Philly Fed Index Unexpectedly Indicates Modestly Slower Growth In August

The Federal Reserve Bank of Philadelphia released a report on Thursday showing an unexpected slowdown in the pace of growth in regional manufacturing activity.

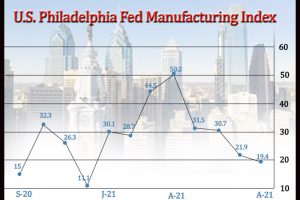

The Philly Fed said its diffusion index for current activity slipped to 19.4 in August from 21.9 in July. A positive reading still indicates growth, but economists had been expecting the index to inch up to 23.0.

The index of Philadelphia-area manufacturing activity decreased for the fourth straight month after reaching a nearly 50-year high in April.

The modest decrease by the headline index reflected a slowdown in the pace of growth in shipments, as the shipments index slumped to 18.9 in August from 24.6 in July.

On the other hand, the new orders index jumped to 22.8 in August from 17.0 in July and the number of employees index rose to 32.6 in August from 29.2 in July, indicating faster growth.

The report also showed faster price growth, as the prices paid index edged up to 71.2 in August from 69.7 in July and the prices received index jumped to 53.9 in August from 46.8 in July.

Looking ahead, the Philly Fed said most future indexes moderated this month but continue to indicate that the firms expect growth over the next six months.

The diffusion index for future general activity tumbled to 33.7 in August from 48.6 in July, falling for the second straight month after reaching a 30-year high in June.

“A solid pipeline of unfulfilled orders, buoyant goods demand, and rising business investment will underpin healthy regional manufacturing expansion, though supply-side constraints will drag on growth,” said Oren Klachkin, Lead U.S. Economist at Oxford Economics.

On Monday, the New York Federal Reserve released a separate report showing a significant slowdown in the pace of growth in regional manufacturing activity in the month of August.

The New York Fed said its general business conditions index plunged to 18.3 in August from 43.0 in July. While a positive reading still indicates growth, economists had expected the index to show a much more modest drop to 30.0.

Firms remained optimistic that conditions would improve over the next six months, with substantial increases in employment and prices expected.

Source: Read Full Article