Are You Unbanked? Save More with Samecoin's Revolutionary Investment Options

More and more people are deciding to move away from the jurisdiction of bricks-and-mortar banks as they want more control over their money. Unbanking is a growing movement, but people aren’t storing their cash under their mattress anymore—they’re holding crypto. Specifically decentralized finance coins (DeFi).

Getting full control of your money and operating with DeFi coins has a huge number of benefits when compared to traditional currencies. But there’s still one area where traditional banks have an advantage—savings. When you keep your money in a bank, you normally earn interest.

While crypto does have investment potential, this growth is normally only incurred when your holdings are sold at a profit. Simply holding Bitcoin doesn’t earn you anything until you actually sell them. There are no interest rates for hodling.

Thankfully, things are changing with Samecoin ecosystem, and holding the utility token Samecoin ($SAME) could be an extremely worthwhile investment with regular payouts—whether you’re unbanked or not.

The benefits of decentralized finance

More and more people are becoming unbanked these days, like Bob. Bob wanted a way to store his funds securely without relying on traditional banking companies. He doesn’t have a huge amount of faith in banks, and while most of them are secure—he’s seen a few fail in their time. He’s also seen them mismanage people’s funds.

With decentralized finance, Bob gets to hold his own money and control where it goes along with how it is spent (rather than relying on people mismanaging his funds). Transfers can also happen in minutes rather than the days that many banks take. He likes DeFi because it’s a system that’s built on transparency that’s open to everyone, and the markets are always open.

But Bob still wants a way to earn money on his savings, and that’s why he likes Samecoin’s stablecoins.

Saving with Samecoin’s Stablecoins

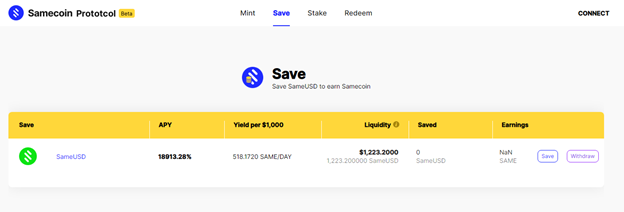

The Samecoin Protocol provides a Save Smart Contract that helps holders generate very good interest income. If someone like Bob chooses to save their Samecoin stablecoins e.g., SameUSD and SameEUR, the smart contract automatically deposits the coins they are backed by (like USDC) to approved applications like Compound. This pays out regular interest to users.

Holding Samecoin opens up the potential for rewards, as well. Not only can this utility token be used to pay reduced fees, but it can also be used for governance votes on the future of the platform, by staking them for vSamecoin (the governance token for Samecoin ecosystem). Because Samecoin’s value looks set to grow in the future, you can see how the whole ecosystem has benefits for people like you and Bob as both growth and income investments.

Samecoin’s Smart Contracts work together to mint and burn currency, give loans and give interest on savings. Now Bob can enjoy all the benefits of DeFi coins that made him first start getting into crypto, but also make the most of the savings he would get by leaving his funds in a traditional bank. That’s why more and more people are choosing to get involved in the Samecoin ecosystem, and why you should too.

Worried about the security? Samecoin’s smart contracts are audited by Certik and the details can be verified transparently.

For getting further questions answered, one can check out the upcoming AMA with Satoshi Club here on May 14th, 2021 at 03:00 PM UTC.

Source: Read Full Article