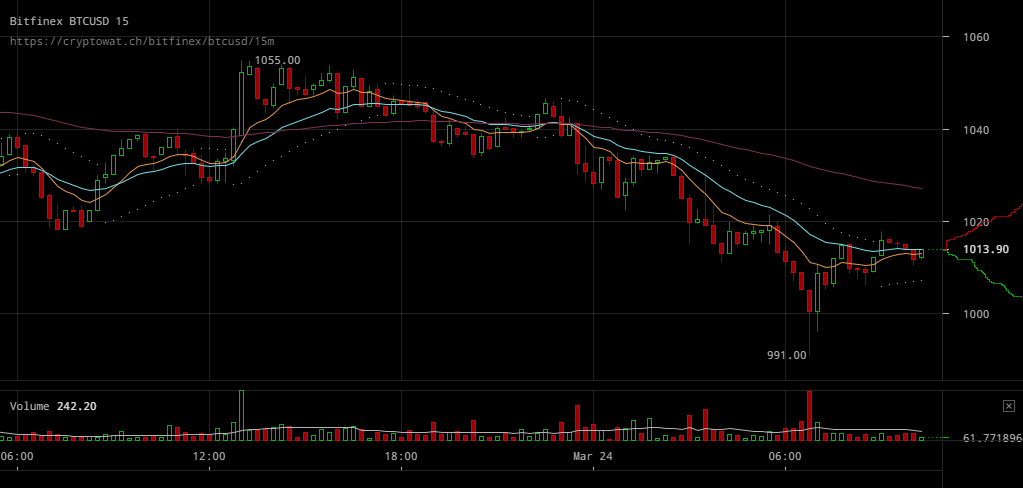

Bitcoin Price in Another Bearish Spiral

As of today, a breach through the weak support at $1000 levels was close but was eventually followed by a swift recovery with BTC/USD rates finally settling around a $1010 price point.

Major Signals

- BTC/USD rates fell from a peak above $1050 levels after the weakened selling pressure managed to breach the apparently weaker support

- It’s not obvious that the market’s sentiment is still not ready to support upward price swings

- Support at even $1000 levels seems dangerously weak through the recent downturn as the market’s bearish sentiment continues

Summarizing, it’s important to highlight that the recent recovery has so far been unsuccessful at helping BTC/USD rates to return at price levels as those prior to the fall. With buying pressure backing down and support weakened, traders are naturally playing safe. A break out from such a mood would require selling pressure appearing to be exhausted.

Source: Read Full Article