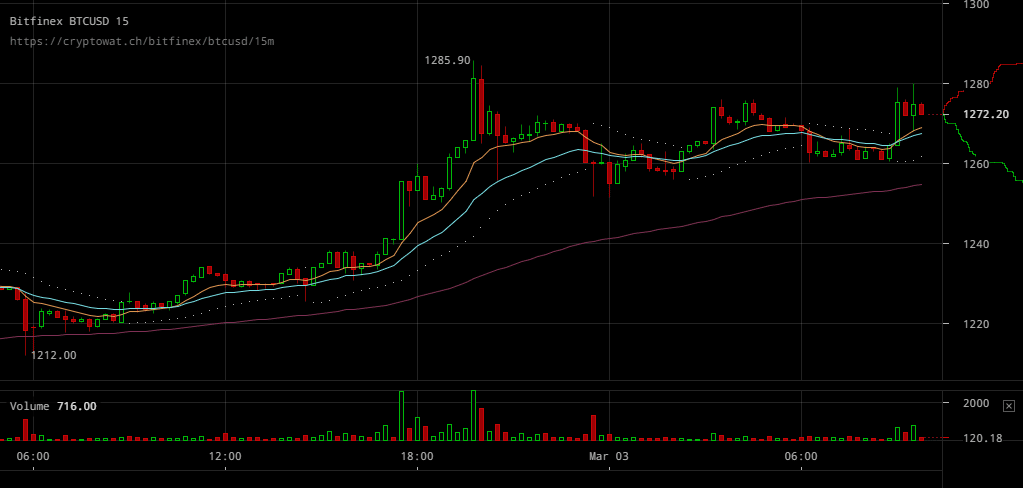

Bitcoin Price Keeps Climbing Past Resistance Levels

Bitcoin markets are continuing to be bullish as the recent price rise also triggered a sizeable increase in trading volumes. Large buy orders keep pushing the price up, with the market’s reception to the current price rise still being positive. Whilst selling pressure is still present, significant price falls have yet to be recorded amid the current market setting.

Major Signals

- BTC/USD rates kept rising through resistance levels, peaking at a top of $1280, up until selling pressure started having a more significant effect.

- Whilst resistance has proved to be easily broken through, a new level of resistance has been formed at $1280 even after the recent rise.

- Bitcoin markets keep showing off the momentum they currently have through bullish signals as upward spikes keep being welcomed in the market.

Finalizing, it’s important to note that whilst bitcoin prices might appear to be going through an uptrend, the recent rise only happened through a trading session with increased trading volumes. Even though bitcoin traders might have been waiting for such a major development to follow up with support for another price rise, the fact that there was no pre-existing support showcased is indicative as to why some traders might not find new levels sustainable.

Source: Read Full Article