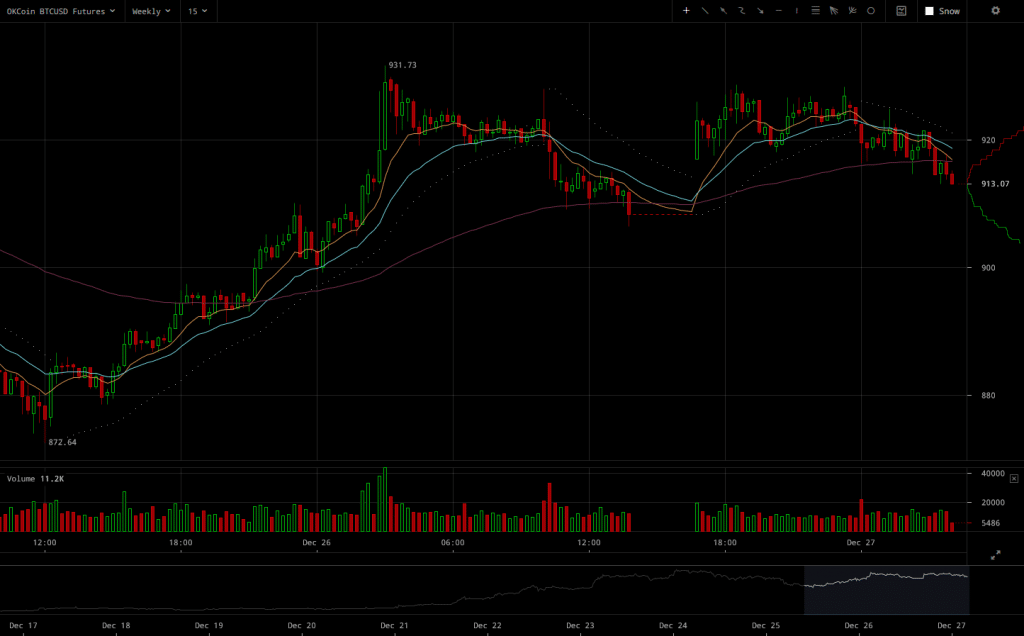

Bitcoin Price Back Above $900 as Volatility Continues

Traders can’t seem to stand by any significant downward pattern as any market downturn for BTC/USD rates till now has been reversed. Although trading volumes are still much higher than the averages, they’ve kept declining ever since the top of $920 was reached. Yet, BTC/USD markets peaked at this level once again.

Major Signals

- Trading volumes have kept falling ever since the previous peak, but this didn’t prevent the price from peaking at $920 once again.

- Buy walls above $900 are for once outweighing sell walls, something that indicated that the market might be settling at such levels.

- The more recent peak at $920 was followed by a correction and a so far persistent sideways trading trend.

However, this time the market might be more susceptible to a breakthrough. After a particularly bullish rally pushing the price to peak levels, sideways trading would most likely be followed by a continuation to previously ongoing patterns. Selling pressure also isn’t negligible at the moment, but given that the price being able to recover above $900 it surely is outmatched amidst this market sentiment.

Over the course of the last few trading sessions, it’s been established that bulls aren’t having a particularly hard time breaking through resistance levels one after another; as bearish outbreaks are broken off pretty easily with the market’s sentiment changing so rapidly. This time bulls are faced with a challenging resistance level, which they’re now failing to surpass for the second time in the span of a few days. The following days could be detrimental for the continuation of the uptrend that still seems to be ongoing.

Source: Read Full Article