Bitcoin through the looking glass: A 21st century language-game

When I use a word,” Humpty Dumpty said, in rather a scornful tone, “it means just what I choose it to mean—neither more nor less.”

“The question is,” said Alice, “whether you can make words mean so many different things.”

“The question is,” said Humpty Dumpty, “which is to be master—that’s all.

Alice was too much puzzled to say anything…

— Lewis Carrol (1871) ‘Through the Looking-Glass’

Lewis Carrol (aka Oxford mathematician and logician Charles Lutwidge Dodgson) used literature such as the wordplay between Alice and Humpty Dumpty to expound his ideas on mathematics and logic, and their connection with precise use of language. Much 20th century philosophy later focused on the role of language in shaping understanding.

Philosophers who spurred this “linguistic turn” such as Frege, Russell and Wittgenstein, suggested the meaning we give to words is crucial not just in communicating, but in fundamentally conceiving the world around us. Wittgenstein declared that “The limits of my language mean the limits of my world.”

The story of Bitcoin is a strange manifestation of the kind of wordplay seen between Alice and Humpty Dumpty, later more formally espoused in Wittgenstein’s concern over “language-games”: misuse of language sets traps for people to fall into, failing to understand their environment by clinging on to false definitions. If we can’t get basic language right, we are lost in the woods.

Wittgenstein cites St. Augustine as to how we (as children) learn language from physical reality through the guidance of our parents and teachers. For instance, a small round green or red fruit is called an apple; a small round orange fruit is called an orange. Or at least we hope we are led by teachers who know the difference between apples and oranges!

Those familiar with the internecine wars in the wider Bitcoin community may already see the purpose of this analogy: people are lost in the “crypto” woods today because the vast majority of the media, government, and academia have unwittingly adopted a definition of a word which bears little relation to its original meaning, viz., “Bitcoin” is not Bitcoin as envisaged by its creator Satoshi Nakamoto.

The software protocol of BTC (BTC Core, although now ubiquitously referred to simply as “Bitcoin”) has been altered—by the Core developers—to serve a different objective to that of Bitcoin. This new purpose is purely to be a form of digital gold. BTC today may certainly be more accurately referred to as “bitgold”.1 BTC/Bitgold is the metaphorical apple of our language-game.

The term ‘bit gold’ was coined (no pun intended) by computer scientist Nick Szabo in the 1990s, essentially as a hard-core libertarian idea to circumvent government, based on a narrow understanding of the financial system. But Szabo’s concept stayed just that—a theoretical concept—as he failed to work out a way to implement it in terms of a software protocol with logical economic incentives.

When Satoshi Nakamoto published the now famous Bitcoin white paper in 2008, Nick Szabo’s idea for bit gold wasn’t cited at all, whereas Wei Dai’s idea for b-money (cash) was.

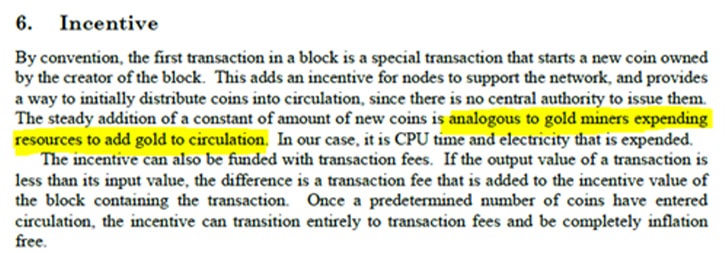

The only reference to gold in the white paper is in one sentence, where mining is used as a metaphor as to how to get bitcoins into circulation to incentivise maintenance of the distributed network, thus enabling transactions to take place:

It is perplexing—to say to least—to think that the entire narrative of digital gold in Bitcoin has been built by the BTC community on top of this one sentence.

It is more instructive to note that this sentence is where use of the word miner comes from in the context of Bitcoin, meaning a transaction processor. So it is important to understand that the white paper was cleverly describing how to create an economic incentive system in Bitcoin (by distributing the “objects,” bitcoins) to maintain a distributed transaction network of micropayments (indeed, one designed to scale to compete with Visa, as Satoshi emphasized in communication a few weeks later).

Bitcoin is a software protocol offering a self-contained, distributed transactional database, primarily designed to facilitate small, casual payments, with some algorithmic complexity (such as escrow transactions, often now referred to as smart-contracts): this is our metaphorical orange of the language-game.

So in this language-game, how did the Bitcoin orange come to be ubiquitously confused as the “Bitcoin” (bitgold/BTC Core) apple?

One only has to compare Nick Szabo’s writing with Satoshi’s white paper and subsequent postings to see that Bitcoin was something far more than merely bit gold. Confusingly, if Bitcoin were to become successful as a distributed, timestamped server and transaction processing system, the bitcoins themselves could certainly serve as a form of bit gold (albeit likely within a fully regulated environment), but to promote the system as a form of bit gold was, inasmuch as not being totally misleading, putting the cart before the horse: utility is the precursor of value.

The problem was that many people attracted to Bitcoin (or merely the bitcoins) were not especially interested in Satoshi’s vision for an efficient, distributed database and transaction processing mechanism for casual transactions on the internet (using bitcoins) to out-compete Visa. They wanted an anonymous store of digital value to outwit governments, and they saw an opportunity to use the Bitcoin system to implement Nick Szabo’s bit gold idea.

Szabo had written that “it would be very nice if there were a protocol” [emphasis added] to implement “bit gold.” According to his blog, he wrote in August 2008 just a few months before the Bitcoin white paper that:

There are some problems involved with implementing unforgeable costliness on a computer. If such problems can be overcome, we can achieve bit gold. [emphasis added]

Hal Finney was one of the first to see the potential explicitly to use Bitcoin to serve bit gold’s agenda, as he noted on November 7, 2008, in the cryptography mailing list (where Satoshi introduced the white paper) that “This would be more analogous to gold than to fiat currencies. Nick Szabo wrote many years ago about what he called “bit gold” and this could be an implementation of that concept.” [emphasis added].

On November 13, 2008, in response to the mysterious “James A. Donald” (who claimed to be working on a similar project and was already referring to “bitgold coins”), Finney noted that “I found that there is a sourceforge project set up for bitgold, although it does not have any code yet.”

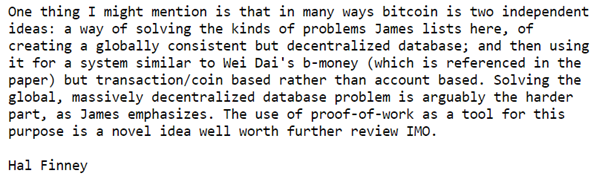

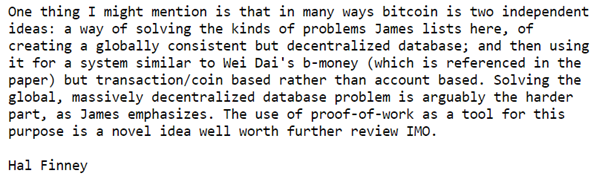

Finney continues that he didn’t yet fully understand Bitcoin, but he did understand that Bitcoin represented “two independent ideas”:

So while Finney notes the citation of Wei Dai’s b-money, and that the “massively decentralized database problem is arguably the harder part,” both “Donald” and Finney were effectively referencing bitgold as a kind of asset that could be run on Bitcoin.

Bitgold and Bitcoin are two different portmanteaus, implying two different concepts: apples and oranges (bitcoin in the narrow sense of the “coin” itself of the e-cash system is closer to bitgold, although this clearly misses the larger context of Bitcoin as a system).

Bitcoin could enable bitgold, (as one kind of application), but those on the thread (and many who followed) who were more interested in bitgold believed they might have to essentially disable the more extensive elements of the Bitcoin system (which looked too complicated, too “attackable,” and not anonymous enough for them) in order to deliver their bitgold dream.

As the cryptography thread moderator warned within a day of the white paper being published:

A bunch of people seem anxious to branch the discussion of cryptographic cash protocols off into a discussion of the politics of money. I’m a rabid libertarian myself, but this isn’t the rabid libertarian mailing list. Please stick to discussing either the protocols themselves or their direct practicality, and not the perils of fiat money, taxation, your aunt Mildred’s gold coin collection, etc. [emphasis added]

Others just saw an opportunity to make money. Eventually some people—for example, those who already made a lot of money in the cosy oligopoly world of transaction processing—even came to see Bitcoin’s cheap transaction processing capability as a threat.

Disabling the functionality of Bitcoin was not so much a regrettable necessity (as in the eyes of the BTC Core/bitgold development team), but a corporate expediency; Mastercard’s early investment into the Core developers responsible for disabling the original Bitcoin protocol attests to that.

The bitgold cuckoo in the Bitcoin nest became the dominant narrative for various reasons, not least because the software protocol of Bitcoin is easily replicable; inasmuch as the digital gold narrative has to hold, strong branding and promotion is the imperative.

Over 13 years Since Satoshi’s Bitcoin white paper and this fundamental obfuscation has really degenerated into a Wittgensteinian language-game.

“Bitcoin” has become a misleading socially constructed term, created by people who either didn’t understand what the Bitcoin system was, or who decided that Bitcoin (more precisely the bitcoins themselves) was merely a useful step for progressing and promoting their alternative political agenda for bitgold.

Commentators on the “crypto” space have become convinced (or simply decided to play the role) that Satoshi’s idea for Bitcoin is Nick Szabo’s idea for bitgold: convinced that an orange is an apple, and trying to persuade others to agree. Elon Musk is simply the latest and most high profile to do this.

This failure in understanding is so ingrained within these organisations, and repeatedly re-asserted within the “crypto” echo chamber, that the whole world of orthodox opinion has totally failed to understand Bitcoin. We are in a “through the looking-glass” world of absurd contradictions.

Vitalik Buterin was so confused that he decided to “fix” “Bitcoin” (i.e., bitgold), when in reality Ethereum is just a more complicated and less serviceable copy of Bitcoin! To really understand Satoshi’s vision for Bitcoin is to understand that Ethereum wasn’t necessary, and by implication, neither is the multi-billion-dollar industry of copy-cat blockchains and side-chains designed to fix Ethereum!

Wittgenstein warned that “Most of the propositions and questions of philosophers arise from our failure to understand the logic of our language […] the deepest problems are in fact not problems at all.”

Perhaps Lewis Carrol was even more astute—through the comic character of Humpty Dumpty—that those who choose to define words are really seeking to answer the question “which is to be master—that’s all.” This, more worryingly, anticipates the Orwellian concern that if we allow others to impose their peculiar definitions of words upon us, it restricts our ability to think and be free.

BTC Core/bitgold—which has essentially rebranded itself as “Bitcoin” (and trades under the symbol BTC)—may or may not be an interesting concept, but it must be judged on its own merits, and its own branding, not those of the clever and versatile micro-transactional database it usurped. Anyone who takes the time to read and understand the white paper will realise that BTC is not Bitcoin, and Bitcoin is actually a far more interesting concept.

***

Reference:

[1] Bitgold not to be confused with the on-line gold trading company established in 2008, now GoldMoney.

Source: Read Full Article