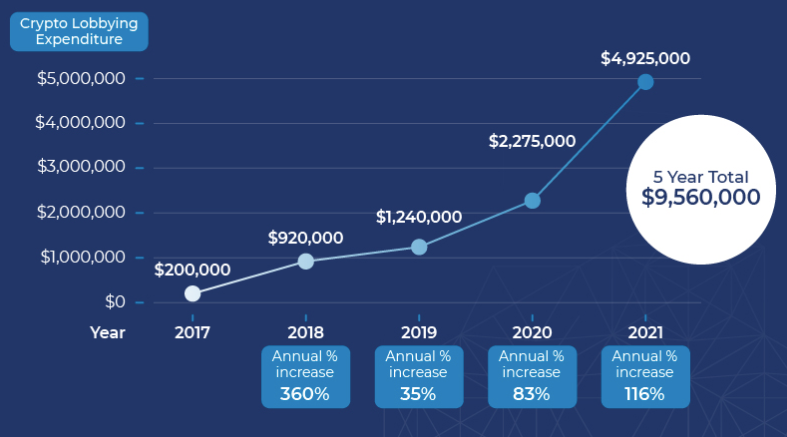

Coinbase, Ripple, and Robinhood Lead $9.5 Million Crypto Lobbying Efforts In The US

- Crypto Lobbying Jumped 116% in 2021.

- Coinbase, Ripple and Robinhood account for 60% of all lobbying efforts.

- Lobbying expenditure is expected to reach $15 million by 2023.

A recently released report by digital assets-focused website Crypto Head, and US top finance accountability NGO, Open Secrets, has revealed that the top crypto companies in America spent approximately $4.9 million dollars in lobbying efforts at the U.S. congress. Coinbase, Ripple, and Robinhood lead the charge for the most lobbying efforts carried out in the year 2022, with Ripple exerting the most influence on crypto-related policies and prepositions for crypto so far. While it may sound odd, crypto lobbying in the US is an acceptable norm practiced across sectors of the economy to influence policies in the Senate.

It is no surprise to see Ripple Labs lead US crypto lobbying efforts in the year 2021. Its legal altercation with the US SEC, which has dragged on for over 14 months, appeared to have rattled the foundation of US digital currency laws, questioning the boundaries of its definitions and demanding more clarity around regulations.

For Coinbase, a large part of its dominance beyond the US market results from utilizing its advantage as an American company against non-US competitors like Binance. Over the past five years, its biggest global rival finance has spent only a paltry $20,000 in lobbying efforts, revealing how uninterested Chanpeng Zhao might be about consolidating his influence in the US market. A look at the chart reveals Coinbase deployed approximately 23 lobbyists, with Robinhood trailing closely at 16, and Ripple Labs’ fielding just 12.

Overall, some of its attempts at policy influence have been successful, while others simply haven’t. Mid last year, the US president, Joe Biden, had slapped a mandatory IRS tax reporting law on the $2 trillion dollar industry, as part of plans to raise at least $28 billion for infrastructure.

Some silver lining, however, appears with the recent reports of the exemption of miners from IRS tax reporting. This represents a huge motivation for this integral sector of the ecosystem, which has seen an enormous setback over the past two years after China shut its doors on all things crypto and Kazakhstan wobbled under the weight of increased electricity demand.

As it appears, lobbying efforts will intensify as the market looks to prevent the dominance of soon-to-be-released CBDCs. Crypto Head estimates the resulting costs at approximately $15 million before the end of 2023.

Source: Read Full Article