Chainlink [LINK] daily whale transactions count climb to its highest level in the last year

A total of 22 whale transactions, each valued above $1 million, were completed during the period under review. This represented a 340% surge from the five whale transactions of the same amount carried out on the previous day.

In addition to a surge in whale transactions, LINK accumulation amongst investors that hold between 100,000 and 10,000,000 LINK tokens also increased. At press time, this cohort of whale investors held 28% of the token’s circulating supply. At the beginning of the month, they only held 26%.

#Chainlink whales have accumulated around 11 million $LINK over the past month, worth roughly $77 million! pic.twitter.com/ZPbo8Preaj

— Ali (@ali_charts) July 27, 2023

Major stakeholders’ sudden interest in LINK could be attributable to Chainlink’s recently launched Cross-Chain Interoperability Protocol (CCIP).

1/ The Chainlink Cross-Chain Interoperability Protocol (CCIP) has officially launched on Avalanche, Ethereum, Optimism, and Polygon mainnets.#LinkTheWorld pic.twitter.com/SdLVyaapg3

— Chainlink (@chainlink) July 17, 2023

At the product’ release, Chainlink noted that the web3 ecosystem has expanded to include multiple blockchains at the layer-1 and layer-2 scaling levels. However, these networks currently function independently and encounter challenges when interacting with conventional systems and other blockchains. The CCIP was introduced to address this issue by serving as a bridge, enabling seamless asset transfers and information sharing between different blockchains.

Traders filling up their LINK bags

While LINK traded under $8 at $7.87 at press time, accumulation continued amongst day traders. On a daily chart, momentum indicators remained in uptrends above their respective neutral lines.

For example, LINK’s Relative Strength Index (RSI) rested at 61.15. Likewise, its Money Flow Index (MFI) was spotted at 68.65. These indicators are commonly used to analyze price trends and identify an asset’s potential overbought or oversold conditions.

Further, above the zero center line at press time, LINK’s Chaikin Money Flow (CMF) indicated the consistent inflow of liquidity into the market. Typically, A CMF value above the zero line is a sign of strength in the market, as buying pressure exceeds selling pressure.

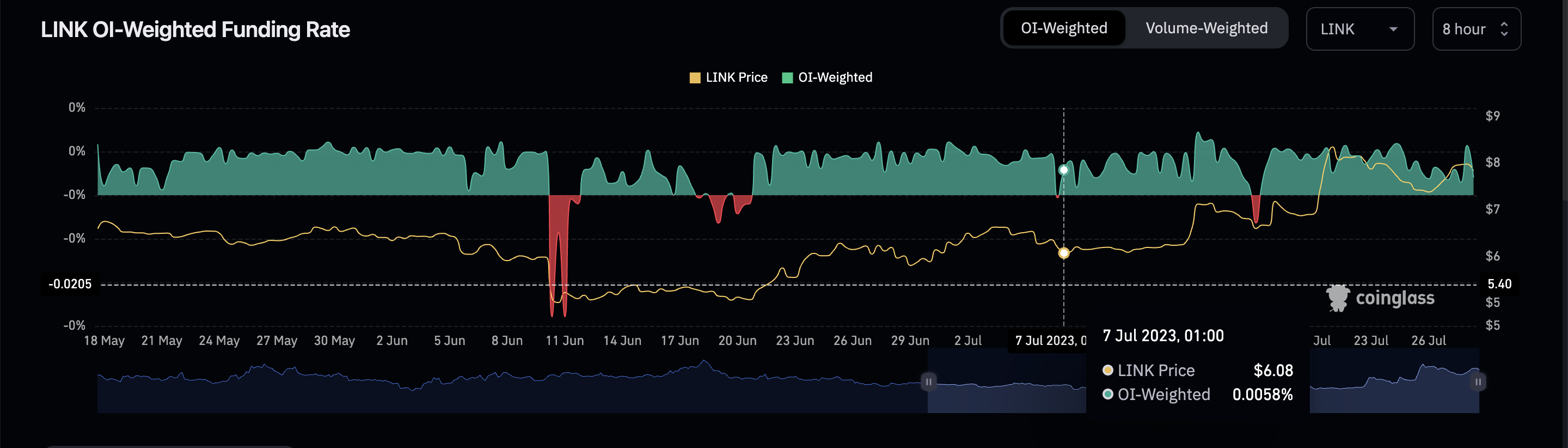

With an 11% rally in LINK’s Open Interest since 26 July, traders have opened more trading positions to trade. With a prevailing bullish sentiment in the market, LINK’s funding rates across crypto exchanges were positive, suggesting that more traders have opened long positions.

Source: Read Full Article