Bitcoin and source of funds

The “crypto markets” highly rely on the premise that one will always be able to sell their digital assets for fiat money when necessary. However, this could be untrue to an extent at the moment, and will probably be completely untrue in the future.

Bitcoins have a history attached to them. The transactional history of a Bitcoin cannot be hidden. That means you are always trading a specific Bitcoin when you sell it for fiat money.

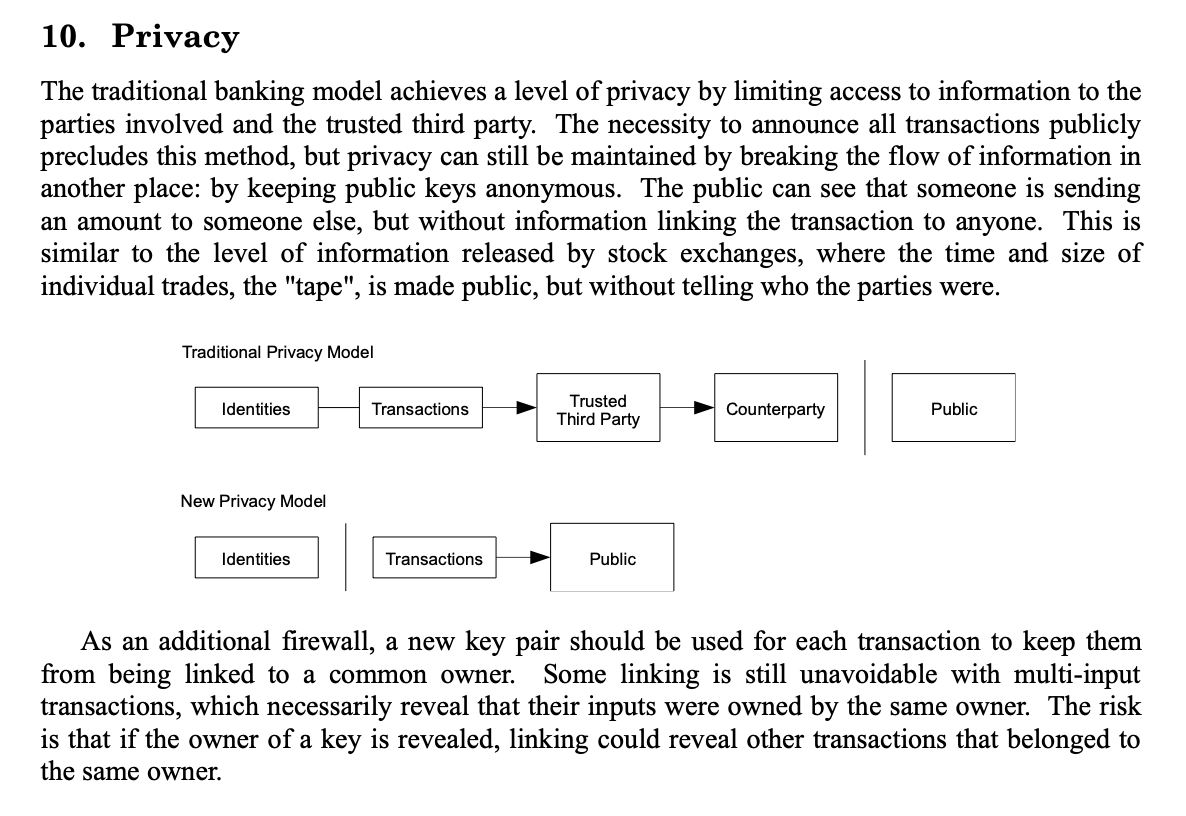

In Bitcoin, identity is firewalled from the public, but the transactional history is not, whereas in the conventional banking system the transactional history is firewalled from the public:

In an article titled “The Property Flaw of Lightning,” Dr. Craig Wright wrote:

Bitcoin tokens are property. Following the purchase of bitcoin where you haven’t met customer due diligence (CDD) and know your customer (KYC) requirements and recorded the identity of the person you’re attempting to buy from, you face a scenario where good title does not pass.

Think about the transaction history of the Bitcoin you have in your possession and ask yourself: Do you really own it? Can you prove it is rightfully in your possession as the owner?

Source of funds is one of the keywords here. Exchanges are already asking customers about the sources of their funds and will be doing it more and more in the future. It is due to anti-money laundering laws. But how are anti-money laundering agencies and tax authorities going to handle all of the trading of digital assets worldwide?

They won’t have to. Others will do it for them. The exchanges will be the extended arm of anti-money laundering agencies and tax authorities. We can call that law enforcement via private entities.

The source of funds is not proven by simply stating, “well, I bought these Bitcoins some years ago, you know.” Exchanges are going to want to see the transactional history of your digital assets and of your fiat money.

Think of all the people who cannot prove any source of funds in a manner that satisfies the exchanges. All these digital assets will basically not be able to be sold in the conventional digital asset market anymore.

It could even be the case that a certain percentage of all digital assets right now are actually not liquid in the sense of being able to be traded. Investors will have to price this in, one way or another.

Exchanges are going to filter out risky coins, tainted coins, criminal coins, undefined coins. These coins will not be able to be sold for fiat on exchanges anymore—internationally.

Picture the exchanges panning for gold, washing gold, trying to find the gold nuggets in the rubble. By sifting out clean coins, the rest of the coins will be thrown away. One could say exchanges are going to delist unclean coins and probably the people trying to trade them.

This will take time, as gold washing takes time. But in the end, we will see clean and unclean coins, gold and useless pebbles.

Furthermore, the alert key within Bitcoin could be used to notify all nodes quickly about certain addresses and/or related digital assets, and exchanges could be notified by that, too.

Dr. Craig Wright wrote about the alert key and source of coins in his article “Ledgers and Design”:

“When I implemented the alert key into Bitcoin, I created a mechanism that allowed people to simply report stolen bitcoin, and other proceeds of crime. It greatly enhanced the ability of Bitcoin to act within a legal framework and protect the users of the system. Right now, the removal of the mechanism of the alert key has increased the difficulty and amount of research required by individuals to find tainted bitcoin. Having said so, all the sources of tainted bitcoin that you should be aware of are available online, in different locations. The cost without the alert key is just far greater. (…)

Removing the alert key does not remove the legal requirement to validate the source of funds. Customer due diligence (CDD), know your customer (KYC), and anti-money laundering (AML) laws apply even in the absence of a simplified system that would allow for the reporting of proceeds of crime and stolen coins. (…)

The alert key would protect users. In quickly being alerted and notified of assets that are frozen, individuals would not receive stolen funds or be deceived into believing that such had value.”

All of this leads to many questions:

- How many Bitcoins and digital assets are contaminated?

- Will those coins go straight to zero in value?

- Is there going to be a secondary market trading these coins at a huge discount?

- Will the “crypto market” price these facts in eventually? In what way?

I do not have the answers, but I know this: for many out there, the source of funds will be the source of problems.

Source: Read Full Article