Ethereum Nears $2300

Ethereum has risen to a new all time high of $2,270 with it appearing to follow bitcoin which also made a new high of $63,800 at the time of writing as shown by the ratio being somewhat sideways at 0.0357 bitcoin.

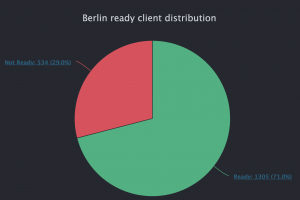

However, ethereum has some of its own developments, including the BLS upgrade (Berlin) which kicks in tomorrow.

This is a minor upgrade that has some technical improvements, including some small improvements in regards to gas and the like.

It is a hardfork upgrade, meaning any node that doesn’t upgrade is cut off from the network, with its expected successful rollout so paving the way for full focus on the fee market upgrade (EIP1559).

That is pretty much finished with the fee market upgrade in development for more than a year, so needing some more polishing and testing to harden it for mainnet.

Mainnet may come as soon as in two months, this June, something that would be a big development where monetary policy is concerned because a base fee algorithmically calculated to target the availability of 50% capacity, will be burned.

In addition this base fee may lower miners’ incentive to outright spam the network so as to drive overall fees up which currently go to miners, or to front-run even for small gains.

Another development is a partnership between ConsenSys and MasterCard, with the latter stating:

“Mastercard’s blockchain patents and payment network combined with ConsenSys’ deep blockchain development expertise will deliver a robust tech stack based on ConsenSys Quorum, an open-source protocol for enterprises built on Ethereum.”

So they playing at the edges on their own ‘intranet’ with Quorum being an ethereum based private blockchain, but it might be interesting to find out just what might come out of this.

In addition ConsenSys raised $65 million from J.P. Morgan, Mastercard, and UBS alongside leading blockchain companies, including Protocol Labs, the Maker Foundation, Fenbushi, The LAO, and Alameda Research. Joseph Lubin, Founder of ConsenSys and Co-founder of Ethereum, said:

“ConsenSys’ software stack represents access to a new automated objective trust foundation enabled by decentralized protocols like Ethereum.

We are proud to partner with preeminent financial firms alongside leading crypto companies to further converge the centralized and decentralized financial domains at this particularly exciting time of growth for ConsenSys and the entire industry.”

So it sounds like they’ve raised this money to build new things, with it unclear whether any equity was given in return or on what terms the funds were raised.

ConsenSys now however has more funds for defi dapp projects and infrastructure projects, all suggesting ethereum is moving forward development wise.

That could be one reason for it nearing $2,300, with another potential reason being the Coinbase listing tomorrow and the geopolitical tensions in Europe.

Source: Read Full Article