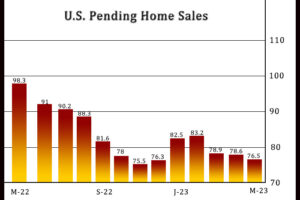

U.S. Pending Home Sales Unexpectedly Tumble 2.7% In May

Pending home sales in the U.S. unexpectedly saw a steep drop in the month of May, according to a report released by the National Association of Realtors on Thursday.

NAR said its pending home sales index tumbled by 2.7 percent to 76.5 in May after falling by 0.4 percent to a revised 78.6 in April.

Economist had expected pending home sales to inch up by 0.2 percent compared to the unchanged reading originally reported for the previous month.

Pending home sales decreased for the third straight month and were down by 22.2 percent compared to the same month a year ago.

A pending home sale is one in which a contract was signed but not yet closed. Normally, it takes four to six weeks to close a contracted sale.

“Despite sluggish pending contract signings, the housing market is resilient with approximately three offers for each listing,” said NAR Chief Economist Lawrence Yun, “The lack of housing inventory continues to prevent housing demand from being fully realized.”

“It is encouraging that homebuilders have ramped up production, but the supply from new construction takes time and remains insufficient,” he added. “There should be more focus on boosting existing-home inventory with temporary tax incentive measures.”

The continued slump in pending home sales in May reflected notable decreases in the West, Midwest and South, which more than offset a surge in pending home sales in the Northeast.

The Commerce Department released a separate report on Tuesday unexpectedly showing a sharp increase in new home sales in the U.S. in the month of May.

The report said new home sales soared 12.2 percent to an annual rate of 763,000 in May after surging 3.5 percent to a revised rate of 680,000 in April.

Economists had expected new home sales to slump 1.2 percent to an annual rate of 675,000 from the 683,000 originally reported for the previous month.

With the unexpected spike, new home sales reached their highest level since hitting a rate of 773,000 in February 2022.

Source: Read Full Article