Dogecoin Overtakes Tether in Market Cap After Making New All-Time High

Key Takeaways

- Dogecoin has posted year-to-date returns of nearly 7,000%.

- The meme coin continues surging while the rest of the market takes the backseat.

- If buying pressure continues mounting, DOGE could rise to $0.36 or even $0.52.

Dogecoin continues its staggering advance thanks to a new wave of interest. Even after nearly 200% in gains, DOGE may just be getting started.

Dogecoin Leads the Charts

Dogecoin has stolen the crypto spotlight after skyrocketing by a more than 180% in the last 24 hours. While the rest of the market bled, DOGE surged from $0.18 to make a new all-time high of $0.46.

The sudden bullish impulse pushed it up in the rankings to become the fifth-largest cryptocurrency by market capitalization, above Tether.

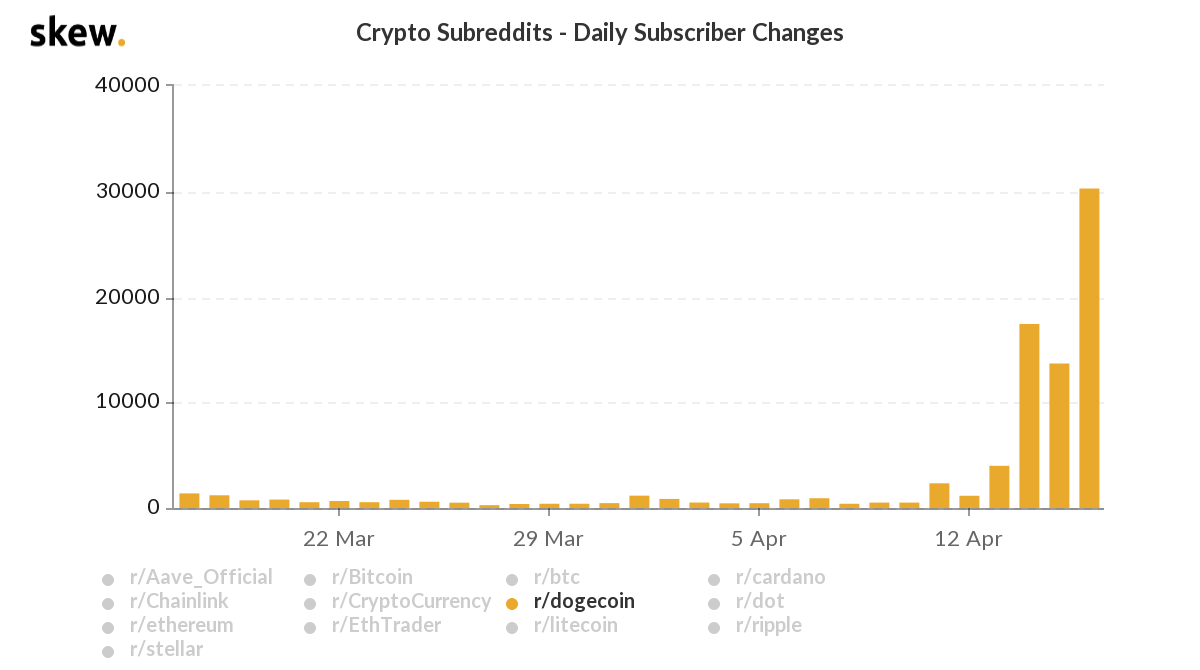

Skew implied that the hype behind Dogecoin is real. The data analytics firm recorded a significant spike in the number of daily subscribers on Dogecoin’s subreddit over the past week.

There were roughly 500 subscribers to r/dogecoin on Apr. 10. Now, more than 30,000 people have joined this subreddit community.

Further Gains on the Horizon

From a technical perspective, Dogecoin’s explosive price action comes from the breakout of an ascending triangle that developed on its daily chart since late January. The three-month-long consolidation period ended on Apr. 13, with a 416% upswing.

The most optimistic target is determined by measuring the height of the triangle’s y-axis from the bottom up and adding that distance to the breakout point. When taking this into account, DOGE has met the bullish target as it rose above the 200% Fibonacci retracement level at nearly $0.36.

As FOMO drives even more investors, Dogecoin may have a chance to advance to the 227.2% or the 261.8%Fibonacci retracement level. These areas of interest sit at $0.52 and $0.83, respectively.

Given the magnitude of Dogecoin’s uptrend, it would be reasonable for prices to slow down before targeting higher highs.

A rejection from the $0.36 hurdle might lead to a spike in profit-taking that sends DOGE back to look for support around the 161.8% or 141.4% Fibonacci retracement level.

These demand walls sit at $0.21 and $0.16, respectively.

Disclosure: At the time of writing, this author owned Bitcoin and Ethereum.

The information on or accessed through this website is obtained from independent sources we believe to be accurate and reliable, but Decentral Media, Inc. makes no representation or warranty as to the timeliness, completeness, or accuracy of any information on or accessed through this website. Decentral Media, Inc. is not an investment advisor. We do not give personalized investment advice or other financial advice. The information on this website is subject to change without notice. Some or all of the information on this website may become outdated, or it may be or become incomplete or inaccurate. We may, but are not obligated to, update any outdated, incomplete, or inaccurate information.

You should never make an investment decision on an ICO, IEO, or other investment based on the information on this website, and you should never interpret or otherwise rely on any of the information on this website as investment advice. We strongly recommend that you consult a licensed investment advisor or other qualified financial professional if you are seeking investment advice on an ICO, IEO, or other investment. We do not accept compensation in any form for analyzing or reporting on any ICO, IEO, cryptocurrency, currency, tokenized sales, securities, or commodities.

See full terms and conditions.

Source: Read Full Article