Oracle Tokens Chainlink, Band Protocol Enter New Bull Rally

Key Takeaways

- Chainlink continues trending upward, making a new record high of $44.30 recently.

- Likewise, Band Protocol broke out of a seven-month-long bullish continuation pattern to hit a new all-time high of $23.30.

- Further buying pressure could push these cryptocurrencies even higher regardless of the recent gains.

Chainlink and Band Protocol have recently made new all-time highs. Though some investors may take advantage of the rising price action to book profits, these cryptocurrencies show no signs of slowing.

Chainlink Looks Unstoppable

Chainlink made headlines after releasing a new whitepaper that details how the project plans to execute “hybrid smart contracts.” The new architecture will expand the network’s utility by adding new services to the off-chain computation of data.

“Hybrid smart contracts are about combining blockchain smart contract application capabilities, and the off-chain world’s proof and data and computations. This is a big leap forward because it redefines what people can build,” said Chainlink’s co-founder Sergey Nazarov.

The release of Chainlink 2.0 comes when LINK has broken out of a symmetrical triangle on Mar. 31 and has risen over 50% since then, hitting a new all-time high of $44.30 recently.

Further buying pressure could push Chainlink by another 19% toward the 200% Fibonacci retracement level at $53.50 – measured from the Feb. 20 high of $37 to the Feb. 23 low of $20.70.

This target is determined by measuring the height of the triangle’s y-axis and adding that distance upward from the breakout point.

After Google Integration, Band Moons

Speculation mounts around BAND after Google Cloud announced that it would integrate the decentralized oracles protocol. The cloud computing services platform will use Band Protocol’s standard dataset to enable real-time analysis of financial time series data.

The goal is to allow developers to build hybrid blockchains and cloud applications using decentralized oracles.

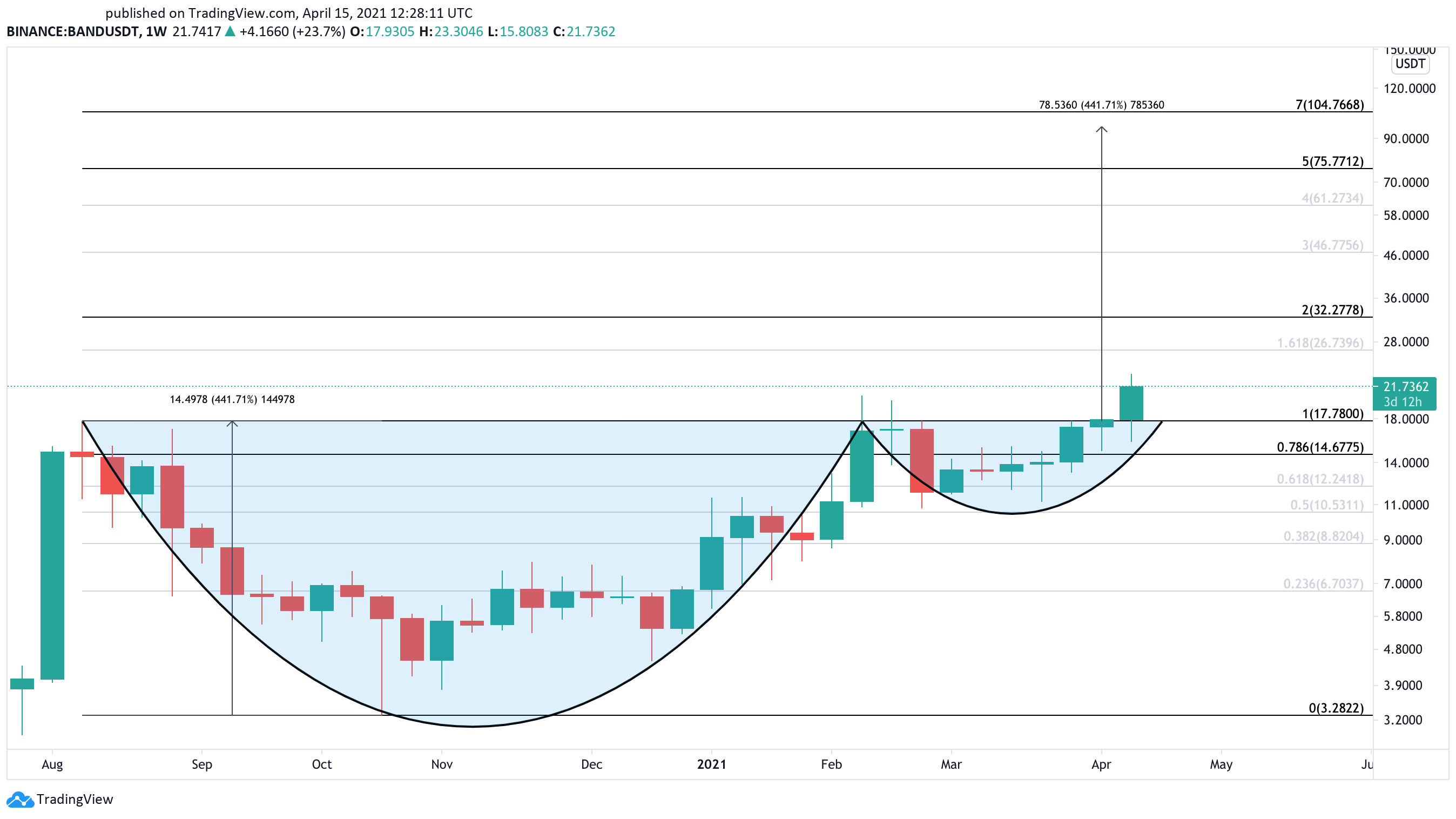

Following the announcement, BAND surged by more than 30%. The sudden bullish impulse allowed this cryptocurrency to break out of a cup and handle formation that had been developing in its weekly chart since mid-August 2020.

If buy orders continue to pile up, Band Protocol could rise another 300% toward the 500% or 700% Fibonacci retracement level – measured from the Aug. 10, 2020 high of $17.80 to the Oct. 23, 2020, low of $3.30.

These potential interest areas sit at $75.80 and $104.80, respectively.

Such an optimistic target is determined by measuring the height between the bottom of the cup and the $17.80 barrier, then adding that distance upward from the breakout point.

Disclosure: At the time of writing, this author held Bitcoin and Ethereum.

The information on or accessed through this website is obtained from independent sources we believe to be accurate and reliable, but Decentral Media, Inc. makes no representation or warranty as to the timeliness, completeness, or accuracy of any information on or accessed through this website. Decentral Media, Inc. is not an investment advisor. We do not give personalized investment advice or other financial advice. The information on this website is subject to change without notice. Some or all of the information on this website may become outdated, or it may be or become incomplete or inaccurate. We may, but are not obligated to, update any outdated, incomplete, or inaccurate information.

You should never make an investment decision on an ICO, IEO, or other investment based on the information on this website, and you should never interpret or otherwise rely on any of the information on this website as investment advice. We strongly recommend that you consult a licensed investment advisor or other qualified financial professional if you are seeking investment advice on an ICO, IEO, or other investment. We do not accept compensation in any form for analyzing or reporting on any ICO, IEO, cryptocurrency, currency, tokenized sales, securities, or commodities.

See full terms and conditions.

Source: Read Full Article