U.S. Pending Home Sales Unexpectedly See Further Downside In February

After reporting a steep drop in U.S. pending home sales in the previous month, the National Association of Realtors released a report on Friday showing pending home sales unexpectedly saw further downside in the month of February.

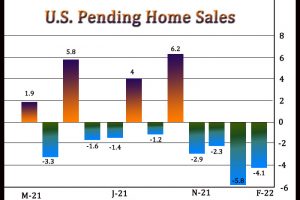

NAR said its pending home sales index tumbled by 4.1 percent to 104.9 in February after plunging by 5.8 percent to a revised 109.4 in January. The continued decrease came as a surprise to economists, who had expected the index to rebound by 1.0 percent.

A pending home sale is one in which a contract was signed but not yet closed. Normally, it takes four to six weeks to close a contracted sale.

“Pending transactions diminished in February mainly due to the low number of homes for sale,” said NAR’s chief economist Lawrence Yun. “Buyer demand is still intense, but it’s as simple as ‘one cannot buy what is not for sale.'”

“It is still an extremely competitive market, but fast-changing conditions regarding affordability are ahead,” he added. “Consequently, home sellers cannot simply bump up prices in the upcoming months, but need to assess the changing market conditions to attract buyers.”

The report showed pending home sales in the Midwest plunged by 6.0 percent, while pending sales in the West and South tumbled by 5.4 percent and 4.4 percent, respectively. On the other hand, NAR said pending home sales in the Northeast increased by 1.9 percent.

The Commerce Department released a separate report on Wednesday showing new home sales in the U.S. unexpectedly extended the previous month’s sharp pullback in the month of February.

The report showed new home sales slumped by 2.0 percent to an annual rate of 772,000 in February after plunging by 8.4 percent to a revised rate of 788,000 in January.

The continued decrease surprised economists, who had expected new home sales to jump by 1.1 percent to a rate of 810,000 from the 801,000 originally reported for the previous month.

With the unexpected drop, new home sales continued to give back ground after reaching their highest annual rate since last March in December.

Source: Read Full Article