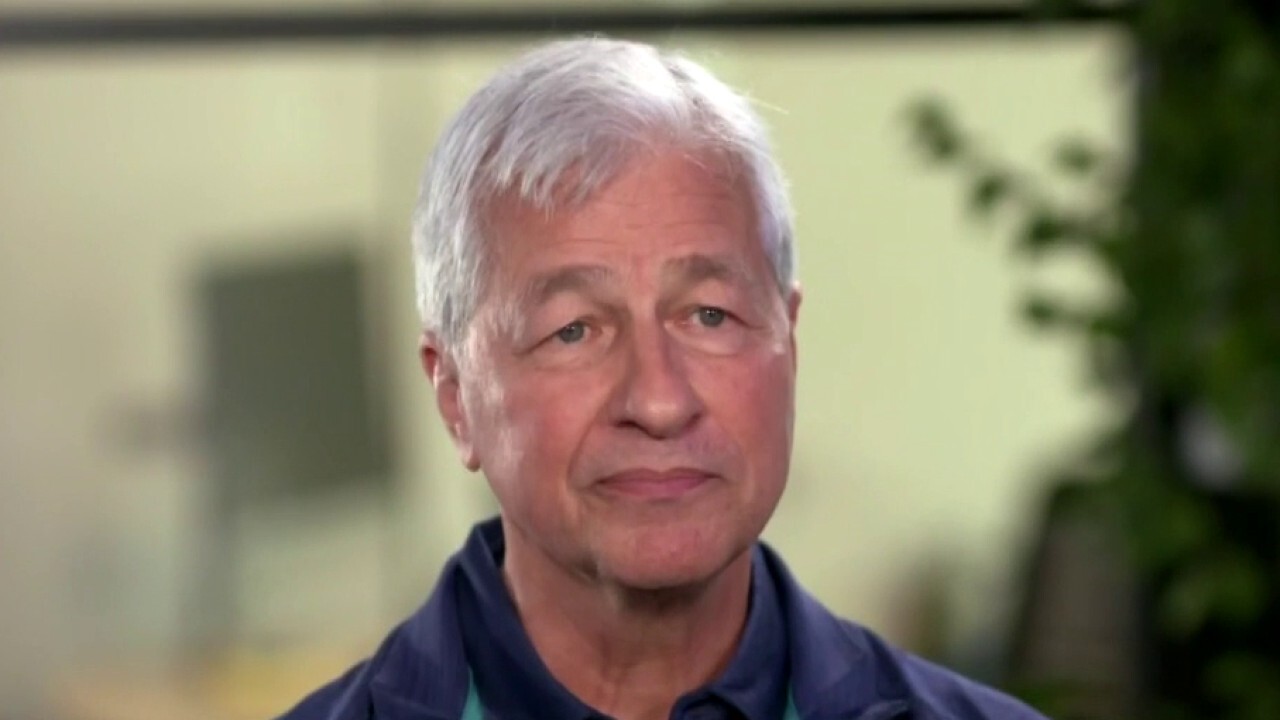

JPMorgan Chase CEO Jamie Dimon, in a wide-ranging interview with FOX Business’ Maria Bartiromo, discusses the new Fargo branch and the economy.

JPMorgan Chase CEO Jamie Dimon argues that "we should celebrate the growth" and explained during an exclusive interview with FOX Business’ Maria Bartiromo why he believes interest rates are still low at a time when the economy is bouncing back from the coronavirus pandemic and its associated lockdowns.

"We should celebrate the fact that we can grow at 6%, 7% and God knows in the next year," Dimon told Bartiromo in the interview that aired on "Mornings with Maria" on Wednesday.

Gross domestic product [GDP]– the broadest measure of economic performance – grew at a 6.5% annual rate during the second quarter, according to an advance estimate released last week by the Commerce Department. Analysts surveyed by Refintiv were expecting 8.5% growth. First-quarter GDP was revised down to 6.3% from its previous reading of 6.4%.

The above-trend growth in the second quarter reflected the continued reopening of the U.S. economy and government support via business loans, stimulus checks and extended unemployment benefits.

The current figures provide a stark contrast from those during the onset of the pandemic.

The U.S. economy shrank at a dizzying 33% annual rate in the April through June quarter last year, which was by far the worse quarterly plunge ever as the viral outbreak shut down businesses, throwing tens of millions out of work and sending unemployment surging to 14.7%, according to the government.

As economies reopened, GDP surged by 33.1% on an annualized basis in the three-month period from July through September of last year, the Commerce Department said. The previous post-World War II record was a 16.7% increase in 1950.

Last week, the Federal Reserve said that it would maintain ultra-low interest rates and reaffirmed its commitment to other easy monetary policies, but suggested it could dial back that support in coming months if the U.S. economy continues to strengthen.

SURGING INFLATION COULD DERAIL ECONOMIC RECOVERY FROM PANDEMIC, IMF WARNS

The U.S. central bank, as widely expected, held the benchmark federal funds rate at a range between 0% and 0.25%, where it has been since March 2020, when the virus forced an unprecedented shutdown of the nation's economy. The Fed will also keep purchasing $120 billion in bonds each month, a policy known as "quantitative easing" that's designed to keep credit cheap.

Dimon explained that he believes interest rates are still low even as the economy is recovering "mostly because central banks around the world have bought $12 trillion of bonds." He then explained the positive and negative outcomes of that policy.

Jamie Dimon: Rates are low because governments are buying bonds

JPMorgan Chase CEO Jamie Dimon weighs in on interest rates.

"One outcome is that rates go up," Dimon told Bartiromo, noting that he believes interest rates belong at around 3-3.5% and 2% in the short end. He said that with those rates, the U.S. will "still have healthy growth going for a couple of years."

Dimon explained that the negative outcome of current monetary and fiscal stimulus is higher inflation.

"We do have a lot of fiscal stimulus, which is unspent, a lot of monetary stimulus is still out there and that may very well lead to higher inflation," Dimon said.

He then stressed that in the meantime, the U.S. should "celebrate the growth and we'll deal with the next problem when we get there."

Last month it was revealed that prices for goods and services in June jumped by the most in 13 years, fueling concerns that a rapidly rebounding economy could lead to runaway growth.

The Labor Department said that prices rose 5.4% year over year with prices trending higher every month this year. Analysts surveyed by Refinitiv were expecting prices to rise 4.9% annually.

According to the department, the consumer price index rose 0.9% in June, faster than the 0.6% increase in May. Analysts surveyed by Refinitiv were expecting a 0.5% gain.

JPMorgan CEO Dimon says inflation is not temporary, disagrees with Fed

JPMorgan Chase CEO Jamie Dimon on stimulus payments, 10-year Treasury rates and the banking competition.

Used car prices spiked 10.5% last month, accounting for more than one-third of the increase. Additionally, energy prices climbed 1.5% month over month and food prices rose 0.8%.

GET FOX BUSINESS ON THE GO BY CLICKING HERE

The concern on Wall Street is that rising inflation could force the Fed to pump the brakes earlier than expected and start pulling back the massive monetary support it's providing for the economy.

CLICK HERE TO READ MORE ON FOX BUSINESS

FOX Business’ Jonathan Garber, Megan Henney and The Associated Press contributed to this report.

Source: Read Full Article