Blur solidifies reign in NFT space with 60% trading volume market share

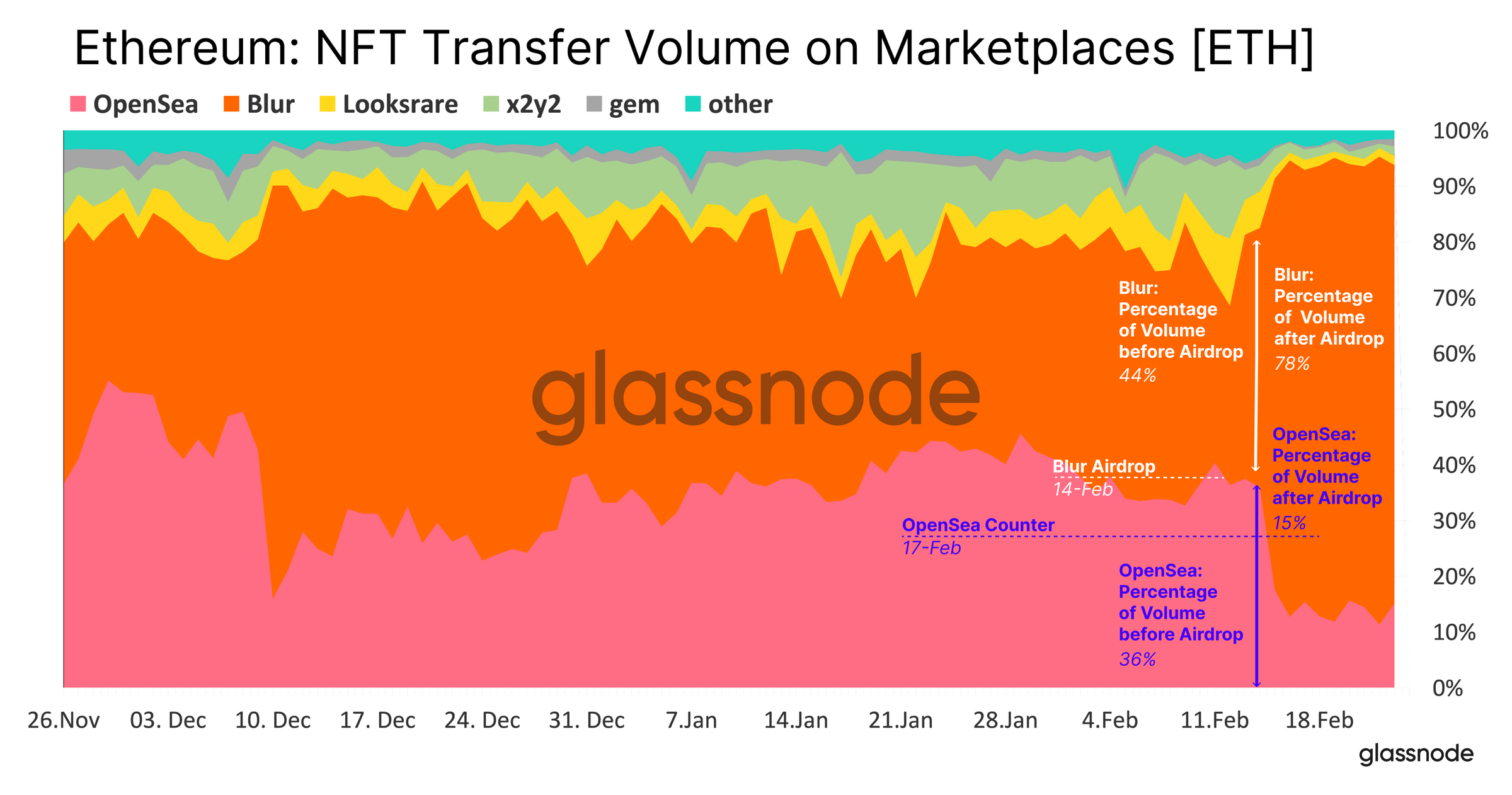

Blur has gained significant traction since its launch in October 2022, overtaking industry leader OpenSea. Its popularity skyrocketed after its token airdrop event on 14 February.

Prior to the airdrop, Blur held 48% of the NFT transfer volume in the market. However, its share jumped to 78% a few days after the airdrop. This caused OpenSea’s NFT transfer volume to drop by 21%.

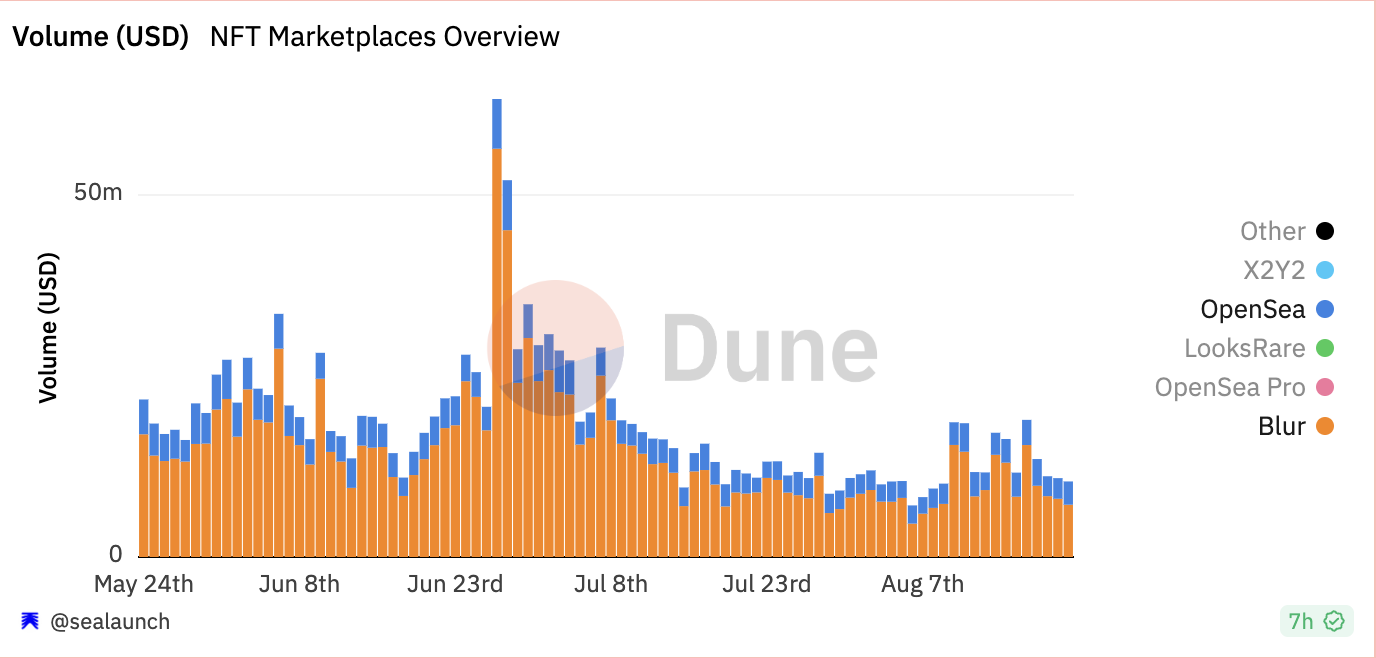

While NFT trading volume across Blur has declined since then due to the drop in the general market interest in NFTs, data from Dune Analytics revealed that the daily volume of NFT transactions completed on Blur still exceeds OpenSea.

Collectors have continued to shy away from NFTs

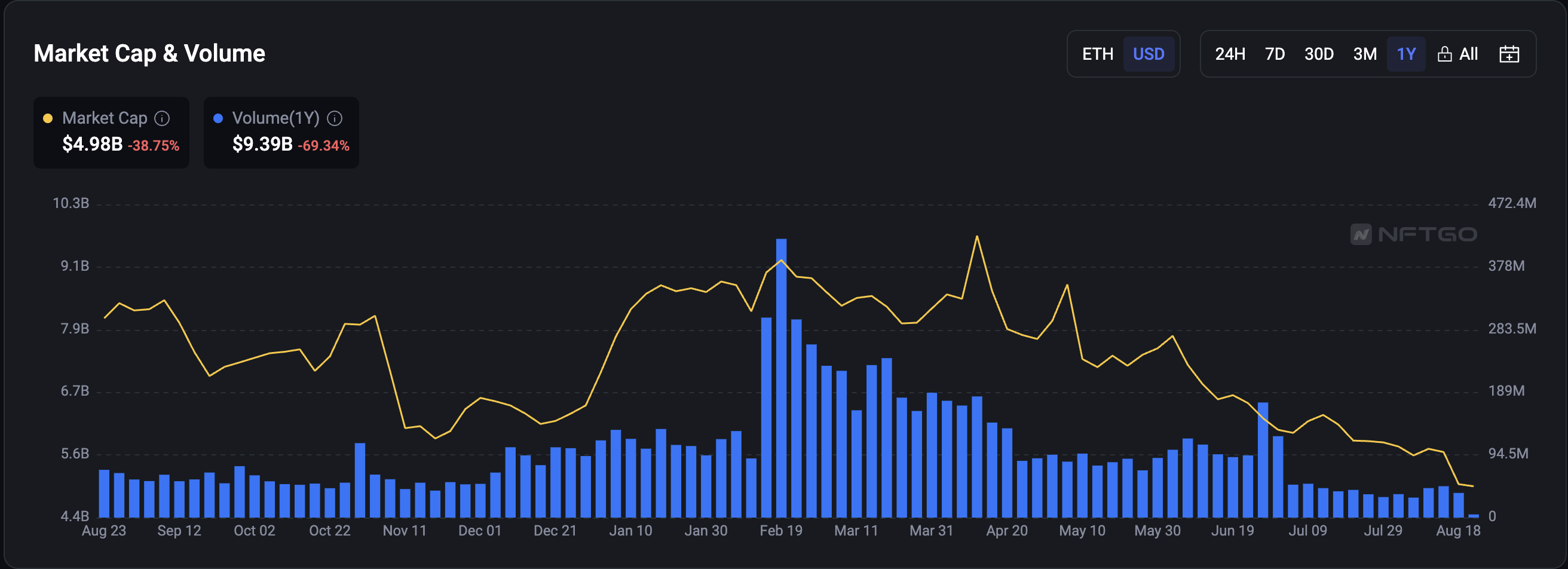

The year so far has been marked by a general decline in interest in NFTs as a category of digital assets. On a year-to-date, interest peaked around February, and NFT market capitalization and sales volume have since trended downward.

According to NFTGo, the sum of the market capitalization of all collections has fallen by 46% in the past seven months. Also, the daily total volume of NFT sales across all collections has dropped by 98% within the same period. For context, this was $420.48 million on 19 February. As of 19 August, the sales volume recorded was less than $5 million.

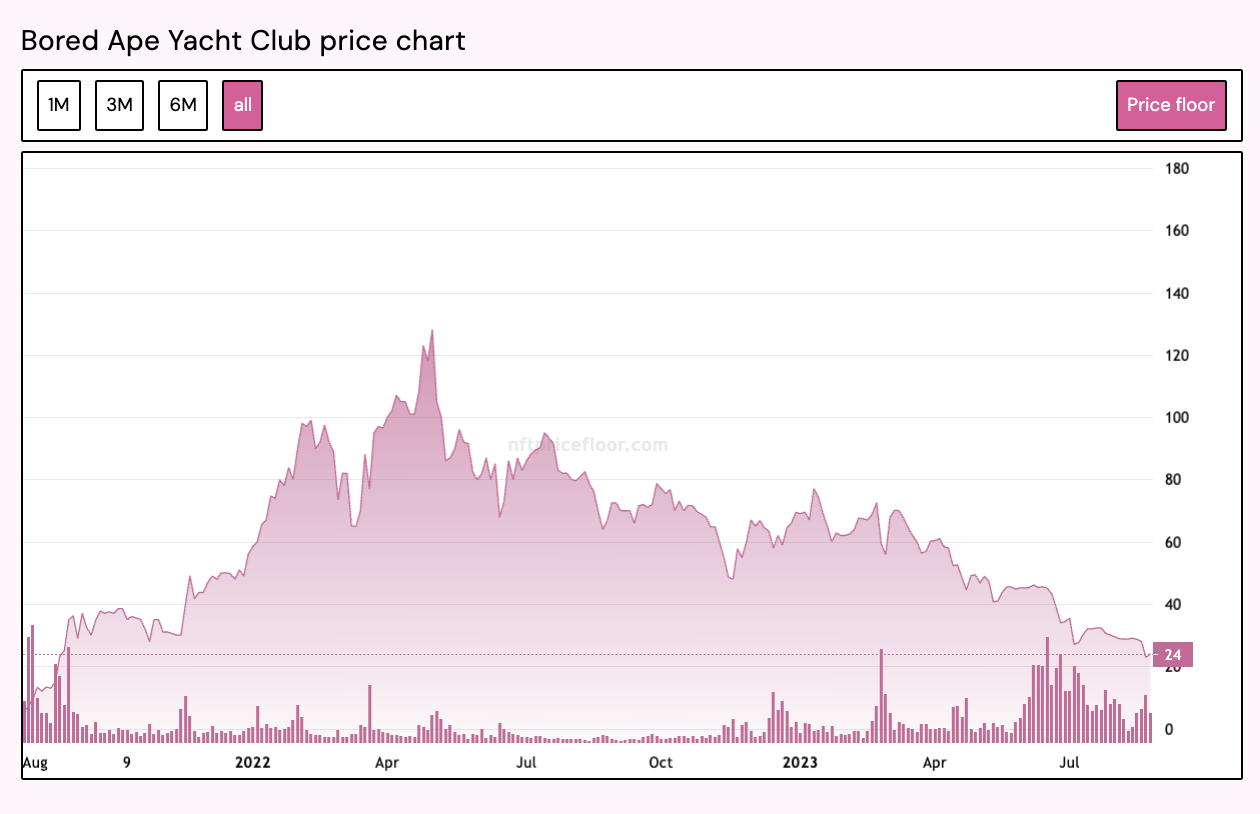

Amid the waning interest, the values of blue-chip NFTs have also been affected. For example, as of this writing, the floor price of an NFT from the Bored Ape Yacht Club [BAYC] collection stood at 24 ETH. The last time the average price was this low was in August 2021, three months after it launched. This year alone, the collection’s floor price has plummeted by 64%.

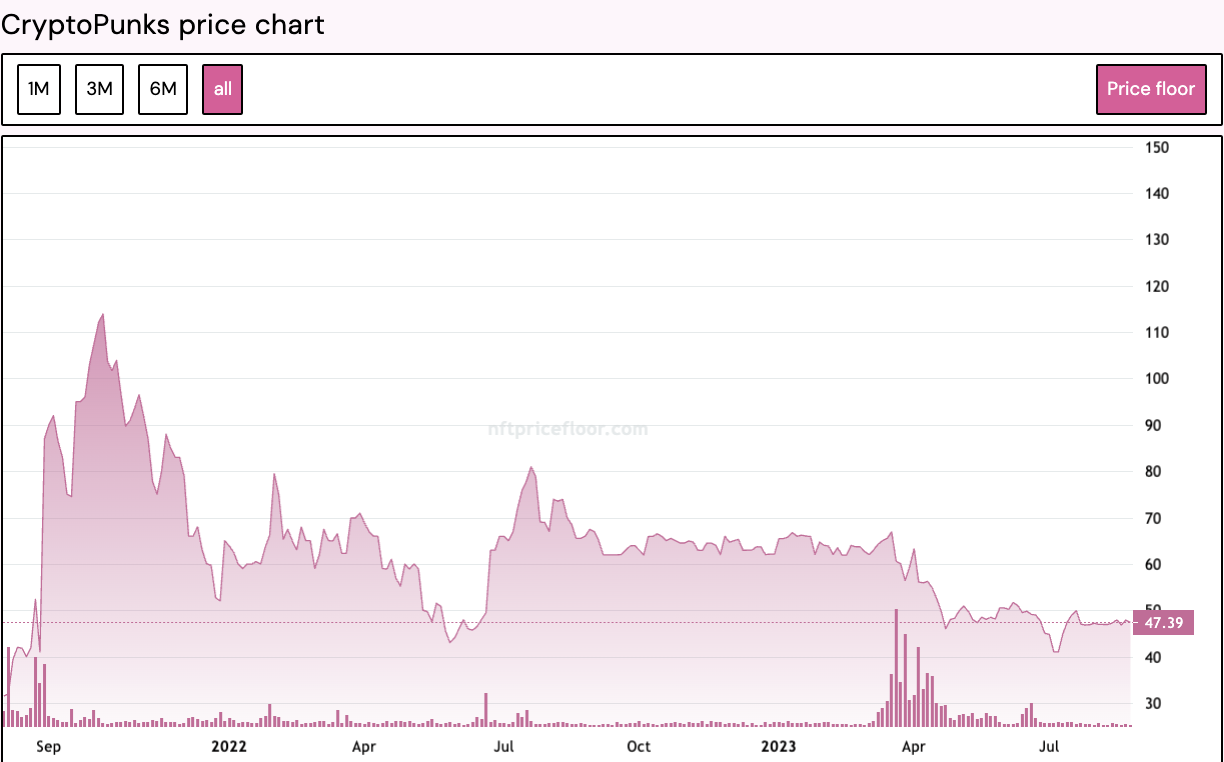

Another leading blue-chip NFT collection affected by the whirlwind of disinterest in digital collectibles is CryptoPunks. At a floor price of 47.39 ETH, one CryptoPunk NFT currently trades at a price last recorded in June 2022.

Source: Read Full Article