Bitcoin Remains Bullish After Shaking on Amazon Rumors

Key Takeaways

- Bitcoin has dipped below $40,000 after Amazon denied rumors it would be accepting crypto payments.

- The erratic price action has led to significant liquidations across the board.

- Still, Bitcoin sits on top of stable support with little to no resistance ahead.

Volatility has struck Bitcoin after a prolonged stagnation period. Although the recent price action was based on a rumor, on-chain data shows that Bitcoin has the buying pressure behind it to reach higher highs.

Speculators Search for the Next Catalyst

The outlook for Bitcoin looks bullish despite recent volatility in the market.

The asset surged after rumors of Amazon preparing to accept crypto payments surfaced online Monday. City A.M. initially covered the story and it appeared in numerous publications shortly after.

Although no official sources had confirmed the information, speculators rushed to exchanges to buy Bitcoin when the news dropped. The sudden spike in buying pressure saw the flagship cryptocurrency rise by more than 18% to hit a high of $40,570.

Shortly after Bitcoin had sliced through the $40,000 mark, Amazon denied the report from City A.M. and confirmed that it would not accept BTC payments this year. An Amazon spokesperson said:

“Notwithstanding our interest in the space, the speculation that has ensued around our specific plans for cryptocurrencies is not true. We remain focused on exploring what this could look like for customers shopping on Amazon.”

The leading cryptocurrency dropped 10.25% on Amazon’s announcement to trade at a low of $36,400. Nearly $284 million in liquidations were generated across the board, creating uncertainty among retail investors.

Whales Buy Bitcoin at a Discount

Despite yesterday’s volatility pump and dump, Bitcoin seems well-positioned to advance further.

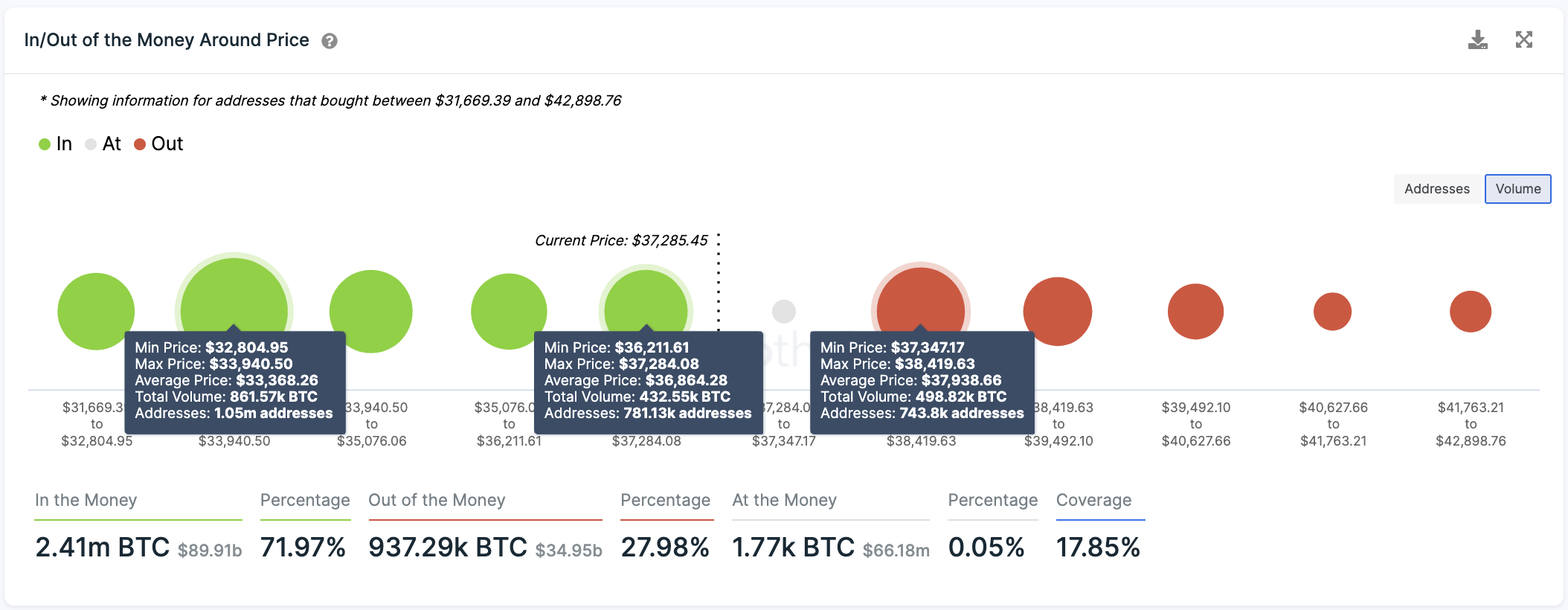

IntoTheBlock’s In/Out of the Money Around Price (IOMAP) model shows that the only supply barrier holding Bitcoin back lies between $37,350 and $38,420. Here, nearly 745,000 addresses have previously purchased 500,000 BTC.

A sustained daily candlestick close above this critical resistance area could potentially help the asset rise towards $46,000, especially when considering that whales have been buying the asset at a discount. Behavior analytics platform Santiment maintains that addresses holding between 100 and 10,000 BTC have accumulated around 40,000 BTC in the past ten days alone.

Bitcoin is currently trading at $37,386, which puts its market cap at around $701.7 billion.

The information on or accessed through this website is obtained from independent sources we believe to be accurate and reliable, but Decentral Media, Inc. makes no representation or warranty as to the timeliness, completeness, or accuracy of any information on or accessed through this website. Decentral Media, Inc. is not an investment advisor. We do not give personalized investment advice or other financial advice. The information on this website is subject to change without notice. Some or all of the information on this website may become outdated, or it may be or become incomplete or inaccurate. We may, but are not obligated to, update any outdated, incomplete, or inaccurate information.

You should never make an investment decision on an ICO, IEO, or other investment based on the information on this website, and you should never interpret or otherwise rely on any of the information on this website as investment advice. We strongly recommend that you consult a licensed investment advisor or other qualified financial professional if you are seeking investment advice on an ICO, IEO, or other investment. We do not accept compensation in any form for analyzing or reporting on any ICO, IEO, cryptocurrency, currency, tokenized sales, securities, or commodities.

See full terms and conditions.

Source: Read Full Article