Binance Keeps Losing Market Share as Crypto Trading Volumes Plunge to 9-Month Low

Leading cryptocurrency exchange volume has seen its spot trading volume plummet by 36.8% to $115 billion last month, the lowest level the cryptocurrency trading platform has seen since October 2020. The drop was its third consecutive since June.

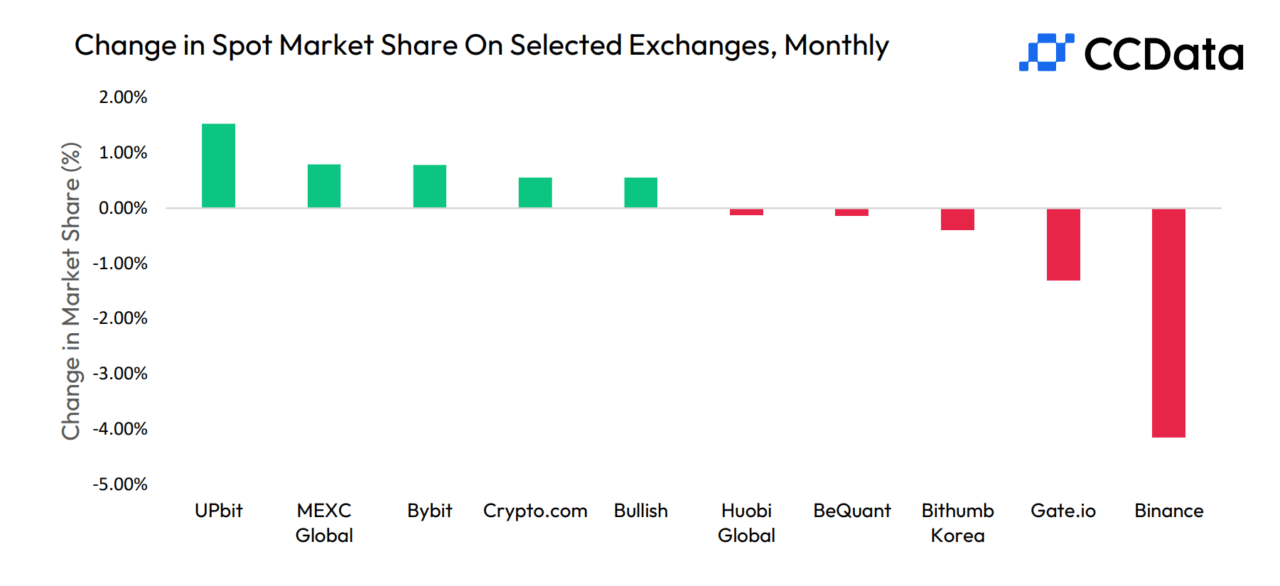

As a result, Binance’s share of the spot cryptocurrency trading market is now at its lowest level since June 2022, at 34.3%. The volume decline was worsened by the end of the firm’s zero-fee trading offer for BTC-TUSD pairs last month.

The data comes from CCData’s latest Exchange Review report, which also details Binance saw a 20.8% drop in derivatives trading volume to $686 billion in September, the lowest level since December 2020.

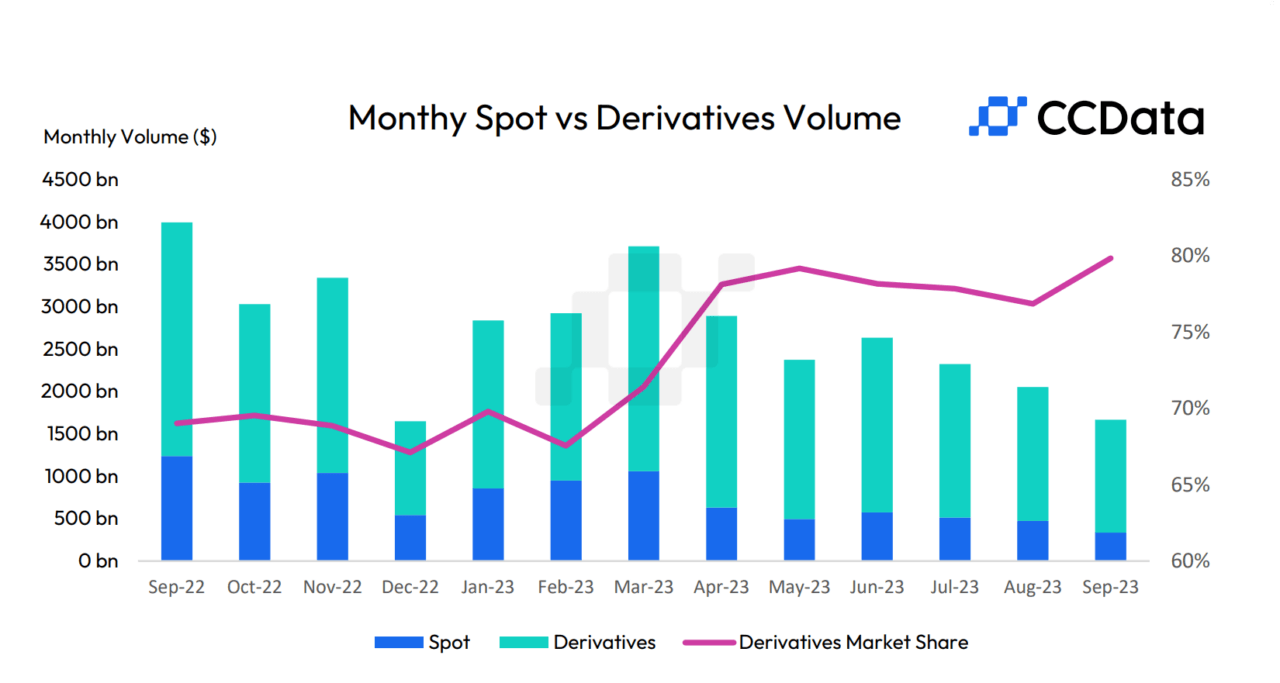

The exchange is nevertheless the derivatives market leader with a 51.5% share of the market. Its dominance has fallen to the lowest level since March 2022, per the report, which also notes that centralized exchanges have seen their derivatives volume drop by 17.7% to $1.33 trillion last month.

The figure marks the lowest level since December 2020, with the sector reaching a new record high dominance of 79.9% as spot trading volumes have been declining more than derivatives volumes.

CCData’s Exchange Review details that combined post and deriatives volumes on centralized exchanges last month declined 20.3% to $1.67 trillion, marking their third consecutive monthly drop. The firm detailed that low volatility and seasonal patterns that usually affect the third quarter of the year led to the depressed volumes.

Last month, as CryptoGlobe reported, the CEO OF PMorgan Chase & Co Jamie Dimon said global financial markets could face unprecedented turbulence if the Federal Reserve pushes its benchmark interest rate to 7% in the face of stagflation.

Despite previously advocating for a rate hike to counter soaring inflation, Dimon underscored that the transition from 5% to 7% would exact a more pronounced toll on the economy compared to the shift from 3% to 5%.

Featured image via Unsplash.

Source: Read Full Article