Is the Gemini Exchange Suffering Financially?

Earn Your First Bitcoin Sign up and get $12 Bonus Referral bonus up to $3,000

The effects of the 2022 bear market haven’t fully disappeared, it seems. There are many companies out there still dealing with the repercussions of those bearish ripples, the Gemini exchange in New York being a big one.

Gemini Gets $100 Million from Its Founders

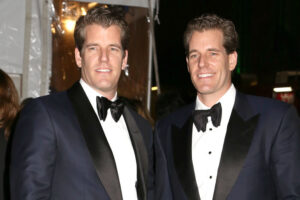

Not long ago, it was announced that Gemini founders Tyler and Cameron Winklevoss issued a loan of approximately $100 million of their own funds to aid in the company’s continued operations. This suggests one of many things, a major one being that the exchange is now on pins and needles and could be walking the same cold and ugly path that so many other crypto platforms (from FTX to Celsius) have trodden over the past 12 months.

To be fair, those companies arguably engaged in fraudulent and criminal activity, which is why they likely experienced troubles (both financial and otherwise) towards the end. At the time of writing, Gemini hasn’t been accused of any wrongdoing, nor is there any evidence suggesting the company took part in scam-like behavior, so it’s likely Gemini is still reeling from the ongoing bear conditions that made themselves so prominent last year.

On the one hand, it’s good news that the Winklevoss Twins are endowed with so much money given their company likely wouldn’t be surviving right about now without it. The fact that they’re able to shell out the necessary funds to keep the firm going suggests Gemini has a fighting chance, and its customers still have time to receive what’s theirs and enjoy a certain degree of stability.

However, it’s disappointing to know that while individual assets are doing relatively well (BTC, for example, recently hit $30K for the first time in about ten months), the respective exchanges that sell or hold them are another story. It’s as though the fall of FTX is still ringing bells (and rather negative ones at that) approximately half a year after the exchange came crashing to the ground, and it’s likely that trust for crypto exchanges has fallen in recent weeks and months due to the fraudulent behavior that has clearly taken place within its departments.

While neither Cameron nor Tyler Winklevoss have issued individual statements regarding Gemini’s fate, they have mentioned that the money they’ve issued will be utilized strictly for operational purposes.

A Lot of Previous Problems

Gemini has been hit hard over the past 12 months. The company engaged in not one, but two separate layoff orders that saw more than ten percent of its overall staff suddenly hitting the bread lines. In addition, the company’s lending arena Genesis Global Capital is now being scrutinized by the Securities and Exchange Commission (SEC).

The agency recently hit Genesis with charges that it sold unregistered securities through a lending program called Gemini Earn.

Source: Read Full Article