S&P Global Ratings' Stablecoin Assessment Reveals Concerns Over Tether's Stability

S&P Global Ratings has announced the launch of its stablecoin stability assessment.

S&P Global Ratings, a division of S&P Global Inc. (NYSE: SPGI), is a leading provider of independent credit risk research. The firm publishes credit ratings on debt issued by various entities across multiple sectors. With a global team of credit analysts and a history spanning over 150 years, S&P Global Ratings offers a unique combination of global coverage and local insight, supporting the growth of transparent, liquid debt markets worldwide.

This initiative, as detailed in their recent press release, aims to evaluate the ability of stablecoins to maintain a stable value relative to fiat currencies. This assessment marks a crucial advancement in S&P Global Ratings’ efforts to blend its analytical prowess with the evolving needs of both traditional finance (TradFi) and decentralized finance (DeFi) sectors.

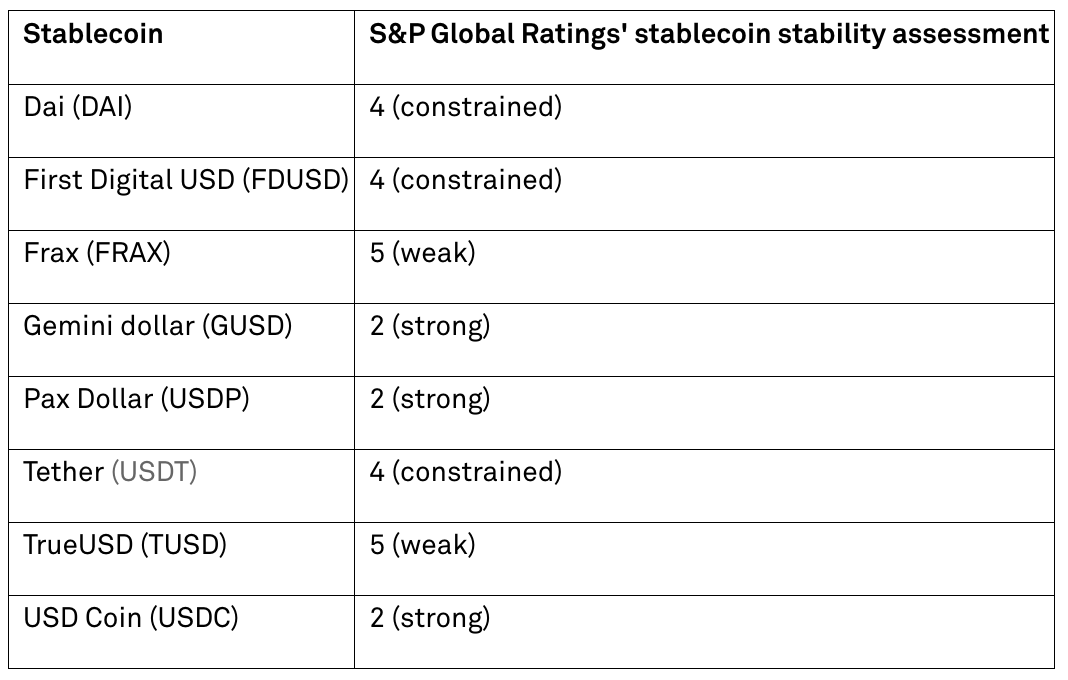

The assessment employs a scale ranging from 1 (very strong) to 5 (weak). This evaluation process begins with an analysis of asset quality risks, including factors such as credit, market value, and custody risks. The methodology also takes into account the extent to which overcollateralization requirements and liquidation mechanisms can mitigate these risks. Additionally, the assessment considers governance, legal and regulatory frameworks, redeemability and liquidity, technology and third-party dependencies, and the stablecoin’s track record.

S&P Global Ratings’ assessment encompasses eight prominent stablecoins: DAI, FDUSD, FRAX, GUSD, USDP, USDT, TUSD, and USDC. The ratings assigned to these stablecoins vary, with some achieving stronger stability scores and others, including Tether (USDT), receiving lower scores. Specifically, Tether’s rating of 4 (constrained) highlights concerns about its stability in maintaining its peg to a fiat currency. The press release indicates that the lower scores are influenced by weaknesses in several areas, including regulation and supervision, governance, transparency, liquidity and redeemability, and track record.

Lapo Guadagnuolo, a senior analyst at S&P Global Ratings, emphasized the growing importance of stablecoins in financial markets. He acknowledged their potential to bridge digital and real-world assets but cautioned that they are not immune to challenges such as asset quality, governance, and liquidity issues. Guadagnuolo’s remarks underscore the complexity and multifaceted nature of stablecoin stability.

S&P Global Ratings also announced a live interactive webinar scheduled for 10 January 2024 to discuss the stablecoin stability assessment and field questions. This event aims to provide deeper insights into the assessment methodology and its implications for the stablecoin market.

Featured Image via Unsplash

Source: Read Full Article