Bitcoin's Price Faces Bleak Outlook as Selling Pressure from Miners Surge

Bitcoin, the world’s largest cryptocurrency, is facing a challenging outlook as selling pressure from miners increases.

The cryptocurrency’s price has been consolidating in a tight, sideways pattern in the past week after facing a significant pullback in early May. On several occasions this week, the price attempted to push and stay above $27,000 but failed towards the weekend, with various fundamentals suggesting the cryptocurrency could face a further drop.

Miners Sell their coins

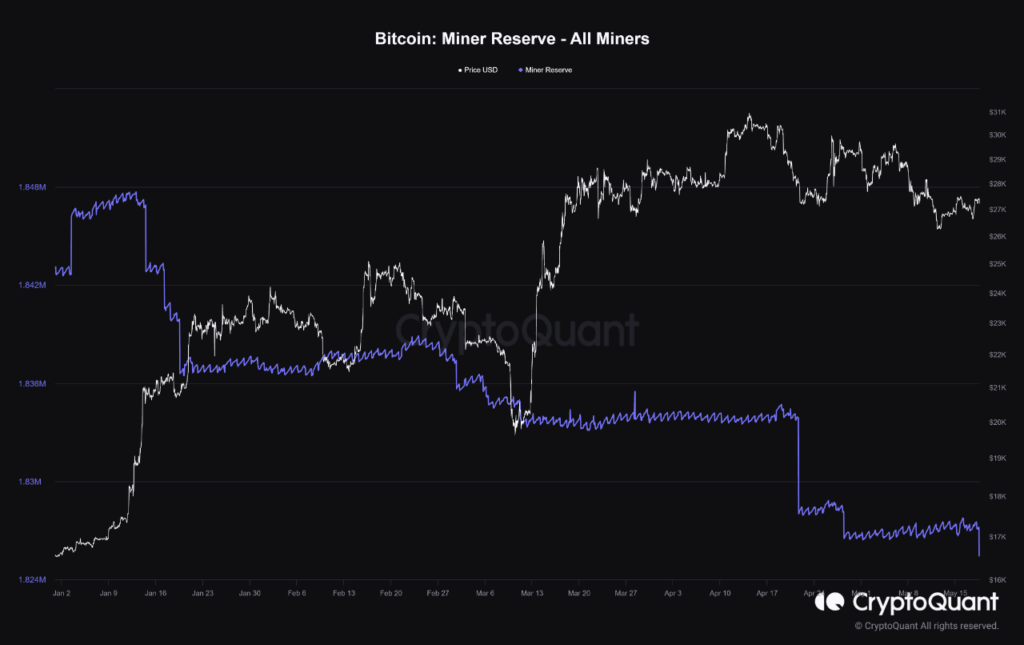

Apart from dwindling trading volumes, potentially reflecting investors’ lack of interest in a low-volatility market, there are indications that Bitcoin miners may have played a role in the recent decline in price.

Earlier today, onchain analytics firm CryptoQuant took to Twitter to share these observations, stating that there is a high probability that 1,750 BTC has ultimately made its way to Binance, one of the leading cryptocurrency exchanges. CryptoQuant’s assertions came after a thorough examination of various wallets linked to Bitcoin miners by “IT Tech”, an author and analyst at the firm, who tracked the movement of the coins to the exchange.

“There is a high probability that 1750 BTC ultimately went to Binance. Miners’ reserves are decreasing, indicating a selling pressure from the miners’ side,” wrote IT Tech.

Notably, amid declining prices, Bitcoin’s hashrate has also experienced a minor decline in recent days. This decrease indicates a migration of miners away from the Bitcoin ecosystem. As of the current writing, Bitcoin Network Hash Rate was 344.77M, down from 440M on May 2.

These developments raise concerns among market participants, which explains the stagnation of Bitcoin’s price. Bitcoin’s price has been experiencing volatility in recent weeks, with several factors, including regulatory inflation concerns impacting its trajectory. The increasing selling pressure from miners, combined with whale transactions, thus adds another layer of complexity to the market.

Miners’ Sales to Subside Soon

Nevertheless, despite these developments, CryptoQuant’s analyst “BaroVirtual” notes that the unloading of bags may slow down soon.

“From May 5, 2023, Bitcoin miners began to reduce their Bitcoin holdings drastically, and on May 9, 2023, the miner’s net position moved into negative territory, indicating intense pressure from miners. Currently, the miner net position values are in the zone where Bitcoin bounced off in previous times, and the local uptrend continued,” the pundit recently wrote.

According to him, miners could significantly slow down sales when Bitcoin hits the $24,000 target.

Bitcoin traded at $26,853 at press time, down 1.14% in the past 24 hours. In the past week, the price has only managed to gain by 1.73%, as per data from CoinMarketCap.

Source: Read Full Article