Bitcoin Price Could Rebound Despite Flash Crash

Key Takeaways

- Bitcoin crashed by nearly 15% within minutes on Sunday, Apr. 18.

- The sudden downswing generated over $9 billion in liquidations.

- Given the current state of the market, investors may be more inclined to buy than to sell at the current price levels.

Bitcoin prices fell today in one of the steepest corrections since the beginning of the year. Despite the significant losses generated across the board, on-chain metrics show a high probability of a rebound.

What Caused Bitcoin’s Crash?

Bitcoin suffered a significant pullback after rising to a new all-time high of nearly $65,000 on Wednesday, Apr. 14. The correction accelerated over the weekend, leading to $9 billion in liquidations.

BTC’s sudden crash to $51,300 seems to be correlated with the network’s hash rate. According to analyst Willy Woo, a coal and gas accident in Xinjiang, China, caused a citywide power outage that forced Bitcoin miners to shut down. As a result, the processing power of the BTC network was halved and prices suffered.

The on-chain analyst suggested that insiders might have known about what was happening in Xinjiang and profited by triggering a “cascade of automatic sell-offs in a chain reaction.”

Other factors in the crash may be declining demand for Bitcoin in the aftermath of Coinbase’s IPO and reports that the U.S Treasury is planning to crack down on digital asset money laundering.

Bitcoin Will Likely Rise Again

Now that the a Bitcoin sell-has off occurred, it may be the perfect time for investors to “buy the dip.”

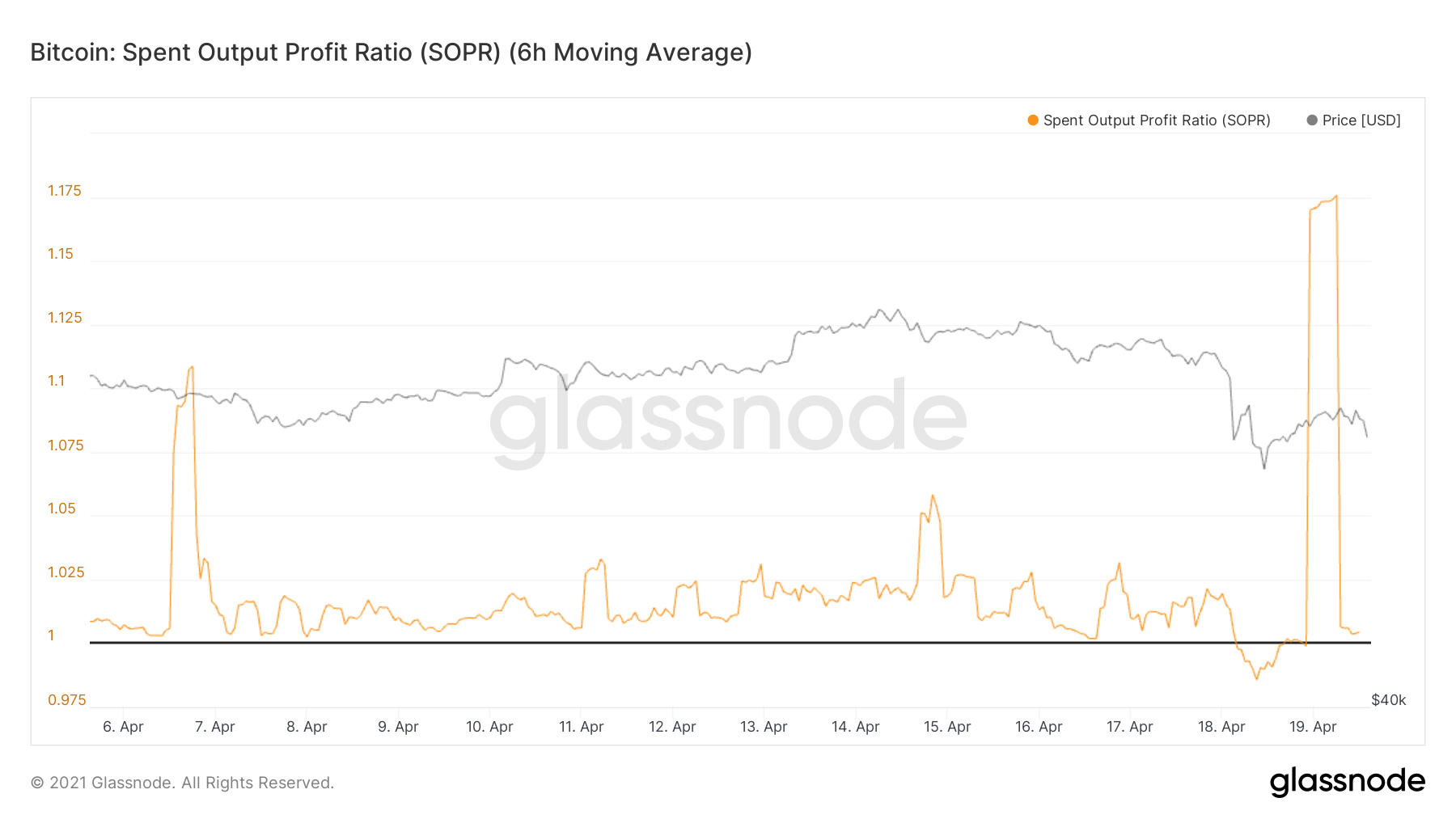

Bitcoin’s Spent Output Profit Ratio (SOPR) indicator has fully reset, suggesting that there is little Bitcoin left to sell at a profit. It is unlikely that existing investors will want to sell at a loss, meaning that the conditions are set for a potential rebound.

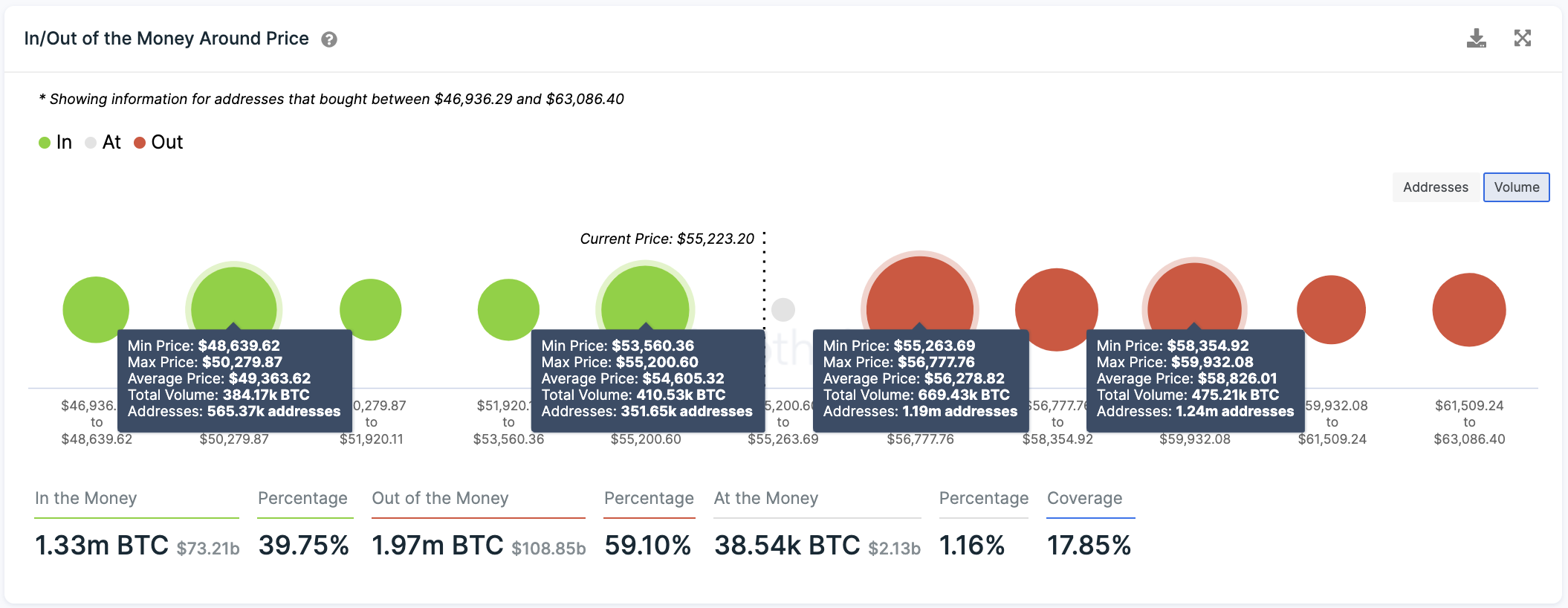

IntoTheBlock’s In/Out of the Money Around Price (IOMAP) model reveals that further price appreciation may prove challenging. Based on this indicator, over 1.19 million addresses previously purchased nearly 700,000 BTC between $55,270 and $56,780.

Only a decisive break of this supply wall might have the strength to push Bitcoin’s price upward once again.

Failing to move past the $56,280 resistance barrier would likely spell trouble for the bulls as the $54,600 support level isn’t as stiff. If this support wall cannot keep falling prices at bay, then a steeper decline to $49,360 becomes imminent.

At the time of publishing, Bitcoin was worth $55,871, according to CoinMarketCap.

Disclosure: At the time of writing, this author owned Bitcoin and Ethereum.

The information on or accessed through this website is obtained from independent sources we believe to be accurate and reliable, but Decentral Media, Inc. makes no representation or warranty as to the timeliness, completeness, or accuracy of any information on or accessed through this website. Decentral Media, Inc. is not an investment advisor. We do not give personalized investment advice or other financial advice. The information on this website is subject to change without notice. Some or all of the information on this website may become outdated, or it may be or become incomplete or inaccurate. We may, but are not obligated to, update any outdated, incomplete, or inaccurate information.

You should never make an investment decision on an ICO, IEO, or other investment based on the information on this website, and you should never interpret or otherwise rely on any of the information on this website as investment advice. We strongly recommend that you consult a licensed investment advisor or other qualified financial professional if you are seeking investment advice on an ICO, IEO, or other investment. We do not accept compensation in any form for analyzing or reporting on any ICO, IEO, cryptocurrency, currency, tokenized sales, securities, or commodities.

See full terms and conditions.

Source: Read Full Article