Bitcoin May Retrace Shortly Before New All-Time Highs

Key Takeaways

- Bitcoin’s price has risen by more than 5.50% in the past 12 hours, slicing through a crucial hurdle.

- If buying pressure continues to rise, BTC’s market value could target a new record high of $61,000.

- However, a particular technical index points to a retracement before Bitcoin reaches higher highs.

Bitcoin is back in the green after turning a crucial resistance level into support. As long as Bitcoin’s price holds above $50,000, the cryptocurrency will likely advance to new all-time highs.

Bitcoin Attempts to Resume its Uptrend

Bitcoin seems to have broken out of an inverse head-and-shoulders pattern that has developed since Feb. 23 on its 4-hour chart. After slicing through the $52,000 resistance barrier, BTC surged by more than 5.50% to recently hit a high of $54,850.

Further spike in buying pressure around the current price level could push Bitcoin’s price up by 12% and towards $61,000. This target is determined by measuring the inverse head-and-shoulders’ widest range and adding that distance upward from the breakout point.

Although the odds seem to favor the bulls, the Tom Demark (TD) Sequential indicator suggests that Bitcoin could retrace. This technical index presented a sell signal in the form of a green nine candlestick on BTC’s 4-hour chart. Such a bearish formation tends to lead to a one to four 4-hour candlesticks correction.

If validated, Bitcoin may pull back to the inverse head-and-shoulders’ neckline at $52,000, then rebound to $61,000.

While a sudden downswing to the $52,000 support level may shake out some of the so-called “weak hands,” investors should understand that this is a massive area of interest.

Glassnode CTO Suggests Strong Support

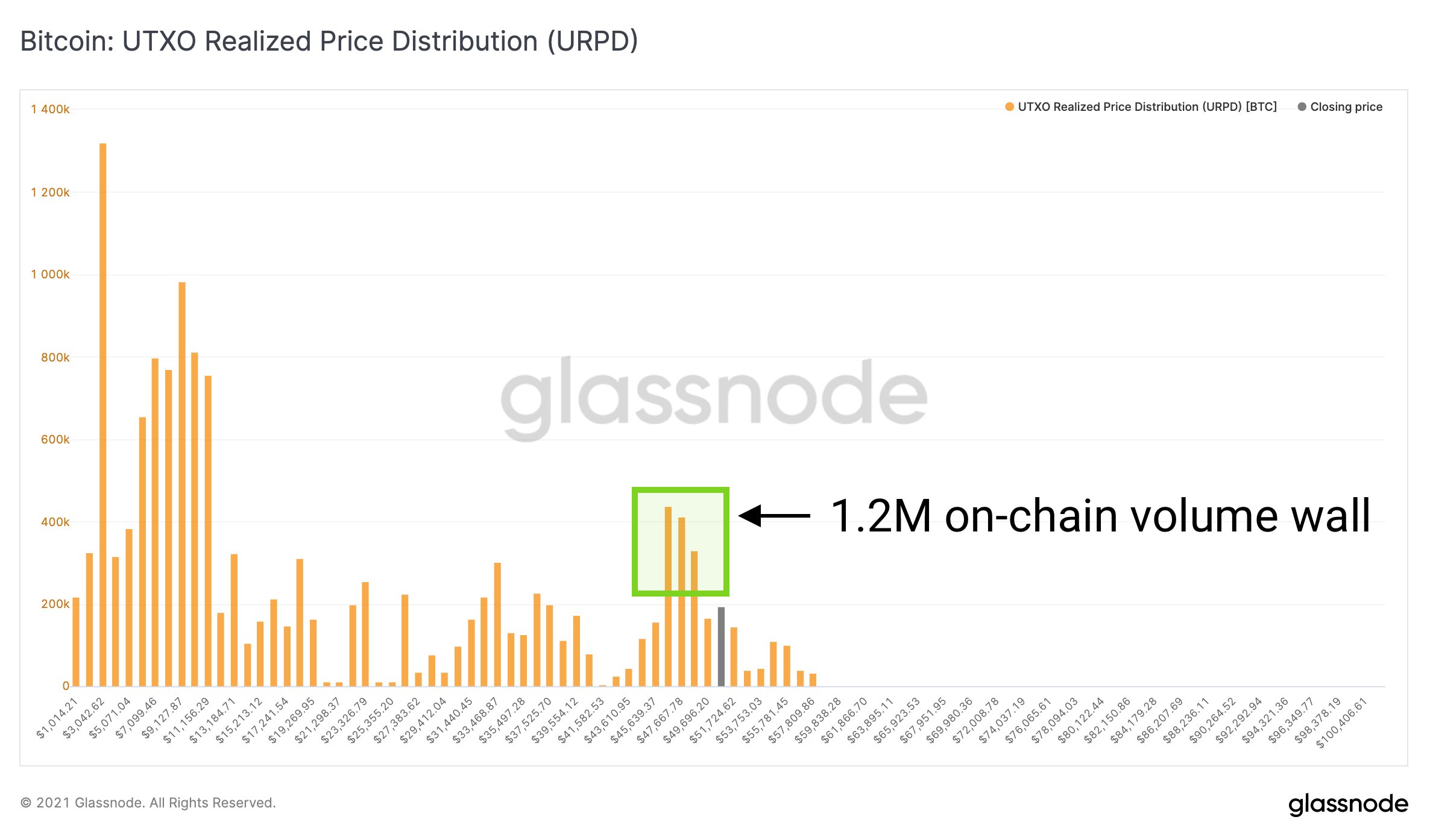

Glassnode co-founder and CTO Rafael Schultze-Kraft maintains that more than 1.2 million BTC (roughly 6.5% of Bitcoin’s circulation supply) were transacted around $50,000, making this a “strong” support zone.

“When a large volume of coins move on-chain, and an on-chain support level holds, it suggests that there is significant accumulation interest and buyers see it as a ‘value’ entry point,” he says.

It is worth noting that while a rebound from the $52,000 support zone may lead to a 17% upswing, breaking through it could be catastrophic for the bulls. A 4-hour candlestick close below this price hurdle might generate panic among investors, igniting a sell-off.

Under such unique circumstances, Bitcoin may drop to $40,000 to look for support at that level.

Disclosure: At the time of writing, this author owned Bitcoin and Ethereum.

The information on or accessed through this website is obtained from independent sources we believe to be accurate and reliable, but Decentral Media, Inc. makes no representation or warranty as to the timeliness, completeness, or accuracy of any information on or accessed through this website. Decentral Media, Inc. is not an investment advisor. We do not give personalized investment advice or other financial advice. The information on this website is subject to change without notice. Some or all of the information on this website may become outdated, or it may be or become incomplete or inaccurate. We may, but are not obligated to, update any outdated, incomplete, or inaccurate information.

You should never make an investment decision on an ICO, IEO, or other investment based on the information on this website, and you should never interpret or otherwise rely on any of the information on this website as investment advice. We strongly recommend that you consult a licensed investment advisor or other qualified financial professional if you are seeking investment advice on an ICO, IEO, or other investment. We do not accept compensation in any form for analyzing or reporting on any ICO, IEO, cryptocurrency, currency, tokenized sales, securities, or commodities.

See full terms and conditions.

Source: Read Full Article