Cardano Could Be Ready to Retest All-Time Highs

Key Takeaways

- Cardano is up 15.8% in the past 24 hours.

- The upward price action allowed it to turn a significant supply barrier into support.

- Now, ADA faces no opposition to retest the $2.47 all-time high.

Cardano was recently on shaky grounds as it projected a 55% decline. Still, the recent break of a critical resistance level seems to have invalidated the bearish outlook and could lead to higher highs.

Cardano Shrugs Off the Bears

Cardano is back in the green after printing a massive trend reversal pattern on its daily chart. In the last 24 hours, it’s up 15.8%.

Trading veteran Peter Brandt has suggested that the head-and-shoulders formation that ADA has developed since mid-March has been invalidated. The bearish pattern projected a 55% downward target that could have taken the fifth-largest cryptocurrency by market cap to $0.45.

A recent spike in buying pressure behind Cardano sent prices above the pattern’s right shoulder, negating the pessimistic outlook. Now, Brandt believes that ADA will remain bullish as long as the $1.25 support level continues to hold.

Transaction history reveals that Cardano faces no opposition on its way to higher highs.

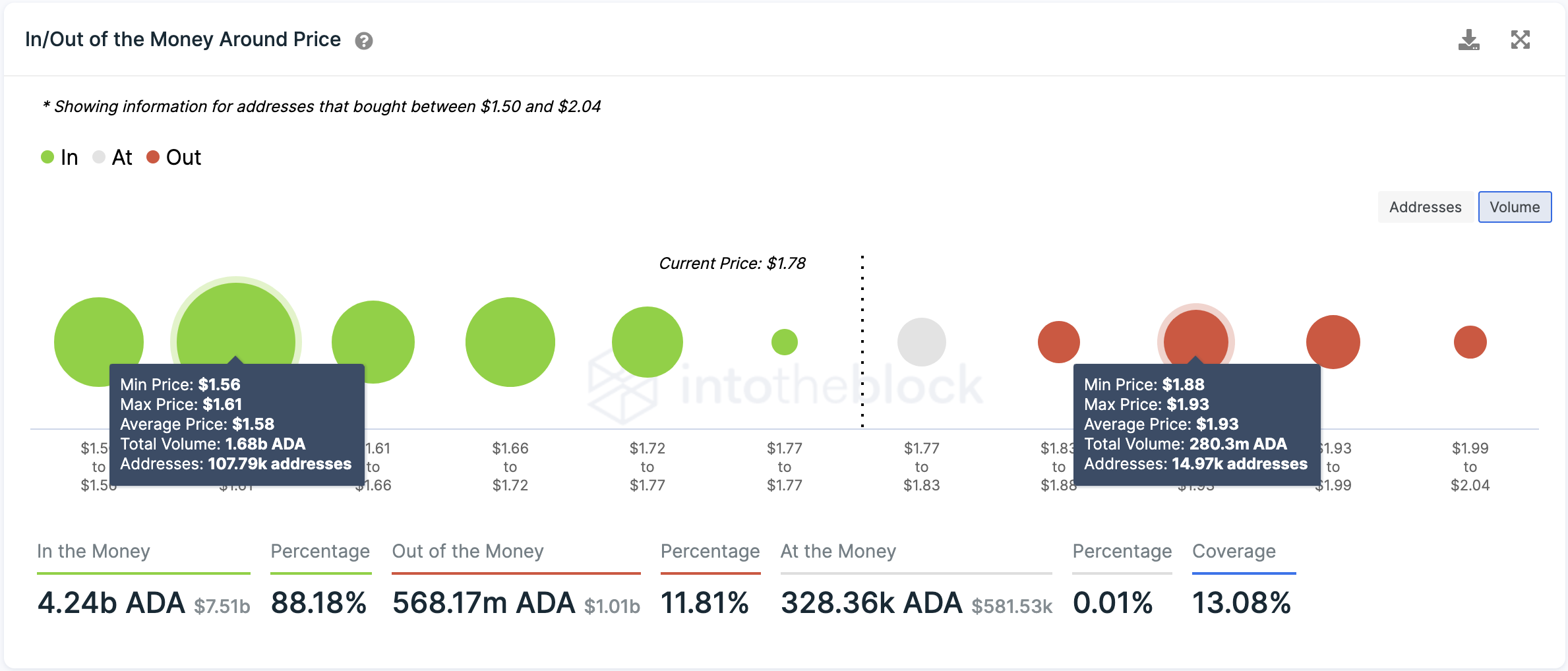

IntoTheBlock’s In/Out of the Money Around Price (IOMAP) model shows no significant supply barriers ahead for the asset. Based on this on-chain metric, the only considerable interest area sits between $1.88 and $1.93, where roughly 15,000 addresses have previously purchased 280 million ADA.

This resistance wall may have the ability to absorb some of the recent buying pressure. Holders who have been underwater may try to break even on their positions, slowing down the uptrend. But if Cardano can slice through this hurdle, it could climb and retest the $2.47 all-time high.

The IOMAP cohorts show that Cardano sits on top of stiff support. More than 100,000 addresses bought approximately 1.7 billion ADA between $1.56 and $1.61. This crucial demand zone suggests that bears will struggle to push prices down in the event of a sell-off, adding credence to the bullish thesis.

The information on or accessed through this website is obtained from independent sources we believe to be accurate and reliable, but Decentral Media, Inc. makes no representation or warranty as to the timeliness, completeness, or accuracy of any information on or accessed through this website. Decentral Media, Inc. is not an investment advisor. We do not give personalized investment advice or other financial advice. The information on this website is subject to change without notice. Some or all of the information on this website may become outdated, or it may be or become incomplete or inaccurate. We may, but are not obligated to, update any outdated, incomplete, or inaccurate information.

You should never make an investment decision on an ICO, IEO, or other investment based on the information on this website, and you should never interpret or otherwise rely on any of the information on this website as investment advice. We strongly recommend that you consult a licensed investment advisor or other qualified financial professional if you are seeking investment advice on an ICO, IEO, or other investment. We do not accept compensation in any form for analyzing or reporting on any ICO, IEO, cryptocurrency, currency, tokenized sales, securities, or commodities.

See full terms and conditions.

Source: Read Full Article