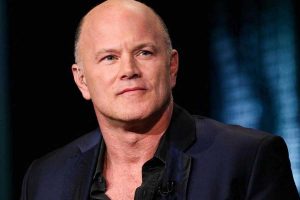

Mike Novogratz Defends BTC Despite Latest Crash

Bitcoin has tanked hard. There is no point in denying this. The world’s number one digital currency by market cap was already in a sorry position having spent the last few weeks trading in the mid to high $30,000 range, though now at the time of writing, things have taken a turn for the worse and the digital currency is trapped in the high $20,000 range. Despite all this, there are still many individuals – such as Mark Cuban and Mike Novogratz – that stick by the asset.

Mike Novogratz and Mark Cuban Are There to Defend BTC

Cuban has long been a crypto investor. He recently came out to say how much he admired both bitcoin and Ethereum and admitted that they make up a large portion of his crypto portfolio. In a recent interview, he said that despite the nasty slip bitcoin has endured, it is still a much stronger asset than gold. He said:

No worries about storing it. Easy to transfer. Easy to trade. Easy to convert. Does not require an intermediary. Can be fractionalized.

Mike Novogratz – a billionaire investor and former hedge fund manager – was also quick to jump to the asset’s defense, claiming in a statement not too long ago that bitcoin is presently a victim of China, which has been cracking down on crypto mining operations like mad. He explained:

We had China really be much more forceful in their idea to ban cryptocurrency. That has created a retail deleveraging. A lot of crypto happens in Asia. A lot of it is Chinese focused, so we are seeing big liquidations, so it is hard to call a bottom.

Referring to the asset’s present $29,000 price, he stated:

We will see if it holds in the day. We might plunge below it for a while and close above it. If it is really breached, $25,000 is the next big level of support. Listen, I am less happy than I was at $60,000, but I am not nervous.

Many analysts are wondering if a crypto crash similar with what occurred in 2018 will happen today. During that time, bitcoin had reached its first all-time high of approximately $20,000 per unit in December of 2017, though just 11 months later, the asset had fallen to about $3,500.

Another 2018 Incident Will Not Happen Again

Novogratz does not think anything like that will happen again, citing the crypto market’s growing maturity and the number of institutional investors that have gotten involved as positive signs. He said:

The ecosystem is so much more mature. The number of players that are moving in are so much more mature. Every single bank is working on their own crypto project, how they can get bitcoin to their wealthy clients. I think a lot of clients that did not buy it the first time will see this as an opportunity to buy it and get involved.

Source: Read Full Article