Payday loans can have interest rates over 600%—here's the typical rate in every U.S. state

Over the last few months, several states have moved to limit payday loan interest rates in an effort to protect consumers from getting in over their heads with these traditionally high-cost loans.

During the November general election, voters in Nebraska overwhelmingly voted to cap payday loan interest rates in the state at 36%. Prior to the ballot initiative's passage, the average interest for a payday loan was 404%, according to the Nebraskans for Responsible Lending coalition.

In January, Illinois' state legislature passed a bill that will also cap rates on consumer loans, including payday and car title, at 36%. The bill is still awaiting Governor J. B. Pritzker's signature, but once signed, it will make Illinois the latest state (plus the District of Columbia) to put a rate cap on payday loans.

Yet these small-dollar loans are available in over half of U.S. states without many restrictions. Typically, consumers simply need to walk into a lender with a valid ID, proof of income and a bank account to get one.

To help consumers put these recent changes into perspective, the Center for Responsible Lending analyzed the average APR for a $300 loan in each state based on a 14-day loan term. Generally, payday lenders levy a "finance charge" for each loan, which includes service fees and interest, so many times consumers don't always know exactly how much interest they're paying.

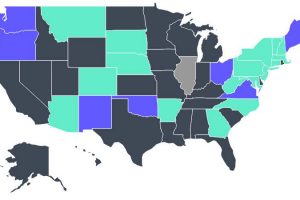

Currently, there are a handful of states (shown here in green) — Arkansas, Arizona, Colorado, Connecticut, Georgia, Maryland, Massachusetts, Montana, Nebraska, New Hampshire, New Jersey, New York, North Carolina, Pennsylvania, South Dakota, Vermont and West Virginia — and D.C. that cap payday loan interest at 36%, according to CRL.

But for states that do not have rate caps, the interest can be sky-high. Texas has the highest payday loan rates in the U.S. The typical APR for a loan, 664%, is more than 40 times the average credit card interest rate of 16.12%. Texas' standing is a change from three years ago when Ohio had the highest payday loan rates at 677%. Since then, Ohio has put restrictions on rates, loan amounts and duration that went into effect in 2019, bringing the typical rate down to 138%.

About 200 million Americans live in states that allow payday lending without heavy restrictions, according to CRL. Even during the pandemic, consumers are still seeking out these loans with triple-digit interest rates.

The rate of workers taking out payday loans tripled as a result of the pandemic, a recent survey by Gusto of 530 small business workers found. About 2% of these employees reported using a payday loan prior to the start of the pandemic, but about 6% said they'd used this type of loan since last March.

While payday loans can be easy to get in certain areas of the U.S., their high interest rates can be expensive and difficult to pay off. Research conducted by the Consumer Financial Protection Bureau found that nearly 1 in 4 payday loans are reborrowed nine times or more. Plus, it takes borrowers roughly five months to pay off the loans and costs them an average of $520 in finance charges, The Pew Charitable Trusts reports. That's on top of the amount of the original loan.

"In addition to the repeat borrowing, we do know that there's an increase in the chances of overdrafts, losing a bank account, bankruptcy and difficulty paying bills," says Charla Rios, a researcher with CRL. Other research has shown the stress of high-cost loans can also have health impacts, she adds.

"People are financially strained right now and we also know the outcome and the harms of payday loans, so these loans are not a solution for the time that we're in," Rios says.

Check out: Nebraska becomes the latest state to cap payday loan interest rates

Don't miss: Here are the 5 best personal loans of December 2020

Source: Read Full Article