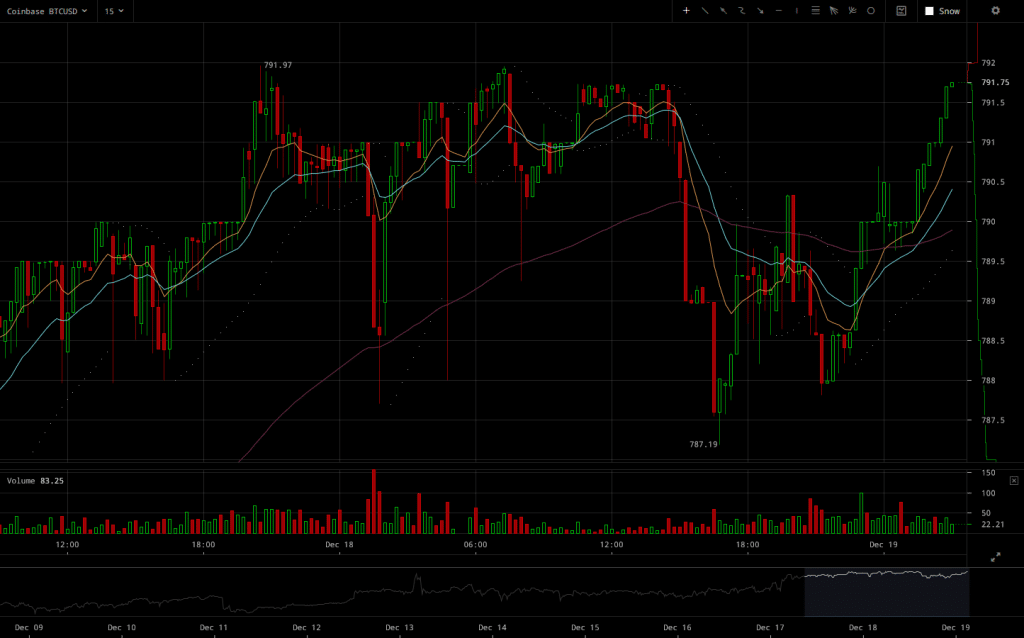

Bitcoin Price Manages to Keep Above $790 Levels

In spite of the break through resistance, selling pressure hasn’t managed to push BTC/USD rates much lower than $790 levels. Volatility was to be expected but as surprising as it might sound, the price hasn’t dropped below $787 after the spike the pushed bitcoin’s price above $790.

Major Signals

- Selling pressure in BTC/USD markets keeps being outweighed by buying pressure in spite of trading volumes returning back to normal levels

- Market sentiment after upward spikes still has a decent outlook as support taking shape at higher levels.

- No apparent resistance levels still. However, volatility within a range reasonably close to $790 is to me expected after such a breakthrough.

Recoveries from downward spikes haven’t been particularly impressive but it’s interesting to see how back to back buy orders always tend to push the price back to levels prior to downward spikes caused by hefty sell orders. Bearish whales probably stand no chance amid such a bullish market sentiment.

In the end, in spite of the correction futures markets seem to be going through, the outlook for live BTC/USD markets is still good. Recoveries from downward spikes have been sufficient to keep the price trading around the newly reached level of $790, and perhaps new highs are to be expected once we see trading volumes rising once again.

Source: Read Full Article