Gold Spikes Higher as Fed's Minutes Report Looms, Central Bank Bullion Purchases Begin to Swell – Economics Bitcoin News

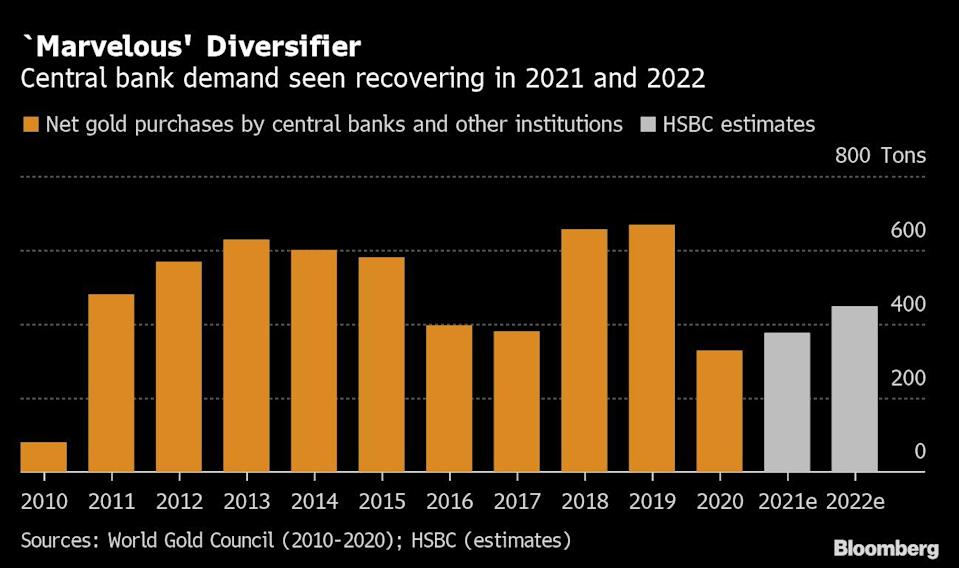

After a long break, monthly purchasing data shows that central banks are buying gold again. The World Gold Council says throughout March and April, the organization recorded a higher level of central bank monthly gold purchases and the latest data from May shows the exact same trend.

Gold Rises After Data Shows Central Bank Gold Purchases Trend Higher

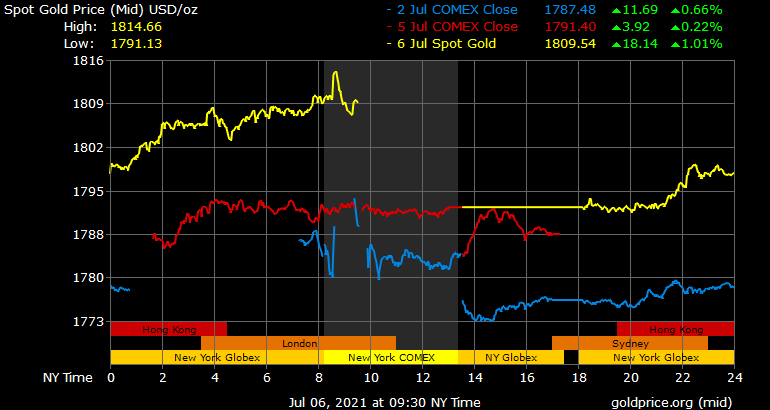

The price of gold per ounce is hovering just above the $1,800 zone, after seeing some fresh gains following the weekend. Gold’s value jumped above its 100-day moving average and is changing hands for the highest price in two weeks. In late June, gold dipped to a two-month low and since then, the precious metal has gathered 3% in gains.

On Wednesday, the Federal Reserve plans to release the Federal Open Market Committee (FOMC) minutes from the latest committee meeting and the outcome could shake markets. The mid-June gold price drop took place when the Fed revealed its hawkish interest rate changes and the U.S. dollar gathered some strength.

One reason why gold may be gaining on the dollar is because some of the world’s central banks have been actively purchasing gold since the start of the year. Central bank gold purchases are much higher than in 2020 already. After the Covid-19 outbreak and throughout 2020, central bank gold purchases were cut in half in comparison to the two previous years.

Today, data from the World Gold Council (WGC) shows higher levels of gold purchased by central banks throughout March and April. Kitco statistics also show that in May, the world’s central banks purchased “56.7t during the month, down 11% M/M but 43% above the YTD monthly average.”

The chief precious metals analyst at HSBC, James Steel, told Bloomberg this week that the central banks moving into gold is a positive trend. “If a central bank is looking at diversifying, gold is a marvelous way of moving out of the dollar without selecting another currency.” Steel further said that bullion purchases by central banks will likely continue. The HSBC precious metals analyst stressed that because crude oil prices have risen dramatically, it has amplified central bank bullion buys.

“Long term, gold is the most significant guardian and guarantor of protection against inflationary and other forms of financial risks,” Vucic told the press. Serbia’s central bank said it intends to add to its 36.3 tons and increase to 50 tons of gold.

Crude Oil Taps a 2021 Price High, Physical Gold Demand Resurfaces

Kitco statistics for May indicate that Thailand was the biggest buyer of gold bullion, as the country captured 82% of the month’s net gold purchases worldwide. The same month, Brazil increased gold reserves for the first time since 2012.

Gold bug and economist Peter Schiff agrees that crude prices have risen significantly in recent times. “In case no one in America is paying attention to the oil market on a Federal holiday,” Schiff said on Monday. “The price just hit a new high for the year of $76.39.” Schiff continued:

We are about 50 cents from hitting the highest price since Nov. of 2014. Low oil prices were transitory. Get ready for much higher prices.

American investors are anticipating this week’s minutes report from the Federal Reserve in order to get a clearer view of what the U.S. central bank will do next. Joseph Stefans, head trader at MKS (Switzerland) SA says demand for physical bullion has reappeared in recent times.

“Physical demand has begun to resurface a bit, U.S. real yields continue to drift lower, which has brought some dollar selling to the market,” Stefans noted on July 6. Gold is trading 0.83% higher than yesterday’s $1,791 per ounce price at $1,806 per ounce on Monday morning. A few other analysts believe it’s still too early to get clarity on gold’s future performance before the Fed’s minutes.

“It seems like the gold price has bottomed out recently after its mid-June sell-off. However, it’s still too early for a clearer picture ahead of the Fed minutes,” Alexander Zumpfe, a senior trader at refiner Heraeus Metals Germany GmbH & Co. KG. told Bloomberg on Monday.

Source: Read Full Article