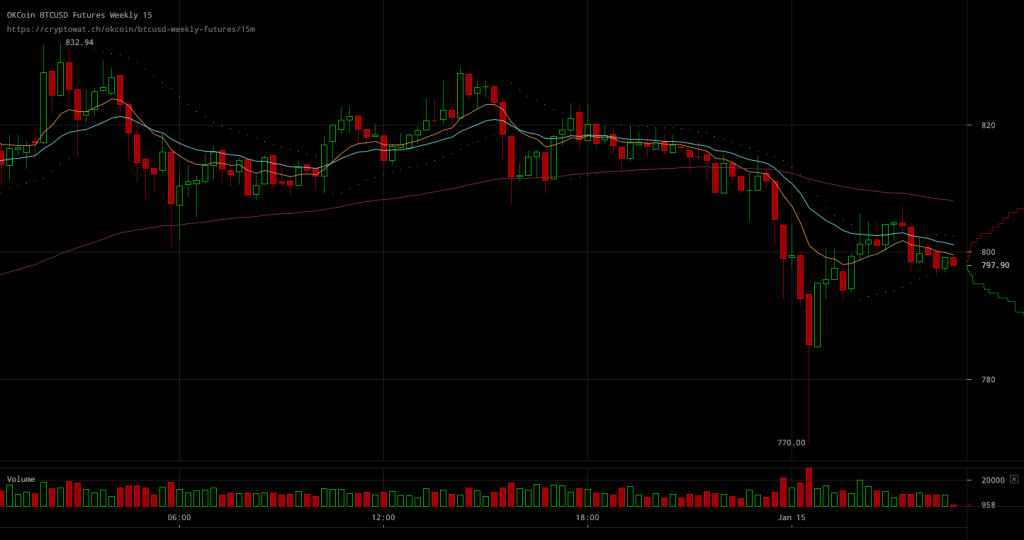

Bitcoin Price Manages to Stay Above $800

Bitcoin markets have kept trading above $800 levels in spite of the selling pressure present in the market. While BTC/USD almost fell to $800 at one point, it has since recovered to levels close to $815. It’s definitely noteworthy that support levels might be starting to take shape but with trading volumes lowered so much it’s not a remarkable achievement.

Major Signals

- The trading volumes in the latest trading session might be of the lowest 24h ones seen throughout the start of the year, perhaps even since the beginning of the rally.

- Selling pressure is still present in the market but sell walls have been significantly reduced in comparison to preceding trading sessions.

- The recovery from sub $800 levels reached a top of $838 but the price also reached $834 yesterday.

The market is looking for a new dynamic, but it doesn’t look like another rally would be starting out soon either. Selling pressure becomes felt in the form of resistance whenever bitcoin prices are reaching close to breaking through it.

Source: Read Full Article