Weekly Cryptocurrency Price Analysis: Total Market Cap Drops by 14% in 7 Days

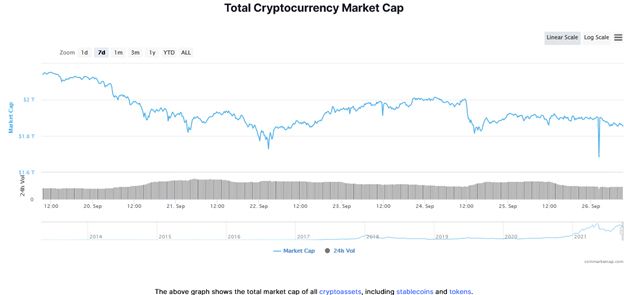

The total market cap of cryptocurrencies is down 13.4% in the last 7 days. It seems to remain bearish this week as well, with no signs of a trend reversal.

At the opening of last week, the total cryptocurrency market was worth $2.140 trillion, but then it faced bearish trades throughout the week, reaching a low of $1.684T (on September 26). Total volume also fell from $155B to about $94.4B now, a drop of about 39%.

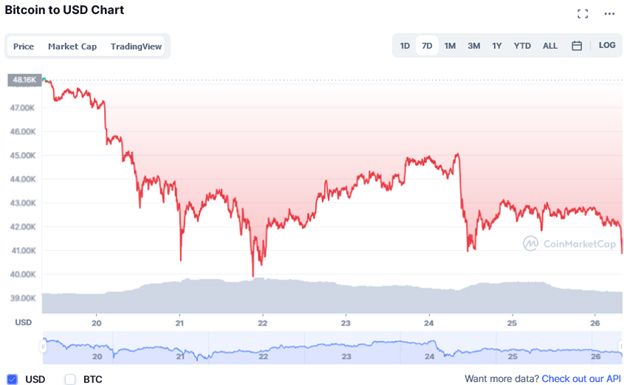

Bitcoin alone has lost about 12.4% in the last 7 days. The flagship digital currency opened the week at $48,268, with a market cap of $889.47B and volume of $26.967B. However, during the week, BTC hit a low of $39,787.61 and a high of $47,328.20.

Over the weekend, BTC/USD traded above $42,000 at around $42,163 and the trend did not bode well for Bitcoin trading above $52,000 this week. The market cap of BTC was $793.93 billion (-1.43%) and the 24-hour volume was $29.7 billion, down about 31.45% in 24 hours.

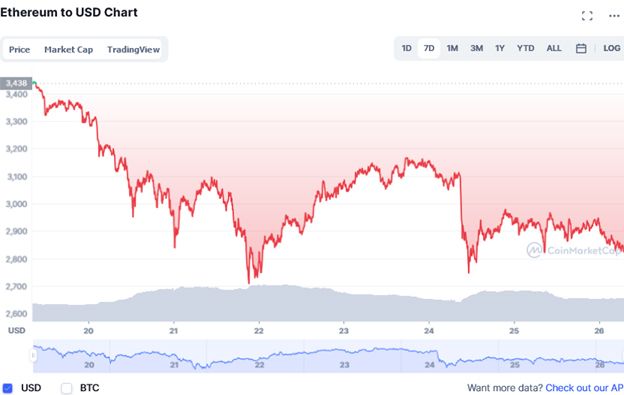

Within 7 days, the price of Ethereum has also fallen by more than 17%. The bearishness in BTC and ETH, as well as the overall market, is due to China’s crackdown on cryptocurrencies.

Evergrande Group, the giant real estate company in China, was about to default on its debt, causing Bitcoin to fall from $48,000 to $39,000. The world’s largest cryptocurrency recovered from this event to reach $45,000, when Twitter allowed paying tips in Bitcoin.

The announcement of Evergrande’s debt settlement and the Fed’s unchanged monetary policy also contributed to the small comebacks. Nonetheless, Bitcoin and Ethereum fell to $42,000 and $2,800, respectively, in 24 hours due to an old article circulating on the internet about China’s ban, which stated that all cryptocurrency transactions other than ownership were illegal.

Top weekly gainers and losers

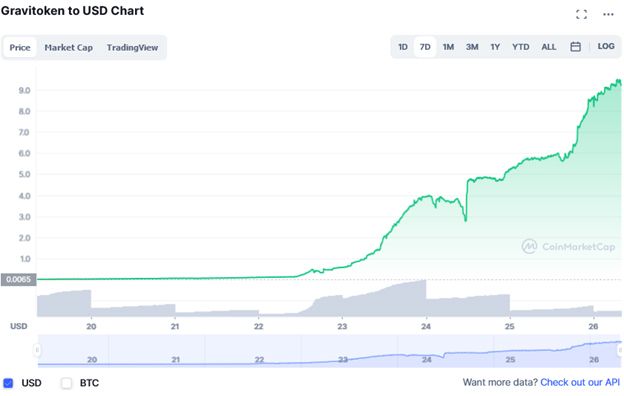

The top 5 performers of the week among all coins on the market were Gravitoken (GRV, $9.21) which was up more than 154,582%, GoldFinX (GIX, $29.03) which was up 3,126%, BabySpaceFloki (BSF, $0.000000000707) up over 2,246%, Blizzard Network (BLIZZ, $18.47) up over 1,798% and Nano Dogecoin (INDC, $$0.00000002587) up 1,671%.

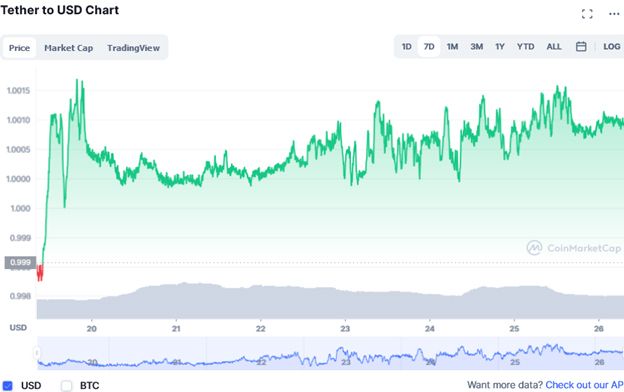

The week’s best performers among the top 20 tokens were Tether (USDT, $1.00, +0.17%), USD Coin (USDC, $1.00), Terra (LUNA, $35.74, +0.80%) and Binance USD (BUSD, $1.00, 0.08%).

The top 5 worst performing cryptocurrencies in the last 7 days were Deswap (DAW, $0.04605), which shrank by almost 93.5%, followed by 3X Long Huobi Token (HTBULL, $1.60), which fell 87.5%, SafeBull (SAFEBULL, $0.000000000529) fell 85.6%, Coinhunters (CHTR, $0.002125) fell 84.3%, and Nerve Finance (NRV, $0.2877) fell 81.2%.

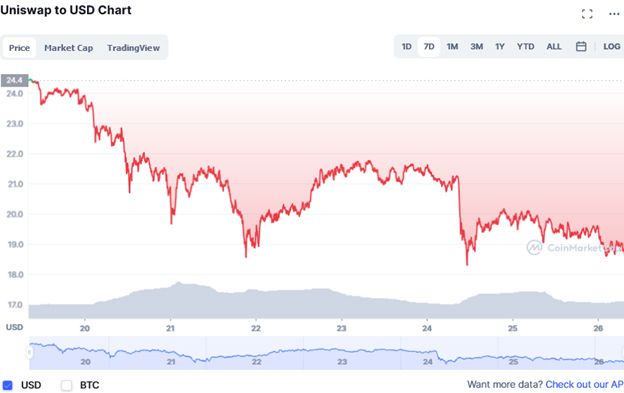

The biggest losers among the top 20 tokens were Uniswap (UNI, $19.0, -22.02%), Algorand (ALGO, $1.67, -21.38%), Bitcoin Cash (BCH, $507, -20.19%), Solana (SOL, $131.27, -19.27%) and Ethereum (ETH, $2,830, -17.66%).

Source: Read Full Article