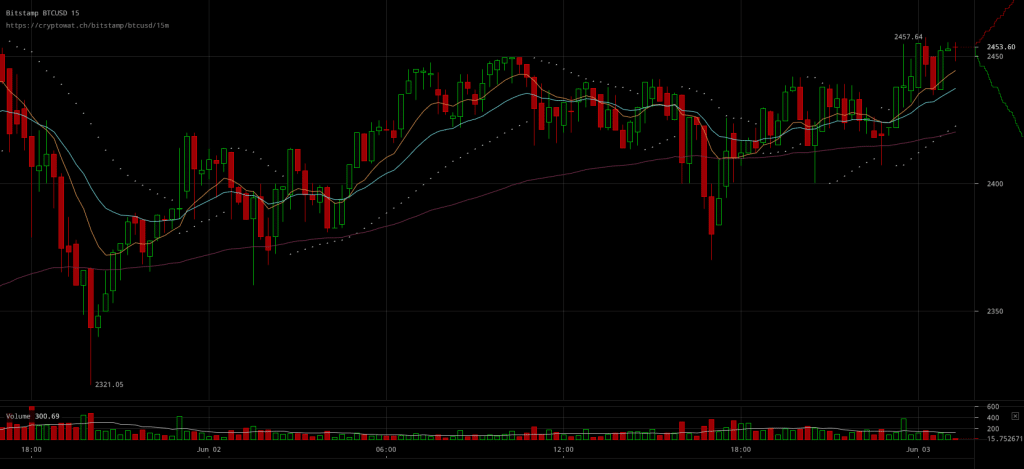

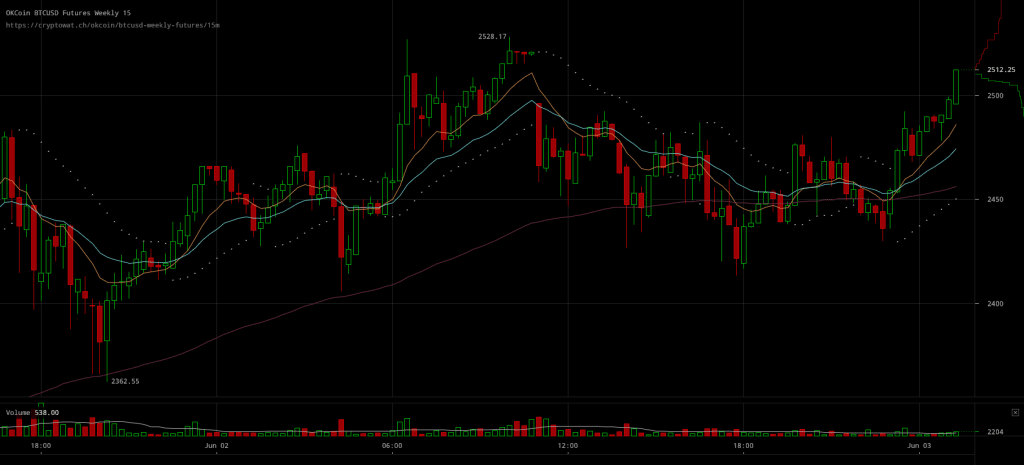

Bitcoin Price; Slow Rise Above $2400

Bitcoin markets are continuing to be into a volatility spiral that’s causing prices to swing at both directions rapidly. This is something especially observed within the preceding trading session, after a downward spike causing a price drop down to $2330 levels was followed by a recovery, markets highlighted the potential volatility is showcasing within the last few days.

Major Signals

- Trading volumes remain relatively high as bitcoin prices are on a slightly positive path, continuing to trade above $2400.

- Breaches of support weren’t rare through the last trading session but prices did for the most part remain above recently reached levels.

- Pressure from either direction seems somewhat balanced at the time being but resistance might be a bit more prevalent after the slight positivity recently.

All in all, the sentiment doesn’t seem to be allowed to bread down to a more bearish one, yet resistance along with selling pressure are playing an important role in putting markets into this volatile state. If a major development was to occur, more support would be needed to make a price rise sustainable amid the current uncertainty and pressure.

Source: Read Full Article