Investors Sell Huobi and OKEx's Tokens After PBOC Statement

Key Takeaways

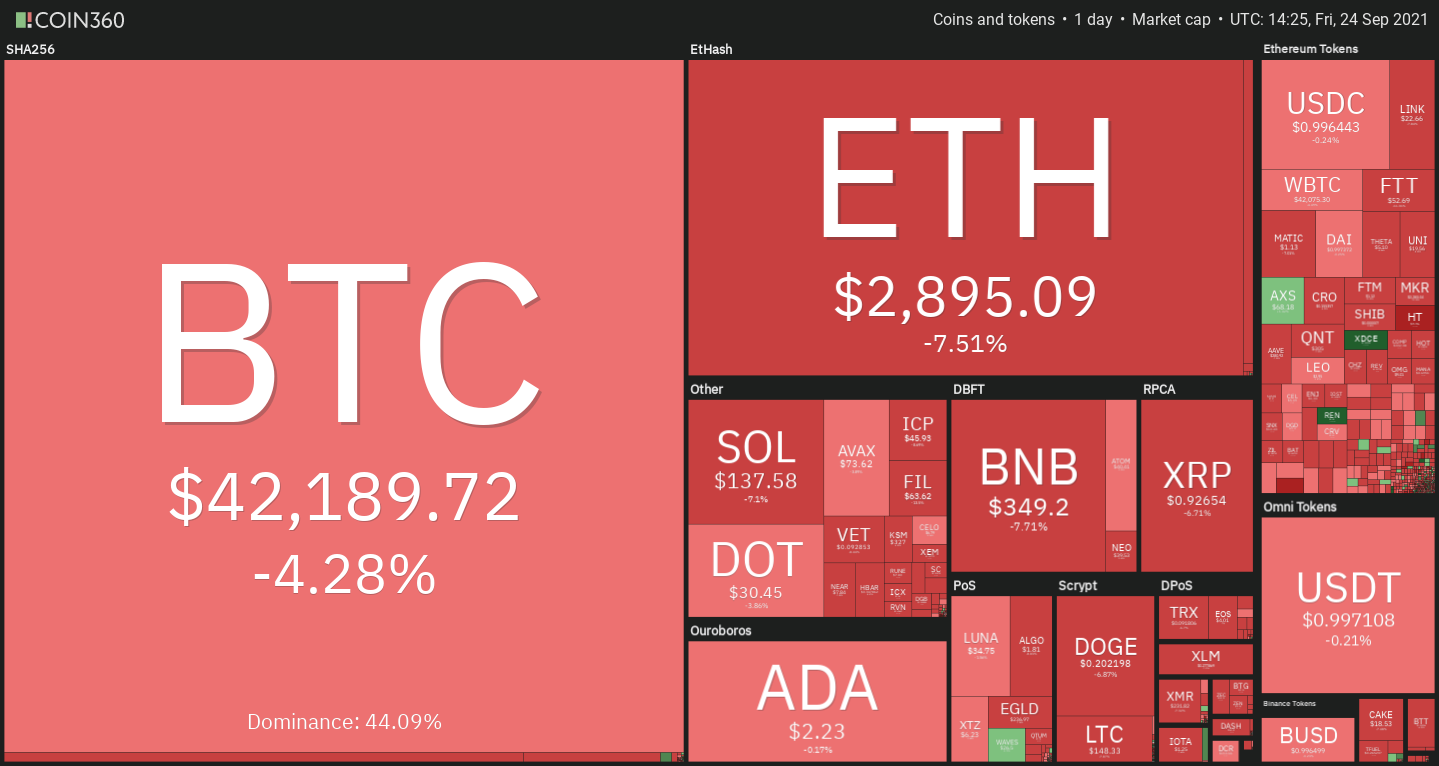

- China’s new crackdown on cryptocurrencies has wreaked havoc in the market.

- Almost every single digital asset has suffered significant losses.

- Huobi and OKEx’s tokens rank among the biggest losers in the recent flash crash.

The utility tokens of cryptocurrency exchanges Huobi and OKEx have fallen significantly following China’s latest crackdown notice.

China Shakes the Crypto Market

The People’s Bank of China (PBOC) has strengthened its crackdown on cryptocurrencies, sending investors into fear.

In the past few hours, more than $1.35 billion has been wiped out from the entire crypto market capitalization. The sudden sell-off generated nearly $450 million in liquidations worth of long and short positions across the board.

Almost every single digital asset in the crypto space has suffered from the crash. Even the stablecoins USDT and USDC briefly dropped by approximately 0.20% from their $1 peg.

The Huobi and OKEx’s tokens have taken the biggest hit from China’s latest crackdown, given their strong roots in the nation where they were founded. These digital assets saw their market valuation plunged by more than 22% within a few minutes and now stand on weak support.

HT and OKB Crash in Tandem

The Fibonacci retracement indicator, measured from the Jul. 20 low of $7.40 to the Sep. 6 high of $17.70, reveals that Huobi Token sits on thin ice. The recent sell-off has pushed its price below the strong foothold at $11.30, and now the last line of defense for the bulls sits at $9.60.

A candlestick close above this support level may relieve some of the selling pressure seen recently, leading to a rebound toward $11.30. But if bears manage to gain control of HT, triggering a close below $9.60, then a downswing to $7.40 seems imminent.

OKB also slid through a significant support level at $15.42 due to the recent flash crash. Now, this utility token doesn’t have any demand barriers underneath it that can prevent it from dropping toward $12.80.

Given the lack of support for OKB, it must keep trading above $12.80 so that a rebound to $15.42 can occur. Failing to hold above this critical support level might generate panic among traders, encouraging them to sell. Under such unique circumstances, OKB could fall to $9.50.

Although some of the most renowned analysts in the cryptocurrency industry believe that the market will absorb the recent spike in downward pressure, it is crucial to pay close attention to the support levels previously mentioned. A daily close below $9.60 for HT and $12.80 for OKB could result in a steeper correction.

The information on or accessed through this website is obtained from independent sources we believe to be accurate and reliable, but Decentral Media, Inc. makes no representation or warranty as to the timeliness, completeness, or accuracy of any information on or accessed through this website. Decentral Media, Inc. is not an investment advisor. We do not give personalized investment advice or other financial advice. The information on this website is subject to change without notice. Some or all of the information on this website may become outdated, or it may be or become incomplete or inaccurate. We may, but are not obligated to, update any outdated, incomplete, or inaccurate information.

You should never make an investment decision on an ICO, IEO, or other investment based on the information on this website, and you should never interpret or otherwise rely on any of the information on this website as investment advice. We strongly recommend that you consult a licensed investment advisor or other qualified financial professional if you are seeking investment advice on an ICO, IEO, or other investment. We do not accept compensation in any form for analyzing or reporting on any ICO, IEO, cryptocurrency, currency, tokenized sales, securities, or commodities.

See full terms and conditions.

Source: Read Full Article