Time to revert to Rs 3.5 lakh as tax exemption limit?

Before 2019, an estimated 22 million individual income-tax returns did not have to pay any taxes.

But after the change in the exemption level, another 13 million individual tax returns did not require to pay taxes.

Thus, of about 58 million returns, as much as 63 per cent or 35 million went out of the direct tax net, A K Bhattacharya points out.

A change in the composition of the Centre’s gross tax revenue (GTR) in 2020-21 has caused consternation among tax experts.

Last financial year, the share of direct tax revenues in total GTR was 4.7 per cent of GDP, much lower than indirect tax revenues at 5.4 per cent of GDP.

This was only the second time in the last 13 years that direct tax revenues were lower than those from indirect taxes.

The earlier occasion was 2016-2017, the year of demonetisation, when direct tax revenues at 5.52 per cent of GDP were just a notch below 5.63 per cent of GDP for indirect taxes.

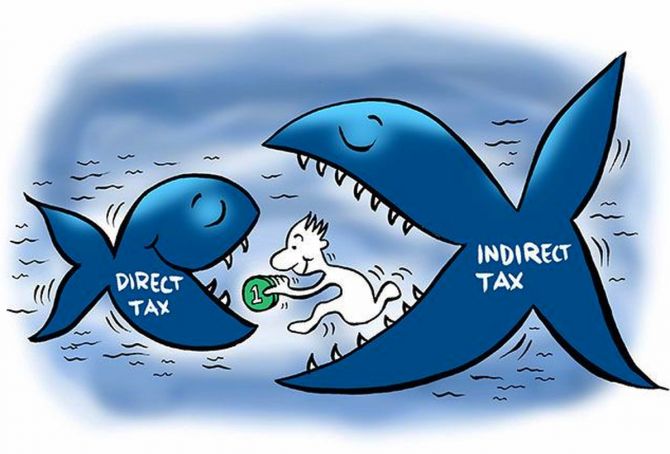

Why are tax experts worried? A preponderance of indirect taxes in the Centre’s GTR is considered regressive and inequitable.

While the levy of direct taxes is linked to the taxpayer’s income level, the burden of indirect taxes is equally shared by all taxpayers irrespective of their income.

For instance, a rich person pays GST on soaps at the same rate as a poor person.

So, tax experts are concerned that the central tax system may become iniquitous once again and the gains secured in the last decade or so may be frittered away.

There is, therefore, a demand that indirect tax rates should be reduced to bring down its share in GTR.

But before assessing how justified such a demand is, it would be instructive to recall the past trend in the composition of the Centre’s GTR.

Remember that in post-reforms India, the Centre took 17 years to reach a stage where direct tax revenues became more than those from indirect taxes in the overall GTR basket.

In 1990-1991, the share of direct taxes in GDP was woefully low at 1.94 per cent, while indirect taxes accounted for 8.17 per cent of GDP. Such was the preponderance of indirect taxes then!

The imbalance was addressed at a slow pace in the years that followed.

By the end of Manmohan Singh’s five-year tenure as the finance minister in 1995-1996, the share of direct taxes in GDP rose to 3 per cent and that of indirect taxes declined to 7 per cent.

Successive finance ministers (P Chidambaram and Yashwant Sinha), irrespective of the ruling parties they represented, maintained the trend of correcting the imbalance through bold and innovative reforms in both direct taxes and indirect taxes.

The net result was that by 2008-2009 and for the first time in post-reforms India, direct tax revenues rose to 5.8 per cent of GDP, inching ahead of indirect taxes at 5.18 per cent of GDP.

Since then, the share of direct taxes in GTR has generally remained stationary at around that level, although it stayed above the level of indirect taxes, largely because the latter’s rates were brought down, decelerating the revenue growth in this period.

The year of demonetisation in 2016-2017 was an aberration. It saw direct taxes at a level lower than indirect taxes, but not because the former grew at slower pace.

Indeed, direct tax revenues maintained a healthy share of 5.52 per cent of GDP.

But indirect taxes saw a boom, raising their share in GDP to 5.63 per cent. And this was largely due to the sharp increase in excise duty on petroleum products, which the Modi government had introduced after a drop in international crude oil prices.

Something similar happened in 2020-2021. Taking advantage of a decline in international crude oil prices (India meets almost 85 per cent of its overall demand for oil through imports), the Centre raised excise duty in two instalments in the middle of 2020, soon after the pandemic brought economic activities to a halt. In addition, it raised Customs duty on a large number of imported goods.

In 2020-2021, therefore, Customs duty collections rose by over 23 per cent and excise collections jumped by about 63 per cent over those in the previous year.

In terms of their share in GDP, Customs duty rose from 0.54 per cent to 0.68 per cent and excise reported a rise from 1.18 per cent to 1.97 per cent in the same period.

GST collections fell, but the annual decline was just about 8 per cent and their share in GDP fell marginally from 2.94 per cent in 2019-2020 to 2.78 per cent in 2020-2021.

In spite of indirect taxes staying ahead of direct taxes, it must be noted that the former’s rise is not unusually high, if you compare these numbers with those in the previous few years.

The share of indirect taxes in GDP has gone up in 2020-21, but it is still nowhere near the levels of 6-8 per cent of GDP that used to be quite normal till about 2001.

In the last decade, the share of indirect taxes in GDP has hovered between 4.5 per cent and 5.5 per cent. So, the increase now is not significant.

It’s true that there is a natural tendency to rely more on indirect taxes.

Indirect taxes are easier to collect with less scope for leakage. And since most of the rates are ad valorem, their buoyancy is automatically ensured in keeping with inflation.

Moreover, almost two-thirds of the central cess and surcharges are levied through indirect taxes.

Thus, higher collections in indirect taxes allow the Centre to share less taxes with the states. Cess and surcharges are not shareable with the states.

But, in spite of that, the real problem lies not with indirect taxes, but with direct taxes.

Note that after having reached about 6 per cent of GDP in 2017-2018, the share of direct taxes has seen a gradual dip with every passing year. Two factors are responsible.

One, individual income-tax exemption rules were amended in 2019, as a result of which annual income up to Rs 5 lakh became tax-free.

Earlier, this benefit was available to an annual income of up to Rs 3.5 lakh only.

Before 2019, an estimated 22 million individual income-tax returns did not have to pay any taxes. But after the change in the exemption level, another 13 million individual tax returns did not require to pay taxes.

Thus, of about 58 million returns, as much as 63 per cent or 35 million went out of the direct tax net.

Two, corporation tax rates too have been lowered from 2019 and the impact of lower taxes began to be felt on the corporation tax revenues in the following years.

Thus, those who are complaining about the increase in indirect tax revenues and therefore asking for lower indirect tax rates would be barking up the wrong tree.

The Centre would do well to focus more on the way the direct tax rates could be rationalised.

The agenda for a revamped direct taxes structure should be not just to phase out exemptions, but also to widen the tax base.

Indirect tax reforms should continue, but if India’s tax-to-GDP ratio has to get higher, then the focus should be on restructuring the direct taxes regime to fetch increased revenues for the Centre.

In a country like India with a per capita income of less than Rs 1.5 lakh, income of up to Rs 5 lakh cannot be allowed to remain tax-free through exemptions.

Time to revert to the earlier exemption level of Rs 3.5 lakh?

Feature Presentation: Rajesh Alva/Rediff.com

Source: Read Full Article