Total Value Locked in DeFi Hits New All-time High of $23.12 Billion

Quick take:

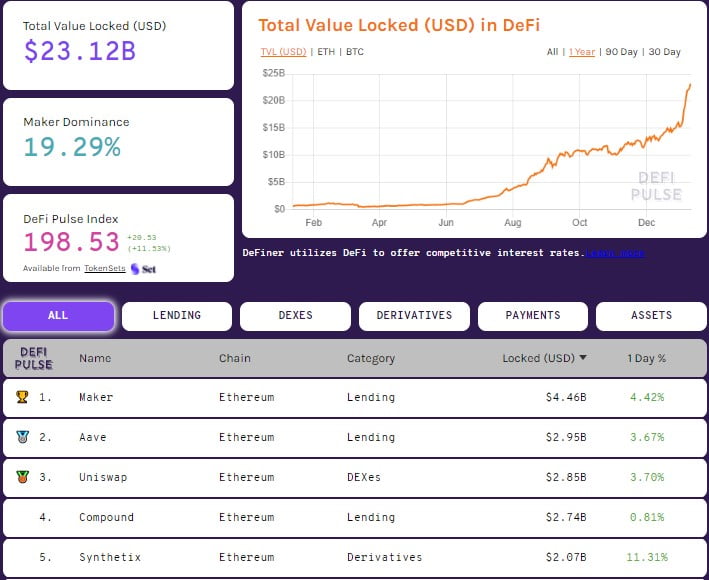

- The total value locked in DeFi has just hit a new all-time high of $23.12 Billion

- This value is attributed to both Ethereum and Bitcoin gaining value in the crypto markets

- At the same time, the amount of ETH and BTC locked in DeFi seems to be decreasing

- This could be attributed to ETH and BTC investors selling their bags as both assets gained value

The total value locked in DeFi has just hit a new all-time high of $23.12 Billion. This is according to data from DeFiPulse.com that also indicates that a majority of the value is locked in the Decentralized Finance platforms of Maker (MKR), Aave (AAVE) and Uniswap (UNI).

The screenshot below courtesy of DeFiPulse further demonstrates the new milestone of total value locked in DeFi and the top 5 protocols in this regard.

Increase in Total Value Attributed by Bitcoin and Ethereum Mooning

Taking a second look at the chart above of the growth in total value locked in DeFi, it can be noted that there was an impressive spike beginning mid-December when Bitcoin was valued at around $18k. The King of Crypto would go on to break the $20k price ceiling and continually post all-time high values. At the time of writing, Bitcoin is valued at $40k meaning it has more than doubled since the aforementioned time period.

In the case of Ethereum, mid-December found ETH trading at around $600. The same Ethereum is now valued at $1,300 thus proving that the increment in the total value locked in DeFi has been due to both Bitcoin and ETH gaining value in the past month.

Amount of Ethereum and Bitcoin Locked in DeFi is Reducing

As the total value locked in DeFi hits a new all-time high, the amount of ETH and BTC in the various DeFi protocols is moving in the opposite direction. This is best demonstrated by the following two charts courtesy of DeFiPulse.com.

The continual decline in the amount of Ethereum and Bitcoin locked in DeFi is most likely due to traders and investors of the two digital assets taking profits. As earlier mentioned, both ETH and BTC have more than doubled in value since mid-December. Therefore, it is only natural that traders and investors decided to take profits on the way up.

Source: Read Full Article