Bitcoin Price Keeps Above $1200 Levels as Volumes Go Down

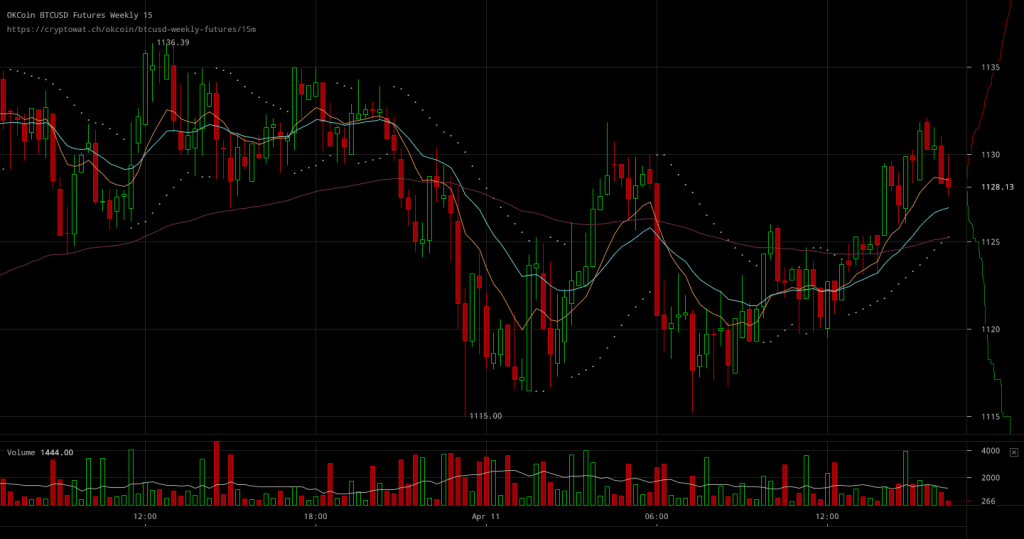

Bitcoin markets seem to be in par with the notion that $1200 levels are here to stay, as traders keep responding to downward swings with buying pressure and back to back buy orders. In spite of trading volumes going down considerably, buying pressure effectively battles volatility, keeping BTC/USD rates are levels above the recent break through price point.

Major Signals

- Buying pressure continues to keep up even with trading volumes going quite after the recent run

- Back to back buy orders are still present in today’s trading session, countering downward effectively so far

- BTC/USD rates are now looming above $1220 levels in spite of recent volatility that pushed bitcoin prices down below $1210 levels

In summary, it is important to note that the market’s sentiment has put traders in a mood to stand against selling pressure. Even though volumes have gone considerably lower sell offs were not able to cause a crash. It’s almost as though traders are anticipating the next positive development eagerly.

Source: Read Full Article