This Is the US City Where Home Prices Are Rising Fastest

Home prices have soared to record levels in the past year. Compared to 2021 in most months, the national average of the increases is nearly 20%. In some large cities, it is well above that.

One reason for the jump was mortgage rates that dropped below 3% for a 30-year fixed home loan. Those days are over, however, as rates have surged well above 5%.

Another reason is demand in some metro areas. People increasingly have left expensive coastal cities like New York and San Francisco for areas inland where home prices are less expensive.

Finally, the COVID-19 pandemic prompted many companies to close offices. Millions of Americans began to work from home, and many of them will not go back to their offices. These people are free to move wherever they would like.

Several organizations measure home data, from prices to foreclosures. The gold standard for this research is the S&P CoreLogic Case-Shiller Indices, which measure home prices nationwide and in America’s largest cities.

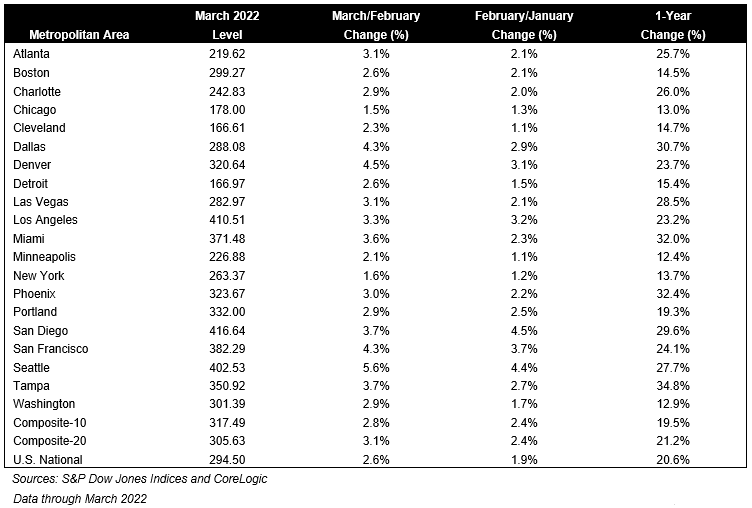

The most recent Case-Shiller data covers home prices in March, which rose a record 20.6%. The company keeps records that date back 27 years.

Craig J. Lazzara, managing director at S&P DJI, commented on the numbers: “Those of us who have been anticipating a deceleration in the growth rate of U.S. home prices will have to wait at least a month longer.” Perhaps at that point, rising mortgage rates will cool down price increases.

Three cities had particularly large home price increases compared to March a year ago. In Tampa, the increase was 34.8%, while in Phoenix and Miami the numbers were 32.4% and 32.0%, respectively.

These are the year-over-year price increases in all 20 markets measured in March:

Get Our Free Investment Newsletter

Click here to see which is the most overpriced housing market in America.

Sponsored: Find a Qualified Financial Advisor:

Finding a qualified financial advisor doesn’t have to be hard. SmartAsset’s free tool matches you with up to 3 fiduciary financial advisors in your area in 5 minutes. Each advisor has been vetted by SmartAsset and is held to a fiduciary standard to act in your best interests. If you’re ready to be matched with local advisors that can help you achieve your financial goals, get started now.

Source: Read Full Article