Nearly $1 Billion ETH Locked in L2

Ethereum’s second layer solutions are beginning to take off just weeks after some of them launched with a new one, Arbitrum, going out just this Tuesday.

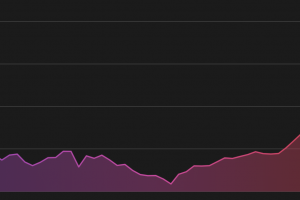

The speed of adoption for such scaling solutions is a first for this space, with$882.3 million worth of digital assets now locked in ethereum second layers.

According to data by L2Beat, the vast majority of it is in dYdX with nearly $300 million locked, followed by Loopring.

dYdX is currently rising as the poster child of second layer solutions with many that were picking up the airdrop likely impressed by just how smooth the spots and futures trading decentralized exchange has become.

It used to be the case that you’d feel a bit like back in the 90s annoying dial-up with a lot of waiting time – and a lot of fees – when trading on dYdX.

Now, it’s not just that broadband has arrived on this dapp, and that network fees are almost non existent, but also every time you trade one can’t help the feeling of a bit of magic that this is as smooth as something like Deribit while running on the permissionless global ethereum network.

The onboarding is arguably smoother too, presuming you already have MetaMask. You just deposit to the dapp – to the second layer by default – just as you’d deposit on any exchange, and thereafter you no longer deal with the network at an interface levels with trades – buys or sells – happening instantly without requiring any onchain confirmation and without paying any network fees.

It’s amazing, bitcoonnecct, because it works and not only smoothly but to the point where one can’t easily find any criticism or suggestion for improvements at a usability level as this is better than a cex.

dYdX in fact overtook Kraken in trading volumes, albeit somewhat briefly with it currently handling about $1 billion in the past 24 hours, up from circa $50 million last month.

Some of it is presumably due to people dYdX token mining, but some may be because people are finding out just how smooth trading on the dex has become, and considering you get new tokens then some of that new volume may remain with some 250 million (out of 1 billion) dYdX tokens to be distributed over the next five years.

In addition now that people have gotten a taste of the future, you’d expect pressure to increase on dapps that have not upgraded to second layers because the difference is pretty much that of an expensive and very slow dialup dapp vs an almost free and speedy broadband usage once you get in.

So the speed of adoption is not too surprising, but it is worth bearing in mind all this is open source code that can potentially have bugs and thus one needs to engage in some risk management that limits the amount of funds in one dapp.

dYdX itself has been running for some years now without any problems, but the second layer solution is in its foundation a smart contract which itself is open source code, and thus L2 dYdX is barely months old.

However centralized exchanges have been hacked too. So the solution for these dapps should be the same whereby a portion of dapp fees/profits are set aside to cover any potential bug related losses with that seen as just the cost of business.

The security risk therefore is not necessarily greater, but there is one as new systems go through the test of time.

Currently there’s quite a few such new systems, with the above mentioned site having a nice summary:

From the above it seems a second layer is using either Zero Knowledge (ZK) proofs or fraud proofs with the data either on-chain or presumably on another chain-like system that connects to the main-chain.

StarkWare, which is the one being used by dYdX, periodically commits the data to the ethereum blockchain itself:

A lot of this looks familiar but we can’t quite read the input data. That’s perhaps because it has a new way of decoding it, with the data itself being the skeleton that allows you to reconstruct the full data so that you can validate yourself just what has happened.

That makes this not quite a second layer as we’ve known of prior to 2018, but more a compression method as everything is still kind of happening onchain with the code itself doing the validation rather than a new set of nodes etc.

Fraud proofs based second layers on the other hand require a whole new system generally with their own nodes/validators and a system of, primarily, incentives that keep it all together rather than one where zk tech is doing all the validation.

Much is in flux however with the launched projects being just the first version that will probably have iterations and improvements as they compete against each other to attract dapp adoption.

Yet even at this early stage, ethereum’s scaling opens with $1 billion in locked assets, suggesting this can perhaps work to increase capacity by some magnitudes as broadband finally begins to roll out in a way that appears to be proper.

Source: Read Full Article