Bitcoin Supply Tightens as Long-Term Holders Refuse to Sell: Glassnode

The available supply of bitcoin is increasingly constrained as long-term holders refuse to part with their coins, Glassnode data indicates. This historically tight circulation has analysts observing impressive accumulation rates for the leading cryptocurrency.

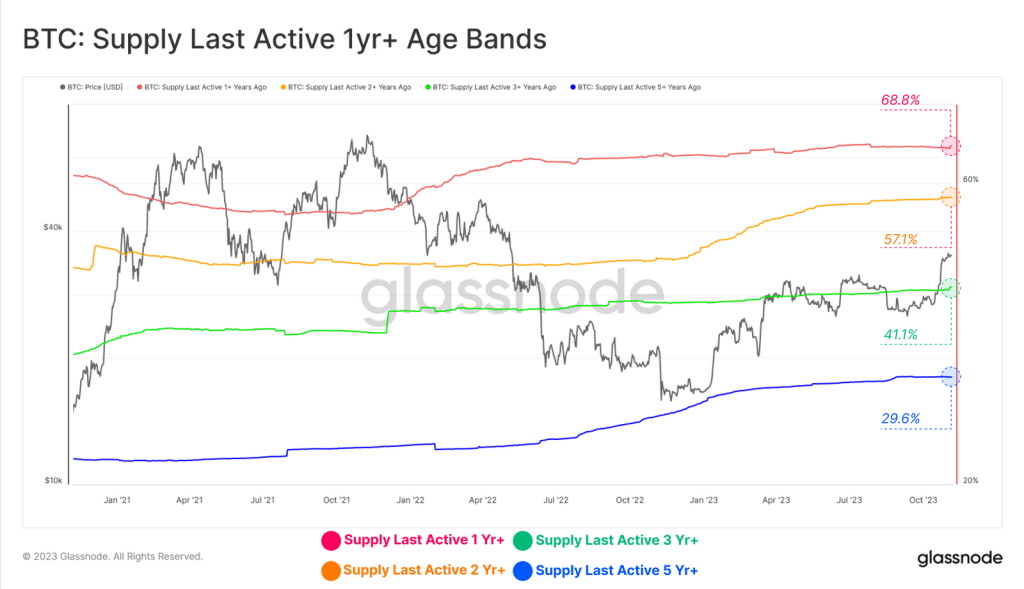

According to a Glassnode report, the percentage of bitcoin’s circulating supply held untouched for over one year sits around all-time highs of 68%. The metric tracking coins held for more than five years are also elevated to nearly 30% of the total supply.

The unwillingness of veteran Bitcoin investors to sell their holdings points to a bullish conviction that higher prices lie ahead. Glassnode described the divergence between long-term holder supply and short-term holder supply, now at multi-year lows, as “powerful.”

Bitcoin’s illiquid supply, representing coins held in wallets with minimal spending activity, also remains at a record 15.4 million BTC and is increasing by over 71,000 BTC monthly. This rise has coincided with investors withdrawing digital assets from exchanges into custody solutions.

More than 1.7 million Bitcoin left exchanges since 2021

Since May 2021, more than 1.7 million Bitcoin have left exchanges for self-hosted wallets, reflecting a preference for personally securing holdings. The tight holder base has left circulating bitcoin historically scarce.

Glassnode noted the recent rally above $30,000 may mark a shift in market character, as short-term holder spending patterns changed after surpassing that key level. Many analysts view $30,000 as an inflection point where a broader bullish conviction could take hold.

With supply dynamics extraordinarily tight, bitcoin may have to reach significantly higher prices to dislodge sizable volumes from long-term investor coffers. The holders that have accumulated BTC throughout its history appear intent on riding out any volatility en route to much loftier prices. Their unwillingness to sell is constricting supply amid growing global demand.

Source: Read Full Article