Biden's inflation swamps wage gains, leaving working families behind

Former Heinz CEO argues inflation ‘not transitory’ for consumers

Former Heinz CEO Bill Johnson warns that inflation is having a ‘huge impact’ on ‘simple things, like container costs coming out of Europe or China.’

President Biden’s economic agenda has boosted wages, but millions of American workers are still being left behind as inflation has more than wiped out salary gains.

U.S. wages grew at a 4% year-over-year pace in July, but trailed the 5.4% annual increase in inflation, as measured by the consumer price index, suggesting that while nominal wages are rising, real wages are falling.

"Call it the ‘Biden pay cut,’" said Alfredo Ortiz, CEO of the Job Creators Network, a conservative U.S. advocacy group. "Rapid inflation and declining real wages are the direct result of the Biden administration’s historic spending that is overheating the economy and creating disincentives to work."

CONSUMER PRICES RISE 5.4% ANNUALLY IN JULY

Biden has long touted his "Build Back Better" economic agenda which aims to create jobs, cut taxes and lower costs for working families.

Instead, Biden’s economic agenda plan stalled job growth, raised taxes in the form of higher gasoline prices and has eaten into the wage gains won by American families.

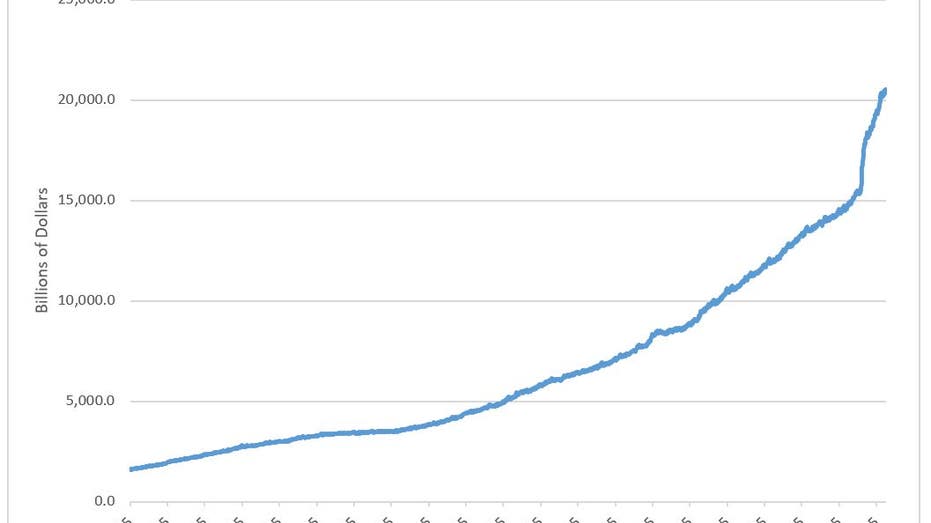

Source: Bureau of Labor Statistics The Biden administration’s $1.9 trillion American Rescue Plan, which was signed in March, sent $1,400 checks to most Americans, extended the $300 in weekly supplemental unemployment benefits until September, and expanded the child tax credit to up to $3,600 per child. CONSUMER SENTIMENT SINKS TO APRIL 2020 LOW The tidal wave of money helped unleash inflation that has been absent since the 2008 financial crisis, and has exacerbated a labor shortage that has made it more difficult to rectify the supply-chain disruptions caused by the pandemic. The national average for a gallon of gasoline is up $1.01 from a year ago to $3.18. Americans are also paying more for groceries, everyday staples and big-ticket items. This period of higher prices comes as many Americans have chosen to stay unemployed, given the Biden administration’s economic policies that allow them to make more money while remaining out of the workforce. PRODUCER PRICES SOAR 7.8% ANNUALLY IN JULY, MOST ON RECORD The unemployment rate fell to 5.4% in July, down from 6.3% in January, but a record amount of jobs went unfilled last month. The prolonged jobs recovery has made it more difficult to rectify the supply-chain disruptions caused by the pandemic. "We're in a position where it's difficult to get caught up because you don't have people in the plants able to produce these goods and people to distribute them," Andy Puzder, former CEO of CKE Restaurants, the parent company of Hardee's and Carl's Jr., told FOX Business. "And then when you have those two things, if you go to retail stores, you don't have people to sell them." Both the Biden administration and Federal Reserve Chairman Jerome Powell say that the current period of inflation is "transitory," and that rising prices will recede as supply-chain disruptions are remedied. A White House official reiterated that view to FOX Business on Friday. However, Wall Street economists are concerned those predictions may be off the mark. "The annual rate of inflation has seemingly peaked, but the details show a broadening out of price pressures," said ING Chief International Economist James Knightley. "This indicates inflation is likely to be more persistent and pervasive than predicted by the Federal Reserve," he added. "With consumer inflation expectations also on the rise the case for earlier policy stimulus withdrawal is building." The Federal Reserve has since the early days of the pandemic been buying $120 billion of assets each month, helping drive up the money supply by 32% since February 2020. Source: St. Louis Fed "The more money you pour into the economy, the less each dollar's worth," Puzder said. Yet Congress is forging ahead with more spending plans. A $1 trillion bipartisan infrastructure bill sailed through the Senate earlier this week. The package would provide money for "hard infrastructure" projects like repairing roads and bridges. House Speaker Nancy Pelosi has pledged to hold up a vote in the lower chamber until a $3.5 trillion "human infrastructure" package also clears the Senate. GET FOX BUSINESS ON THE GO BY CLICKING HERE The Democrat's plan is like "throwing propane on an already pretty rampant fire," Puzder said. Biden wants to have both bills on his desk later this year so he can sign them into law, completing the three parts of his "Build Back Better" plan. "When it comes to the economy we’re building, rising wages aren’t a bug, they’re a feature," Biden said during a May speech touting his economic agenda. Source: Read Full Article